Silver legacy to pave the way as Alicanto sets drill rig on Sala

Mining

Alicanto Minerals will start drilling the Sala silver project – a project once known as the ‘Swedish Treasury’ for its high-grade historic output – this week.

Sala, located in Sweden and acquired by Alicanto (ASX:AQI) in February, produced more than 200 million ounces of silver at extremely high grades – estimated to average 1244 grams per tonne with reports as high as 7000g/t – up to 1908 when mining stopped.

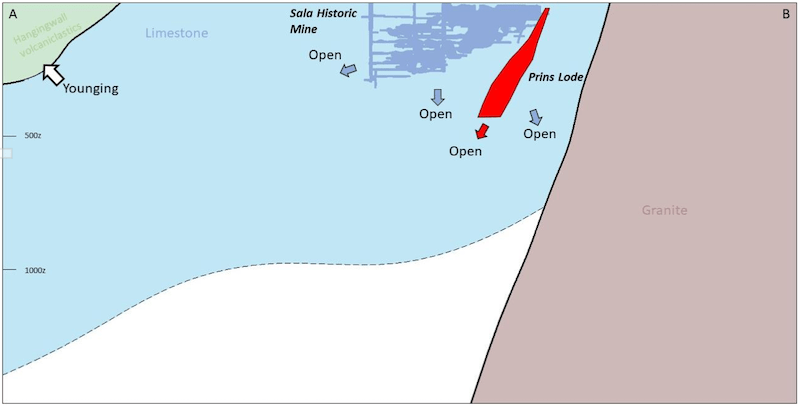

The project was briefly mined in 1951 but was closed based on the belief that mineralisation ended at the 320m level.

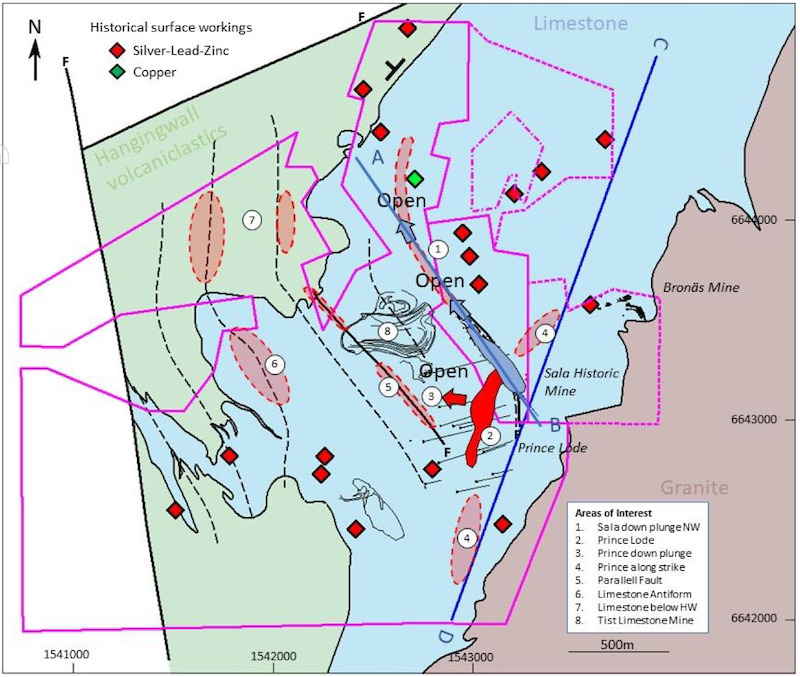

However, a recent review of historical data by Alicanto found the project’s mineralisation remains open at depth and along strike, and that it had immense exploration potential.

That review also found the recently discovered Prince lode was separate and adjacent to the Sala lode, with the two intersecting at a certain point.

Alicanto had previously theorised that the lodes ran parallel, and this new information will inform the exploration approach at the project.

It wasn’t the only important finding from the review.

The historical Bronas mine, which was mined from 1945 to 1962 and produced 171,000t at 350 grams per tonne silver, 2% zinc and 4.2% lead some 300m north of Sala, is now believed to be part of the same mineralised zone that hosts Prince.

