Tech metals drive Aussie mining mergers, while global players go window shopping

Mining

Fewer miners are selling off assets to pay down debt — but globally most players are holding back on acquisitions.

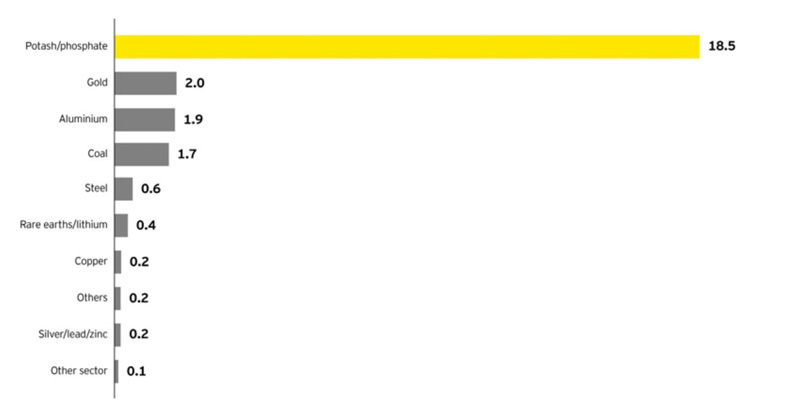

The recent merger between potash heavyweights PotashCorp and Agrium saw the global value of deal activity climb 86 per cent to $US25 billion ($33.1 billion) in the first quarter of 2018 (compared to a year earlier).

But the overall number of deals dropped 16 per cent year-over-year to 101.

“Reflecting the wait-and-see mood prevalent across the industry, activity elsewhere in other commodities was generally slow and the volume of transactions decreased,” Lee Downham, global mining and metals transactions leader for consultant Ernst & Young (EY), said in a recent report.

Miners are transitioning now from divestments to consolidation and strategic acquisitions.

The gold and coal sectors remained buoyant during the first quarter, representing around 15 per cent of deal value.

The gold sector saw at least four transactions worth over $US200 million, while there was consolidation in the coal sector in China, Australia and South Africa.

However, Australia is picking up the slack on the merger and acquisition front as miners continue to improve bottom lines.

“With stronger balance sheets and buoyant commodity demand, acquisitive growth will drive deal activity in Australia in 2018,” said Paul Murphy, EY Asia-Pacific mining transactions leader.

“The volume of Australian mining and metals transactions represents around one-third of global deals, demonstrating the ongoing strength of the Australian market.”

Australia is leading the Asia-Pacific region, which accounts for about a quarter of global deals by volume.

In the first quarter, M&A deal value in Australia rose to $US1.8 billion from $US439 million in the previous quarter.

The sector of interest remains battery metals, with activity set to increase, according to EY.