Silver has gone gangbusters in 2025 and these are the ASX stocks riding the wave hardest

Silver prices are riding high, but these miners have made bigger gains than the precious metal. Pic: Getty Images.

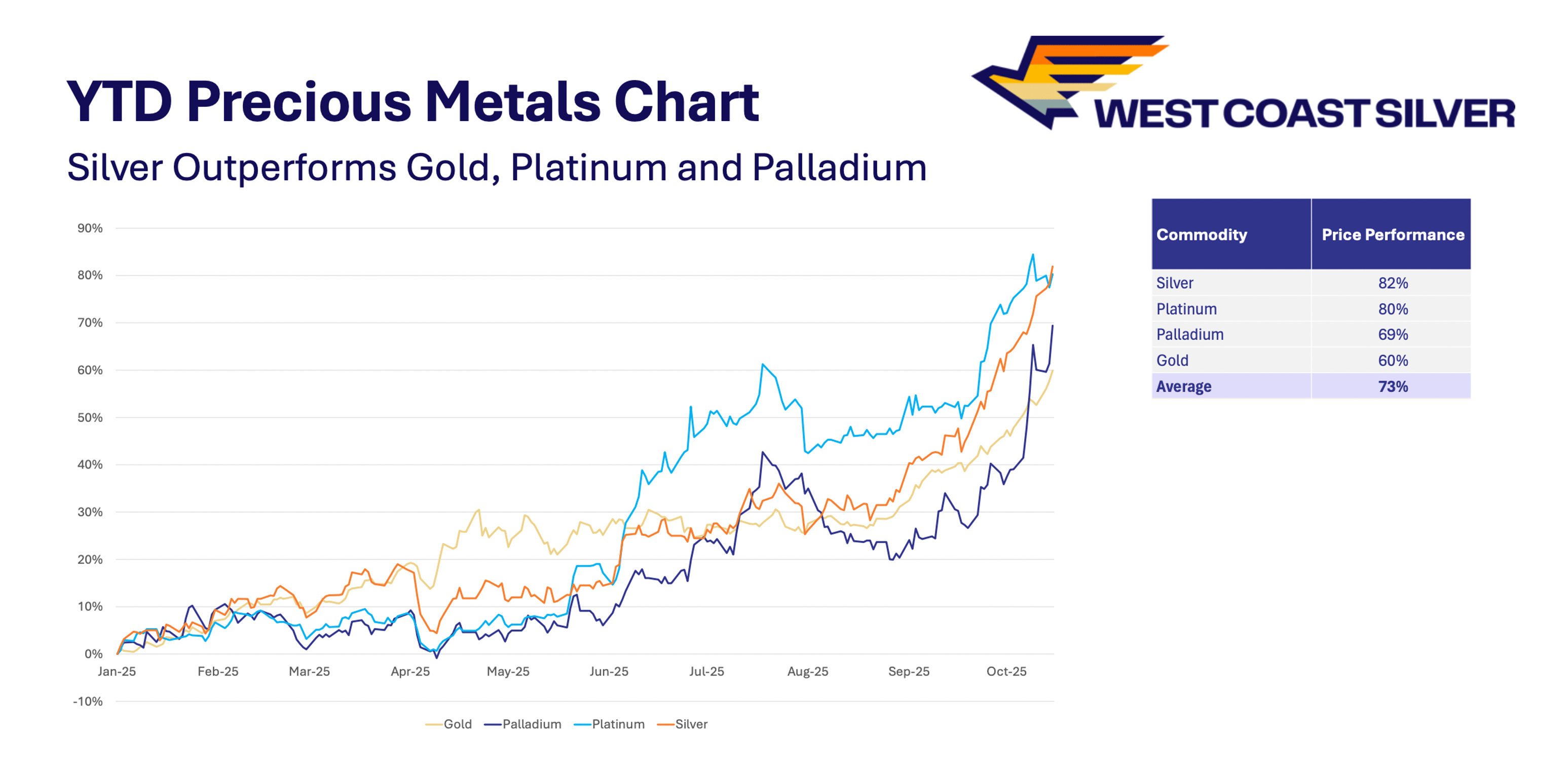

- Silver up 76% year-to-date vs gold’s 58% rise

- Demand growing and deficit set to enter fifth year

- ASX silver plays are seeing some wicked gains too

Earlier this year, billionaire Eric Sprott predicted silver could logically hit the US$250 or US$500/oz mark and that the silver:gold ratio could go to 15:1.

