Southern Cross hits high-grade gold results as it gears up for listing

Mining

Southern Cross Gold is bringing a suite of little known, but potentially very lucrative gold assets in Victoria to the attention of Australian investors.

It’s not very often after all that a company can boast of a very high-grade hit of 3m grading 41.4 grams per tonne (g/t) gold and 12% antimony from their drill programs.

But that and the broader 11.7m intersection at 12.4g/t gold and 3.6% antimony it is part of were returned from the deepest hole that has yet been drilled at the company’s Sunday Creek project in the Victorian Goldfields.

To top it off, mineralisation at Sunday Creek remains open at depth and continues 10km to east covering historical mines, an area that has not seen a single drill hole test. So why hasn’t the typical Australian investor heard about this gem?

It’s for the simple fact that until recently, these assets were held by TSX-listed company Mawson Gold, which is only now looking to spin them off under Southern Cross Gold.

Southern Cross itself is currently progressing a pre-initial public offering capital raise of $2.5m to Professional, Sophisticated and Other Exempt Wholesale Client Investors that will allow it to take management control of the assets ahead of an IPO on the ASX next year.

This will bring a package of assets where Mawson has already spent $6m on exploration over the last year into the limelight.

This work includes significant drilling at the Sunday Creek project and early drilling at the Redcastle and Whroo JV projects, which are noteworthy in their own right.

Redcastle is located near two of the world’s highest grade gold mines, Kirkland Lake Gold’s Fosterville mine and the Mandalay Resources’ Costerfield mine just 2km to the south.

Southern Cross managing director Michael Hudson said earlier this week that both mines are controlled by Canadian-listed companies and are located within two of the remaining six epizonal goldfields in Victoria that it doesn’t control

“Our hope is that we can find similar world class deposits as an Australian company owned by Australian shareholders,” he added.

Adding further interest, fellow Canadian company E79 Resources had in mid-June announced gold grades exceeding 2,400g/t to the east in the Melbourne Zone.

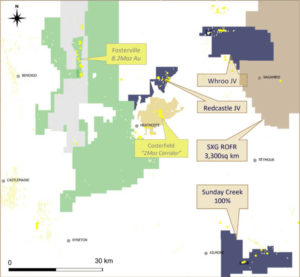

Southern Cross’ Victorian assets cover 471sqkm over three of the nine historical high-grade epizonal goldfields in the Melbourne Zone that produced large quantities of gold in the 19th Century.

Of these, the most advanced is the Sunday Creek project about 56km north of Melbourne that the company will hold 100% of following the pre-IPO raising.

Mawson has completed 26 holes totalling 6,448m at the project since the middle of this year and has plans for more drilling after the rig completes two holes at the Whroo JV project.

Other work carried out to test the 11km trend of historically mined epizonal dyke-hosted mineralisation include geophysical surveys, detailed LiDAR surveys and a 1,200 point soil sampling program.

Southern Cross is also earning 70% in both the Whroo JV and Redcastle JV projects with Nagambie Resources.

Redcastle is one of the most significant historical epizonal high-grade goldfields in Victoria, Australia, hosting an extremely high-grade epizonal gold system with visible gold in quartz association.

Extremely high gold grades were mined over a 4.5 x 7 sqkm area containing over 24 historic mining areas since its discovery in 1859.

Whroo covers 199sqkm and includes the 14km long Whroo gold mineralised trend.

Adding further interest, Southern Cross will hold a direct 10% ownership of Nagambie Resources, giving it a right of first refusal over an additional 3,300sqkm of tenements that stretch north towards the border with New South Wales.

Mawson has already received in-principle advice submission from the ASX to support Southern Cross’ suitability for admission to the official list.

Once the Pre-IPO raising is out of the way, Southern Cross will then seek to raise between $8m and $10m to progress its projects while Mawson will distribute its stake in the company to its shareholders.

Michael Hudson was interviewed following the release of the drill results and this interview can be viewed here https://www.youtube.com/watch?v=py-BeGDNMRo

To register to watch the SCG video interview, please click here: https://ssinsight.com.au/project/southern-cross-gold/

This article was developed in collaboration with Southern Cross Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.