Si6 finds new base metal hints and invests in the Kalahari copper belt in Botswana’s elephant country

Mining

Mining

Special Report: Si6 Metals has opened a new front in its bid to make major nickel, copper, zinc and other discoveries in its prospective landholding in Botswana.

New soil samples have returned elevated levels of copper, zinc and nickel coincident with the Maibele North linear trend in XRF results from its wholly owned Botswana projects.

That is significant as it demonstrates the potential for Si6 (ASX:SI6) to make discoveries on its wholly owned tenure in the southern African nation.

Botswana is emerging as a major resource development opportunity, with Sandfire Resources (ASX:SFR) recently beginning construction of the massive Motheo copper and silver mine.

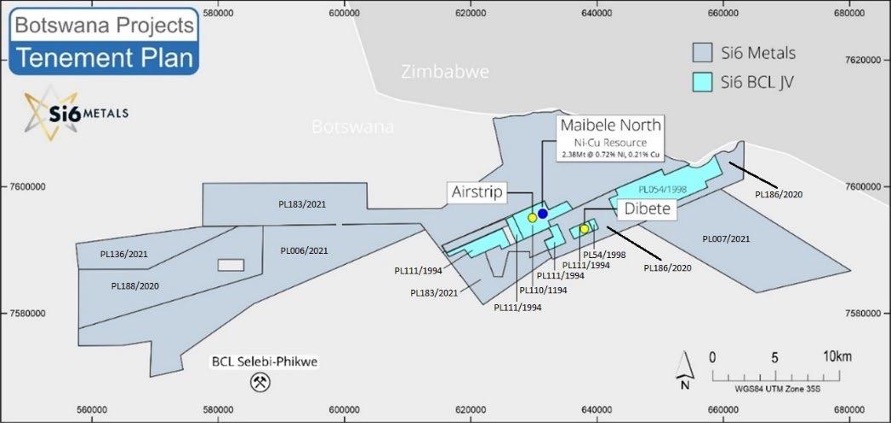

Si6 is the majority 60% holder of the JV that boasts the Maibele nickel-copper-PGE project, which hosts a resource of 2.4Mt at 0.72% nickel and 0.21% copper plus PGEs, cobalt and gold.

Drilling is expected to take place there later this year, but has been frustrated because Si6’s JV partner BCL has been in liquidation for several years. Liquidators recently provided consent for Si6 to drill there, with approvals in progress with local regulatory bodies.

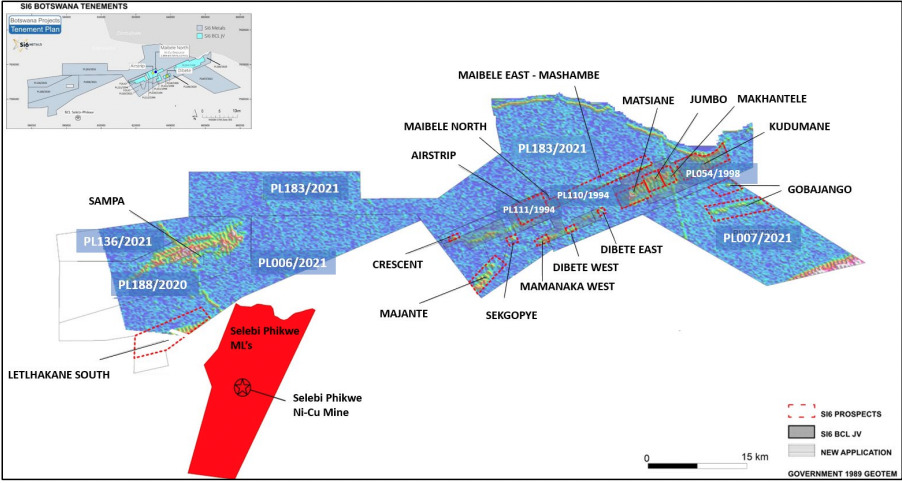

Making potential new discoveries at Si6’s Maibele East, Mashambe and Gobajango prospects would transform the project’s already strong potential given they are wholly owned by Si6.

Following the successful soil sampling campaign, which included samples along 40 by 2km lines spaced 200m apart perpendicular to the strike of the regional lithology, further work including detailed mapping, sampling and ground geophysics will be required to generate targets in the area

Evidence of ultramafic lithology – a geological feature commonly associated with nickel and copper abundance – along the Maibele-Mashambe trend was a positive outcome, lying along an interpreted linear geological trend that passes through the Maibele resource.

It could be a preferential horizon for hosting nickel sulphides.