Such was the level of exuberance as large name investors tipped a ‘silver squeeze’, insisting the ongoing shortage of the precious metal set it up for rapid price gains as stockpiles wound down to unsustainable levels and investors sought protection against decaying macroeconomic conditions.

“I think silver’s going to skyrocket,” he told commodity trading platform Kitco earlier this year.

“In my speech I suggested that Michael Oliver who writes the Momentum Structural Analysis (report), I think his target is US$250/oz on silver … and I believe it.

“Don Durrett … his target was US$500/oz, and I can see both being entirely possible here, because the targets on gold are US$8000-10,000 and silver used to trade at 15 to 1 to gold.

“You interviewed (First Majestic Silver boss) Keith Neumeyer and he said we’re only mining seven ounces of silver for every ounce of gold. Why is the price 90-to-1? Because it’s … been manipulated for the past 50 years.

“Those guys are all still short, they can’t get off their shorts.

“They nominated for 76Moz of silver for the March contract (on the Comex). We don’t even produce 76Moz a month … that’s a new engine in a game that already has a deficit of 200Moz.

“There’s no doubt in my mind we will breach the resistance at US$33/oz and we will just ultimately fly here.”

It hasn’t quite lived up to that hype, but silver has breached the US$50/oz mark several times in recent weeks after largely sitting on the sidelines as gold hit record after record.

It’s at US$51/oz ATM, and silver’s US$54/oz asking price in mid-October crashed through an all-time high that has stood since the short-lived Hunt Brothers squeeze of January 1980.

The precious metal looks set to trump gold as the best-performing commodity for 2025 – a title it took out last year.

A report by Blue Ocean Equities analysts Carlos Crowley Vazquez and Elaine Faddis last month noted that silver was up by around 65% year-to-date at the time versus gold’s rise of 50%. At its apex in mid-October, that gain was as high as 82%, and it’s still 76% to Tuesday.

Blue Ocean suggested the silver price could go parabolic, as previous bull markets show that silver outperforms gold by 2-4 times during the acceleration phase.

The gold-silver ratio has been sitting at a historically high 80-100x over the past five years but just bringing it back in line with average in the previous 20 years of 40-80x could equate to a silver price of US$70-80/oz.

According to The Silver Institute, silver is on track to be in deficit for the fifth consecutive year, thanks to demand growth from photovoltaic solar panels, electronics manufacturing, electric vehicle components and medical applications.

The metal was also recently included on the US critical minerals list.

The real question now is whether the silver price has risen (or is forecast) to be high enough for junior companies operating in the space to contemplate development of their Australian projects.

READ: Silver has surged to a record, but could it go berserk?

Silver plays seeing the gains

As always, while you can bet on a commodity either through physical purchases or ETFs, equities have offered outsized returns in the bull market.

We put together a list of silver stocks on the ASX. Some of these mine silver as a smaller by-product of gold or copper, or as part of a multi-commodity portfolio.

But many are pure plays who give exposure primarily to silver, with the precious metals making up the largest share of their current or future cash flows.

ASX silver stocks performance year-to-date

| CODE | COMPANY | PRICE | WEEK % | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| S32 | South32 Limited | 3.19 | 1% | 9% | 12% | -17% | -6% | $ 13,752,784,357.38 |

| MKR | Manuka Resources. | 0.062 | 13% | 0% | 92% | 71% | 126% | $ 59,768,597.52 |

| SVL | Silver Mines Limited | 0.175 | 3% | -17% | 75% | 82% | 124% | $ 353,445,876.96 |

| BML | Boab Metals Ltd | 0.38 | 0% | -14% | 130% | 192% | 130% | $ 102,110,358.00 |

| IVR | Investigator Res Ltd | 0.053 | 4% | -17% | 130% | 29% | 165% | $ 91,824,517.55 |

| MTH | Mithril Silver Gold | 0.49 | -15% | -14% | 32% | 20% | 23% | $ 84,718,923.12 |

| ARD | Argent Minerals | 0.026 | 0% | -24% | 24% | 4% | 53% | $ 41,934,451.15 |

| KCN | Kingsgate Consolid. | 4.51 | 15% | 12% | 128% | 233% | 251% | $ 1,121,219,860.20 |

| HRZ | Horizon | 0.052 | -4% | -36% | -7% | 18% | 30% | $ 149,164,652.32 |

| AGD | Austral Gold | 0.085 | -2% | 60% | 60% | 183% | 286% | $ 55,108,021.77 |

| SFR | Sandfire Resources | 16.07 | -1% | 3% | 55% | 52% | 73% | $ 7,248,183,662.72 |

