You might be interested in

Mining

Reporting Rodeo: Here's how analysts think the ASX's big miners will shape up in March quarter reporting season

Mining

Goldman Sachs says big miners are big value with upside in iron ore, coal and copper

Mining

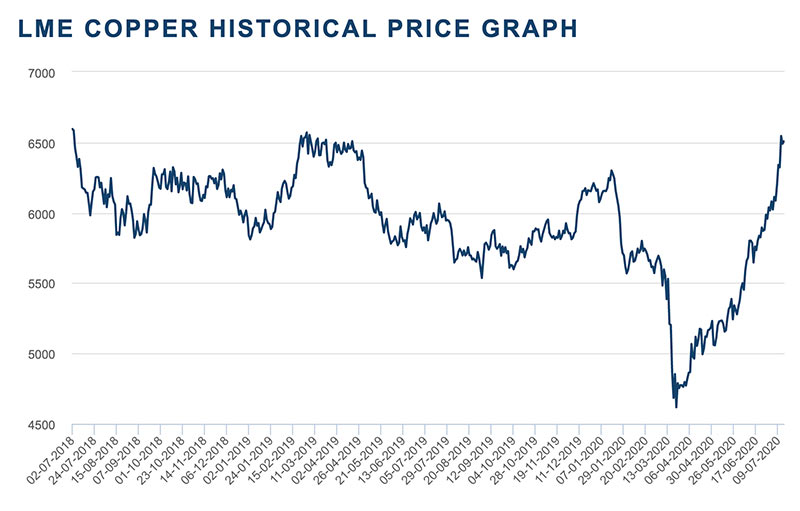

Copper’s relentless upward march since its March low passed another milestone this week, with the red metal hitting a two-year high on the London Metal Exchange (LME).

The LME’s copper contract hit a cash price of $US6,633/t at the start of the week, and closed Wednesday at $US6,507/t — but some market analysts suggest that copper and other industrial metals markets could soon pause for breath.

“Demand destruction is pushing some industrial metals into surplus territory, capping price upside,” Deloitte Access Economics director James Campbell-Sloan said.

Copper spot prices touched a four-year low in March of $US4,760/t as the spreading COVID-19 pandemic crushed industrial metals demand.

> scroll down for ASX small cap copper news from AusQuest and Minotaur Exploration

Australia’s copper production is a one of the few bright spots in a world where many copper-producing countries, particularly in South America, are impacted by COVID-19.

The influential International Copper Study Group said in its latest market update that world copper production declined by 2 per cent in March as a result of COVID-19 lockdowns.

“The partial paralysation of the mining industry in Peru due to COVID-19, combined with operational issues/adverse weather affecting a few major mines, led to a 25 per cent decline in production in March, with the full first quarter presenting a decline of 12 per cent,” ICSG said in a report.

An added complication for the copper market is the possibility of strike action at Chile copper producer Antofagasta’s Centinela mine, according to news reports this week.

AusQuest (ASX: AQD) triggered investor interest Thursday after it was given the go-ahead to start drilling for copper-gold targets at its Gunanya project, a joint venture with miner South32 (ASX:S32) in the Paterson Province of WA.

Shares in AusQuest leapt 13.3 per cent in early trade to 1.7c.

AusQuest is planning a program of six to nine drill holes for a total of 1,800m to test three targets at Gunanya in September, prospective for large-scale copper mineralisation similar to that found at Rio Tinto’s (ASX:RIO) mammoth Winu project nearby.

Minotaur Exploration (ASX: MEP) also saw its shares nudge higher in early trading after the explorer announced a maiden resource estimate for its Jericho copper gold system 65km south-east of Cloncurry in Queensland.

The Jericho resource estimate is 9.1 million tonnes grading at 1.4 per cent copper and 0.3 grams per tonne for gold and is hosted within two parallel lodes spaced 120 m apart along a 3.5km strike length.

Minotaur has a 20 per cent stake in the Jericho joint venture, which is 80 per cent owned by Oz Minerals (ASX:OZL) which is funding exploration activity for the project.