The Argyle mine has been closed for a year. Now its famous pink diamonds are thrashing the ASX 200

Mining

Mining

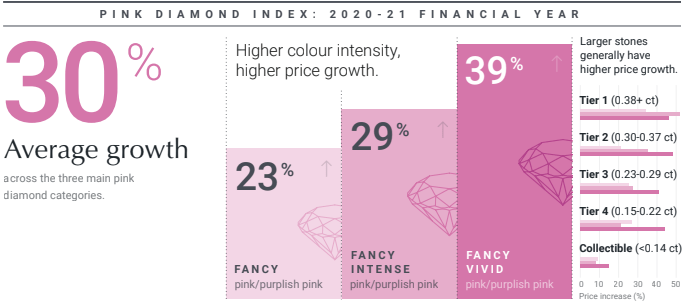

What investment class has risen an average of 30% this year, outshining gold, silver, cash and the ASX 200?

It’s not a crypto or memestock, although there are plenty of those floating around.

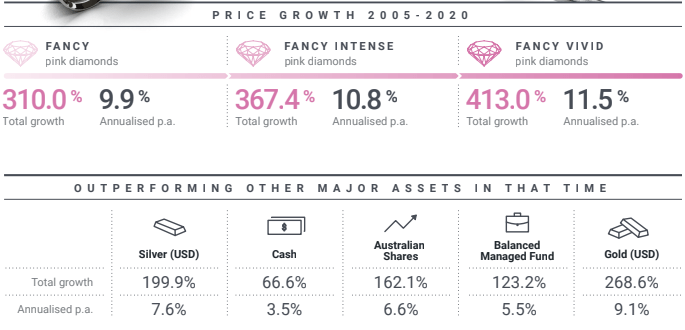

We’re talking about pink diamonds. According to new figures from the Australian Diamond Portfolio, the value of pink diamonds has soared since 2005, gaining 10-12% pa over 15 years to outpace most traditional investments.

That has only accelerated in the past year since the closure of the Argyle diamond mine in November 2020.

The Rio Tinto operation in WA’s remote Kimberley region operated for 37 straight years, producing around 95% of the world’s supply of pink diamonds.

Over the past 12 months fancy pink diamonds have risen in value by 23%, fancy intense pinks are up 29% and fancy vivid pinks have climbed in value by 39%. In 15-year terms, those numbers are 310%, 367.4% and 413%.

Another buyer, Hong Kong’s Kunming Diamonds, secured all 41 lots on offer of rare violet and blue diamonds from the mine.

Despite accounting for 95% of the world’s fancy pink supply, their rarity is underlined by the fact just those diamonds made up just 1% of Argyle’s rough supply.

Now with Argyle run dry and a secondary market beginning to form, the Australian Diamond Portfolio has launched a “Pink Diamond Index”.

ADP executive director Anna Cisecki told Stockhead pink diamonds’ emergence as an investment class has accelerated with the closure of the Argyle mine.

“They’ve had a very unique supply profile in the sense that they’re a finite resource. Almost 95% of the world’s pinks came from one single source, obviously the Argyle mine in WA, and that mine ceased production in November of last year,” she said.

Like gold, pink diamonds have become a safe haven investment because the physical product is extremely rare and holds its value in times of economic instability.

“They have a number of characteristics that investors find greatly appealing,” Cisecki said.

“Particularly considering the economic volatility that we’ve seen in the past few years, and in particular over these last 18 months, while the world’s been dealing with the COVID pandemic.

“They really just feel like a safe haven asset in many ways. Pink diamonds don’t demonstrate the volatility that we’ve seen in equity markets, commodities, or even with gold and other precious metals. So when financial markets wobble, pink diamonds can typically be relied upon to maintain their value.

“When you look at their performance, for example, of the period of the worst of the GFC, in 2008 and 2009, prices remained very steady and actually started quite an incredible bull run.

“So pink diamonds really do act as portfolio insurance when needed and provide great means of diversification for investors. The performance is not tied to movements in really any other asset class.”

Unlike gold bullion, which is mined at a rate of ~3000t a year, you could possibly squat the total inventory of pink diamonds mined and sold at Rio’s Argyle tenders.

“Also, they are truly limited in supply, which gives them inflation protecting qualities, which is another reason why the increasing demand for them has pushed prices up so much over the last 15 to 20 years,” Cisecki said.

“And also as physical tangible assets they are quite desirable to investors because they can be stored outside of the financial system. The feature is pretty attractive to risk conscious investors who value the ability to store assets discreetly.”

Famous pink diamonds include the reputed 6.1 carat engagement ring Ben Affleck bought for past belle Jennifer Lopez in 2002 and the very unlikely story of a stone claimed to be worth $24 million briefly affixed to the forehead of XO Tour Llif3 rapper Lil Uzi Vert this year.

That dumb idea reportedly ended with fans ripping the priceless stone out of his forehead.

Among the investors who claim to have acquired one of the hero stones from the final auction is ASX-listed Burgundy Diamond Mines (ASX:BDM).

In an ASX release BDM said it picked up the 1.79ct fancy purplish pink Argyle Stella, one of five hero stones from the collection, which according to Rio Tinto was sold in the Argyle tender to a buyer from Singapore.

Burgundy says the diamond “is expected to generate multiples of longer-term value for the company’s shareholders by its innovative use as the centrepiece of the Burgundy Fancy Colour diamond brand which will be launched in the coming months.”