Sampling and mapping at Gobajango also revealed previously unknown trenches across gossanous material (often associated with nickel deposits) and outcropping ultramafic rocks coincident with GEOTEM anomalies.

Si6 technical director Steve Groves said work will continue to assess the company’s tenure after the positive results.

“These encouraging results in Botswana on our 100%-owned tenure are a positive development for Si6 as we look to accelerate exploration activities in the country,” he said.

“Si6 intends to continue the work which has started on this tenure as we aim to build a stronger understanding of these areas and generate a number of priority drill targets for future programs.

“In addition to these activities, Si6 is also preparing to commence drilling at our joint venture ground in Botswana this year, with several key targets identified from previous work.

“We are currently progressing the required approvals to commence this work. Having exploration activities underway at both our joint venture and 100%-owned properties in Botswana is an exciting prospect that is now within our grasp and we look forward to updating shareholders on our progress in this regard.”

Soil sampling at Gobajango has revealed two prospective targets containing elevated base metals in soils coincident with GEOTEM conductive anomalies and likely ultramafic-mafic geological sequences.

“These are the characteristics that often mark base-metal sulphide mineralisation in the region and elevates these prospects to targets worthy of further exploration,” Si6 said.

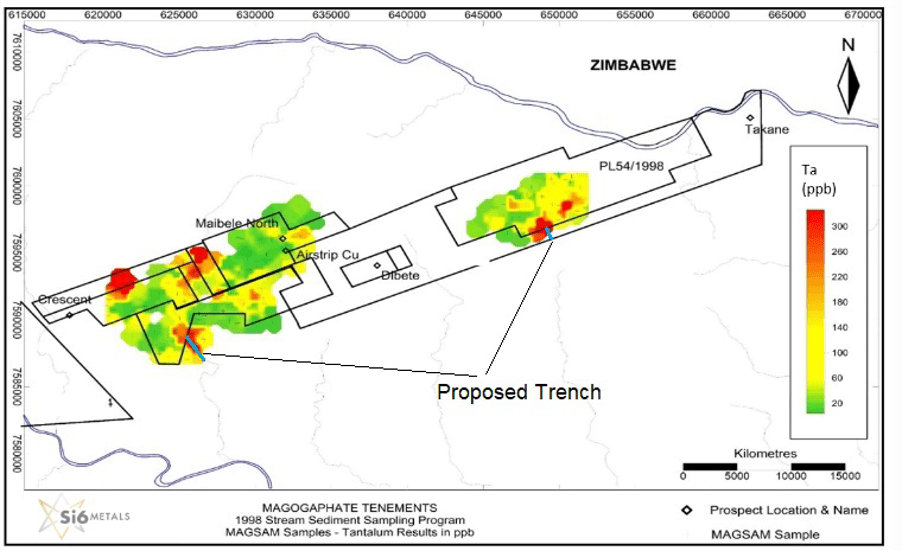

Si6 is also looking deeper into the lithium, rare earths and gold potential of its Botswana tenement holdings.

The company has previously undertaken a limited review, given the project abuts the Zimbabwe border where the same belt of Archean geology hosts Bikita, one of the world’s largest lithium bearing pegmatites.

Previous sampling returned similar tenors of lithium, tantalum and tin to other areas of the world where lithium-caesium-tantalum pegmatites occur.

The University of Botswana has now come on board, expressing an interest in undertaking a regional study of the Si6 portfolio for the potential to host critical minerals like lithium, tin, tantalum and rare earths.

Si6 undertook a desktop review and a brief field visit but it plans to commence further reviews and a comprehensive field program in collaboration with the University. With Si6 now in a position to undertake exploration in the area where previous pegmatite bearing mineralisation was identified after getting approval from its JV partner.

With Si6 left waiting for access to its exploration ground to open up amid its partner’s financial issues, its board focused on acquisitions and investments elsewhere.

One canny purchase has seriously paid off, with Si6 buying 1 million shares in ASX listed Cobre (ASX:CBE) in 2021.

Worth $90,000 at the end of last year, the value of that investment has increased 5x to almost $500,000 after a major copper discovery by Cobre in Botswana near Sandfire Resources’ Motheo copper and silver mine.

Cobre is the second largest landholder after Sandfire in the Kalahari copper belt, one of the world’s most prospective areas for copper exploration, according to the US Geological Society.

Its landholding is also along strike from Cupric Canyon’s high grade Zone 5 copper and silver deposit.

Cobre’s Ngami project has 57 ranked priority targets with mineralisation known to extend over 4km, presenting a sensational investment proposition for Si6.

This article was developed in collaboration with Si6 Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.