| KSN | Kingston Resources | 0.13 | 8% | -19% | 40% | 49% | 83% | $ 109,205,249.79 |

| WCE | Westcoastsilver Ltd | 0.15 | 0% | -17% | 200% | 117% | 206% | $ 46,289,641.30 |

| SS1 | Sun Silver Limited | 1.09 | 14% | -1% | 65% | 42% | 74% | $ 129,865,603.56 |

| USL | Unico Silver Limited | 0.625 | 13% | -2% | 178% | 155% | 221% | $ 290,587,129.20 |

| ASL | Andean Silver | 1.91 | 14% | -7% | 93% | 73% | 136% | $ 324,758,947.48 |

| MMA | Maronanmetalslimited | 0.315 | -6% | -27% | 31% | 34% | 50% | $ 74,176,882.70 |

| RCM | Rapid Critical | 0.049 | -2% | -35% | 104% | -53% | -18% | $ 33,537,788.84 |

| LDR | Lode Resources | 0.195 | -9% | -20% | 70% | 86% | 112% | $ 31,547,908.28 |

| LGM | Legacy Minerals | 0.225 | -6% | -10% | 5% | 13% | 55% | $ 36,119,400.58 |

| BHM | Brokenhillminesltd | 0.86 | 2% | -9% | 310% | 310% | 310% | $ 117,245,597.54 |

| POL | Polymetals Resources | 0.985 | 7% | -21% | 13% | 40% | 24% | $ 241,032,309.30 |

| AVM | Advance Metals Ltd | 0.085 | -13% | -43% | 70% | 118% | 150% | $ 30,419,336.14 |

| AGC | AGC Ltd | 0.185 | 0% | -5% | 23% | -16% | 19% | $ 49,845,972.18 |

| ILT | Iltani Resources Lim | 0.43 | -8% | -9% | 65% | 153% | 110% | $ 27,042,912.78 |

Top 5 ASX silver stocks in 2025

Prices correct as of Monday, November 10.

Broken Hill Mines (ASX:BHM)

+310%

Broken Hill Mines has been a shining light since its reverse takeover of Coolabah Metals, which saw one of Australia’s iconic mining centres return to the ASX in Australian hands.

It owns the Rasp mine in Broken Hill, including the original line of lode operated in the 1800s by BHP, arriving on the scene straight away as a base metals and silver producer.

Outside the run in silver prices, two big potential value drivers are being looked at by investors.

The first is the obvious one. BHM has a majority stake in the high grade Pinnacles mine, which for decades has only been operated on a small scale by a single family.

A second, more speculative, catalyst for further growth could be consolidation with Perilya, the Chinese-backed owner of the other mine in the Broken Hill field.

Moving away from speculation and last month BHM flagged silver hits up to 1562g/t silver equivalent at its Pinnacles mine in NSW.

The plan is to assess the near-term potential of open pit operations at Pinnacles to deliver high-grade ore for processing at BHM’s Rasp Mill about 15km away.

Earlier in October, the company started mining and processing of high-grade ore from the Blackwoods orebody within the Main Lode.

And with a recent $38.5m placement in the works, the company is planning to accelerate exploration with 25,000m of drilling planned at Pinnacles.

Funds will also be directed to bumping up capacity at Rasp to 750,000tpa via a tailings dewatering facility.

Unico Silver (ASX:USL)

+221%

Unico has just picked up a spec buy rating in an initiation note from Canaccord Genuity’s Paul Howard with a $1.30 price target, having grown the resource at the Cerro Leon project in Argentina by 73% since its 2023 acquisition to 162Moz at 161g/t AgEq.

It’s due to get bigger, with a resource due for the Joaquin project some 15km west of Cerro Leon as the crow flies.

Last week, USL announced assays up to 8335g/t silver equivalent at the La Morocha and 3156g/t at the La Negra SE prospects at Joaquin.

Managing director Todd Williams said the bonanza-grade silver mineralisation at the project is typical of that previously mined underground by Pan American Silver and extends far closer to surface than previously understood.

“A standout intercept of 1.8 metres at 8335g/t AgEq from 52 metres demonstrates the potential for early, near-surface ounces and strengthens the case for open pit development,” he said.

“With multiple discoveries and shallow, high-grade intercepts now defined across the Joaquin district, Unico is rapidly advancing the company’s PLUS 150 and BEYOND 300 development and exploration growth strategies.”

BEYOND 300 is the plan to eventually take Unico’s silver endowment beyond 300Moz.

West Coast Silver (ASX:WCE)

+206%

West Coast Silver, previously Errawarra Resources, was transformed in March with the acquisition of the Elizabeth Hill silver project in WA’s Pilbara region, a forgotten orebody that fell out of favour back when silver prices were riding very low.

