You might be interested in

News

CLOSING BELL: Nobody’s quite game to pick the bottom after the ASX makes it 5 losses on the trot

Mining

ASX Resources Quarterlies: This gold player says it's on track to become a ‘significant Aussie producer’

Mining

Mining

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with the managing director of Ausmex (ASX:AMG), Matt Morgan.

Ausmex (ASX:AMG) has a rare look for a junior explorer.

The experienced team has a plan to start mining its extensive, shallow high-grade gold and copper deposits by the end of the year using spare third-party processing in Cloncurry.

This early cashflow will help fund its main game – discovering gigantic iron-oxide-copper-gold (IOCG) deposits in Queensland and South Australia.

Like BHP’s Olympic Dam, these can be deep but tremendously large, high grade, and simple-to-process concentrations of copper, gold and uranium ores.

In other words, IOCG deposits are company-makers.

Here’s what Ausmex managing director Matt Morgan told us about the company’s recent progress.

“We are all seasoned miners and explorers with a history of creating value in ASX-listed companies.

“Our money goes into exploration, into the ground. We aren’t top heavy, or have lush corporate offices and expensive vehicles.

“The current team — Geoff Kidd, Andrew Firek, and myself — have worked together at different companies for the last 11 years.

“[Formerly listed miner] Coalworks was a great journey before we got taken over by Whitehaven for about $240 million in 2012.

“I went on to have a project in Mongolia, sold it, and did very well. Then I was on the board of Gold Mountain (ASX:GMN). I got involved at 2c and left at 18c.”

“Either joint venturing or toll treating our [shallow gold resources] to generate cash for deeper drilling of our big IOCG projects. We are after those big deposits.

“Debt kills small juniors, so we aren’t interested in building infrastructure.

“You take a haircut [toll treating at 3rd party processing plants] but it means low risk cashflow.

“In Cloncurry, Queensland we have some granted mining leases with historic JORC resources on them at Gilded Rose and Mt Freda.

“They aren’t that big yet, but they are shallow, and best of all, high grade.

“Mt Freda has been mined only over 300m, but we’ve identified with SAM survey a structure that runs west of it that is 2.5km long.

“Mineralisation with high grade gold outcrops at the surface everywhere.

“Our focus is to do some drilling, upgrade the historical JORC resource (2004) to JORC (2012).

“Hopefully by Christmas time we’ll have some gold production underway and first cashflow, via third party processing at local plants.

Ideally, as soon as we’ve got that cashflow, we won’t need to go back to the market for any further cash.”

“The first thing I saw when doing project due diligence was that Cloncurry has an oversupply of gold processing capacity.

“We picked it nearly three years ago. In 2016, copper and gold prices were down, I knew this package was available and I started negotiations.

“Malachite Resources’ (ASX:MAR) Lorena 250,000 tonnes per annum gold plant is about 8km from the Gilded Rose gold mine.

“Then there’s the Great Australian Mine [plant] owned by Round Oak Minerals [formerly CopperChem and Exco Resources] which has just had a $18m upgrade of its gold-copper processing plant in Cloncurry.

“We knew we had short-term gold production from the shallow oxide mineralisation on granted mining leases, but what really interested me was a historically producing gold-copper-cobalt project called the Evening Star at the southern end of Mt Freda.

“In the 1980s and 1990s BHP had identified it as a large uranium project.

“There’s some old historic drilling [which returned] high uranium, copper, and gold, and cobalt assays — straight away that screams ‘IOCG’.”

“In early 2018, Round Oak Minerals (Subsidiary of Washington H. Soul Pattinson), bought a gold ore stockpile from Ausmex that was left on the ML [mining lease] for $2.5 million cash.

“Round Oak Minerals owned an interesting EPM [exploration permit] with multiple historical high grade gold mines on two sub blocks, almost abutting Mt Freda that I really liked — so as part of the deal with the stockpile of ore we sold them, we got an 80 per cent beneficial interest in the those two sub blocks.

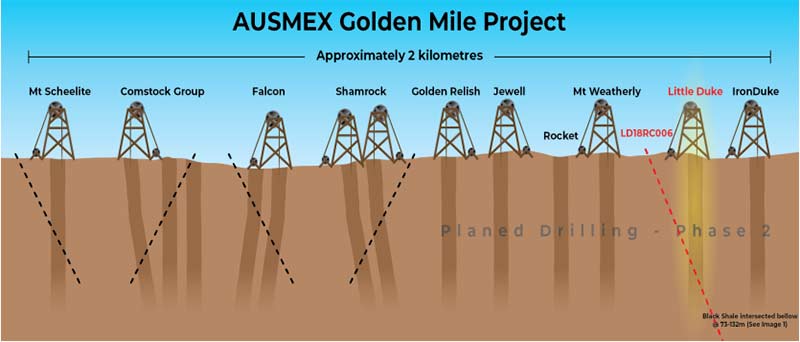

“These two sub blocks are bloody amazing – we call it the Golden Mile.

“There’s surface high grade mineralisation everywhere.

“I walked from one side to the other with a sack filled with sample bags, and there were old mine workings over every ridge.

“No one had got out of the car and walked. Everyone has been looking for the next Olympic Dam and they didn’t see the smaller potential.

“We can have a mining licence granted over those within about 9 months if we put the application in, purely because there would be no processing on site.”

“But it gets better.

“The two sub blocks we got from the $2.5 million gold ore stockpile deal with Round Oak Minerals are an integral part, and abut, an EPM that [global miner] Newcrest in joint venturing with Round Oak Minerals.

“I was flying to Cloncurry one day sitting next to a fella with a Newcrest shirt on, and he opened a folder with the ‘Canteen Joint Venture’ written in it.

“That’s when I knew we had something big.

“Newcrest started drilling the [IOCG] project in April last year. I know this because they asked if they could drive through our mining licence to access their tenement EPM joint venture tenement.

“I saw all the action. They drilled 8 holes, over 850m deep each from April to August and they have not released an assay.

“Newcrest drilled 850m diamond core holes. They cost a fortune.

“They had whole camps there. It was 24-hour drilling. If there was four dud drill holes I don’t think they would’ve kept going to eight.

“They could sit on those results for a couple of years, but it doesn’t matter because we are going to drill ourselves.”

“Well, we are a junior with a bit of baggage.

“We relisted in June 2017 at 8c on a reverse takeover [with Eumerella Resources] and there was a lot of older shareholders that just wanted to get out.

“There’s no 2-million-ounce gold resource at the moment, but we keep getting good grades. We actually have 10km of continuous mineralisation on surface.

“Now, the short term cashflow is great and we might get a bit of a rerating, but what do we do with it?

“It’s the big projects – you only have to hit one big 300m intersection at 1 per cent copper and you are a different company overnight.

“We don’t know any other $30m market cap company that can offer this much potential uplift.”