The diamond is one of the last creations of Rio craftsman Richard How Kim Kam, who has hopped over to Burgundy as its master craftsman.

The company is planning to resurrect the Ellendale diamond mine in WA’s north, famous for its production of rare fancy yellow diamonds.

But it plans to make the Argyle Stella the centrepiece of its Paris-based luxury brand, in the knowledge its value is likely to soar.

“Acquiring this ‘hero’ stone represents an exciting step on our journey to creating a visionary ultra luxury brand that will transform the Fancy Colour diamond niche sector,” BDM CEO Peter Ravenscroft said.

“This is a highly strategic purchase of one of the rarest diamonds in history, which we liken to buying ‘one of the last Bugattis’.

“Less than a dozen stones like this have ever been produced, and there will never be another one.

“We have plans to leverage the beauty and rarity of this diamond, and use it as a foundation stone in building a brand at the pinnacle of ultra luxury, housed in our subsidiary company that we are establishing in Paris.

“We are looking forward to being able to talk more about this brand in the very near future, and expanding on the value that Argyle Stella will bring to Burgundy shareholders in the longer term.”

Traditional white diamonds may be valuable in jewellery, but their reality as an investment asset is they’re just not that uncommon.

“If we’re talking about white diamonds, they’re really not that rare at the end of the day … the pinks are simply that rare that they command those kind of prices,” Cisecki said.

“Even with Argyle in production 95% of (pink) global supply still equates to ultra rare.

“When you’re looking at white diamonds, even if you’re looking to buy a five carat, top quality, internally flawless, white diamond, they’re not that rare.

“You can make a few phone calls and have 10 options for that sort of half-million dollar stone in a heartbeat. Whereas if you’re looking for something very specific in the pink diamond market, you could be looking for a very long time.”

With the closure of the Argyle diamond mine there is virtually no rough supply in the world.

While the average has been between 10% and 15%, there is evidence of far steeper rises now that Argyle is done.

“In some years, we have seen 20-25%, but 30% is the highest we’ve seen in terms of an average,” Cisecki said.

“Some categories of growth have been higher, if you look at the top categories of pinks, they’ve increased closer to between 40 and 50%.

“Going forward, regardless of the fact that Argyle is closed, supply will continue to be more and more constrained.”

While the hero stones of the Rio tenders make the headlines, Cisecki said a robust secondary market is emerging.

“We can already see it starting, and I’m sure there’ll be a number of platforms emerging in the near future, which makes it easier for investors to trade their pinks.

“In terms of other predictions for the future, we think the investment story is far from over. Supply of these stones is finite and we do expect demand will continue to grow meaningfully.

“Some of these reasons are specific to the diamonds themselves, including their rarity, physical beauty, which makes them very alluring to investors.

“And again, their inflation protecting qualities and ability to generate strong long-term returns makes them attractive investments in their own right too.”

Cisecki says there are lower entry points than many people know. The trade is not necessarily reserved for the Bennifers and Lil Uzi Verts of the world.

“It’s the multimillion dollar stones and collections that get the headlines, but it is actually a market that everyday investors can participate in,” she said.

“High quality pink diamonds are available from as little as $20-25,000 as a starting point. The biggest growing segment of clients we work with are actually self-managed super trustees.

“On average, they’re investing about $50,000-150,000. But we certainly see clients that invest more and some that are more comfortable at that entry level.”

The reality is there is little prospect of Rio reopening Argyle, where the company has had to shift from open pit to riskier and higher cost underground mining in recent years to extract its treasure.

“Argyle has run dry. Every mine has what’s called its mine life after which it is no longer economically viable. So Argyle has reached that point and the point is exhausted supply, so there are no more diamonds there,” Cisecki said.

“Rio Tinto will go ahead and restore the land now.

“In terms of finding a new source, certainly that is a possibility. But they’ve been looking for new sources of (pink) diamonds for the last 30 years, none have been detected.

“And even if one were to be detected now, it takes on average 10 to 15 years for a mine to go from detection to the point of actual commercial production to consumers.”

Much of the pink diamond’s allure is wrapped up not just in its beauty and rarity, but its mystery.

Only select ateliers who will promise to promote and steward the Argyle Pink brand are invited to the tenders, and official prices are not published.

According to Cisecki it is nigh on impossible to gauge the size of the market because most sales are conducted in private.

“Unfortunately not, because most pink diamond sales are private,” she said.

“Even Rio Tinto, when they publish figures, they don’t actually publish figures for how many pink diamonds or how many carats of pink diamonds have been mined.

“It’s an overall figure for the entire mine itself. We can make some inferences in terms of if less than 1% of that production is pink this is how many rough diamonds there were but then you lose half of that to polishing.

“And it’s not like gold where, you know, an ounce of gold is an ounce of gold.

“The units are fungible – each pink diamond has a different value to it. So it makes it virtually impossible to try and put a figure on that or to put a dollar figure on it.”

She hopes the ADP Pink Diamond Index fills a gap and brings transparency to the growing investment segment for the market.

“As it’s grown, the need for high quality information and more pricing transparency, particularly with regards to pricing trends, has become much more important.

“So we’re basically hoping that this information helps to empower investors to see both what happens in their portfolios and to make the right choices with their money so that they can build really robust pink diamond portfolios and ones that can perform well irrespective of broader financial market conditions.”