The Elizabeth Hill project was historically one of Australia’s highest-grade silver deposits, having produced 1.2Moz of silver from just 16,830 tonnes of ore at a quite extraordinary head grade of 2194g/t silver.

Mining ceased in 2000 due to falling silver prices –just US$5 an ounce – but the recent revival has highlighted untapped potential within the deposit.

Just last week, WCE struck visible native silver in a drill hole at Elizabeth Hill, part of a 1300m diamond drilling program.

This program will follow up on a whopper hit from inaugural drilling of 2m grading 10,049g/t silver from 63m and 1m at 15,071g/t from 27m.

Thicker intersections included 21m at 1047g/t Ag from 10m in hole 25WCDD001, which contained the 15,000g/t section, and 15m at 723g/t Ag from 1m in hole 25WCDD002.

Those are grades that are rarely seen on the ASX, an exchange not well known for its bounty of silver options.

There are other serious tailwinds for the project. The market is one thing, but the site also has a key attribute any explorer wants – a granted mining lease. In WA, that means permitting timelines and heritage matters are far simpler to manage.

The other advantage is its proximity to Artemis Resources’ Radio Hill processing plant, which could provide a ready processing option for the site.

An open pit case is emerging from the shallow bonanza hits, which follow historic drilling that includes intercepts like 3.7m at 6953g/t Ag from 13m.

Deeper mineralisation will be tested in a 10-hole, 900m diamond drill campaign, with 2000-3000m of aircore also coming to test high-priority targets near the historic mine.

Work is underway to advance the near surface oxide resource at Elizabeth Hill or JORC 2012 standard. With a share price of just 16c and market cap of $53m, plenty of room for growth remains even after a strong 2025.

Investigator Resources (ASX:IVR)

+165%

Investigator is the only pure play Australian-focused silver company on the ASX, hosting 57Moz of the precious metal at its Paris project in South Australia.

That gives is a point of difference compared to other silver plays – whose orebodies, it could be argued, are primarily lead and zinc mines.

It also means total leverage to the price of the commodity, which was back moving higher overnight.

That leverage is demonstrated with a quick review of a PFS from 2021 that showed an IRR of 54% at prices that have since increased more than 100%. Plug in recent spot silver and free cash over the mine’s life would be more than $1bn higher.

The project hosts the Apollo prospect, which returned 8m at over 1200g/t and has a plethora of silver targets to test, with a 15km long silver corridor surrounding the project home to several prospects that could make a hub-and-spoke model profitable.

The company recently earned into neighbour Alliance Resources’ Black Hills project, where iron bearing magnetite drilled in 2012 was reassayed for silver in 2013, striking 5m at 493g/t silver from 71m. More high grade assays went unreported.

Investigator plans to commence drilling there early next year.

With new MD Lachlan Wallace on board, a DFS is due in the first half of next year and is expected to highlight a robust economic outlook for the project based on rising silver prices.

Advance Metals (ASX:AVM)

+150%

Advance is well supported by mining institutions, with Tribeca, Jupiter Asset Management, Lowell Resources Fund and APAC Resources all taking part in a recent $13m cap raising.

It is aiming to control three silver deposits across Mexico containing upwards of 100Moz in foreign-standard silver equivalent resources, the latest a 4-year earn in to the +60Moz Guadalupe Y Calvo project from TSX-listed Endeavour Silver.

The project in Chihuahua state could be transformational for Advance, including 36.6Moz at 373g/t AgEq in a high-grade underground component, according to foreign resource estimates.

Last week, the company confirmed high-grade silver up to 848g/t silver equivalent at the 17.2Moz AgEq Yoquivo project.

The results came from sampling unassayed historical drill core, which combined with AVM’s latest drilling results, will be used to upgrade the project resource in Q1 2026.

That incorporates only a small portion of the historic core targeted for sampling, with multiple additional batches currently pending from the central and northern portions of the Pertinencia area.

“The selective legacy sampling by previous explorers has left lots of value behind for us to unlock,” MD Dr Adam McKinnon said.

“The high grade silver and gold mineralisation encountered in this first batch from the southern part of Pertenencia represent only a tiny portion of the material we are planning to re-log and sample, and I’m very much looking forward to what else might be present in these samples.”

Site preparation for recommencement of drilling at Yoquivo is now well underway, with a diamond rig expected on site in shortly.

At Stockhead, we tell it like it is. While West Coast Silver, Broken Hill Mines and Investigator Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.