Historical diamond drillholes at the Prince lode located 300m south of Sala returned multiple mineralised hits including 15.9m at 157g/t silver and 4.2%% zinc, as well as 37.2m at 50g/t silver and 6.1% zinc.

A reinterpretation of historic data also suggested that one hole targeting the Prince lode had likely intersected the down-plunge extension of Sala at around 100-150m below old workings. That intersection came in at 6m at 185g/t silver, 1% lead and 0.4% zinc.

Another historical drill, which hit 0.67m at 844g/t silver and 16.3% lead, is believed to have hit the strike extension of Sala.

On the back of the review, a specialised diamond drill rig capable of drilling at surface and underground is being mobilised to site and will commence work this week.

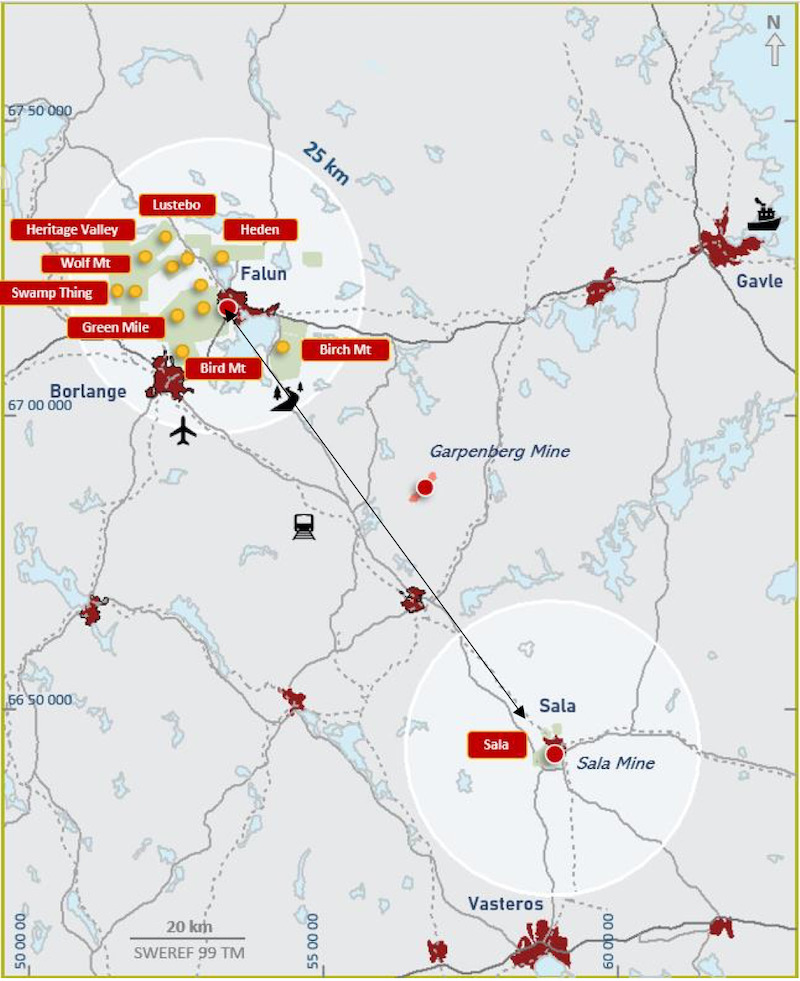

Sala is located 100km from Alicanto’s flagship Greater Falun copper-gold project and 50km from Boliden’s operating Garpenberg mine – once Europe’s largest silver producer.

Alicanto managing director Peter George said the Sala project was intriguing.

“Sala is an outstanding opportunity which would have been explored many years ago had the geology been better understood and had it not been held in part by companies which were focused on other projects and jurisdictions,” he said.

“The presence of extensive high-grade copper-gold mineralisation with by-products of silver, zinc and lead at Falun has been well-established through both mining and exploration. However, the full potential of the Greater Falun area has yet to be unlocked.

“To now have Sala in our suite of projects is a significant addition to our portfolio within the Bergslagen area.”

George said Alicanto’s ongoing drill program at Great Falun was targeting multiple high-priority target areas with known copper-gold and polymetallic skarn mineralisation.

Both projects are located within the broader Bergslagen region – which has produced more than 100 million tonnes of high-grade base and precious metal ore in modern times.

This article was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.