Ripe enough to list on the ASX: Voltaic Strategic Resources has a rare dish waiting in the Gascoyne region

Mining

Mining

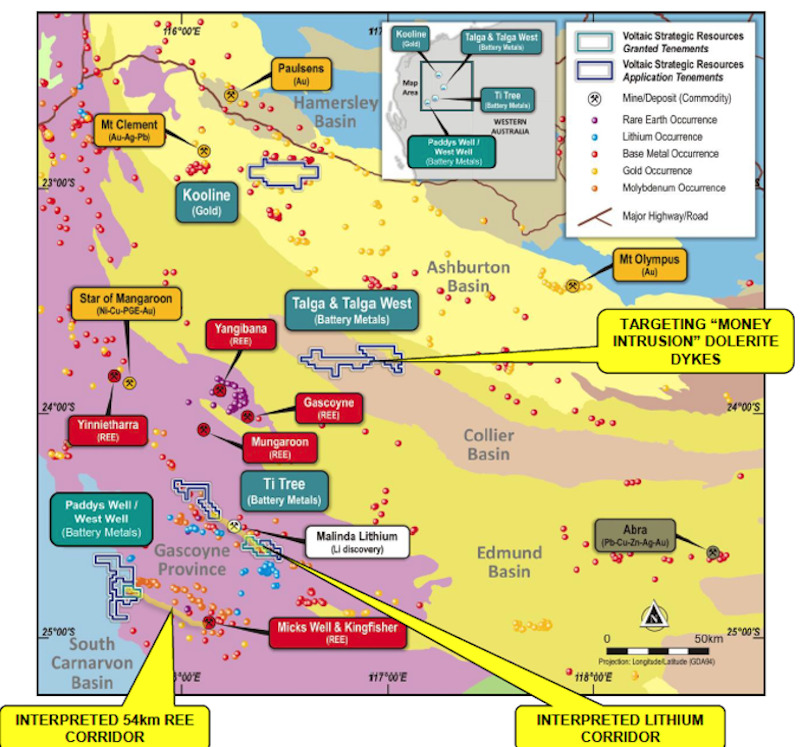

Ahead of its upcoming ASX relisting, WA-based Voltaic Strategic Resources has discovered it may already host an exciting and previously undiscovered rare earths corridor.

WA’s vast Gascoyne region is known for everything big – from whale sharks to banana plantations – but if Voltaic Strategic Resources is right on the money soon the Gascoyne will be synonymous with big rare earths.

Voltaic (proposed ASX:VSR) will be the latest rare earths/lithium entrant into the Gascoyne when its proposed relisting from the shell of Eon NRG comes to fruition at the end of July.

And judging from what the neighbourhood is up to, it could not have timed its arrival much better.

The company will list with a host of highly prospective battery metals projects in the region, at a time when Hastings Technology Metals (ASX:HAS) is pushing closer to becoming the nation’s next rare earths producer at its nearby Yangibana project on the back of huge Australian Government funding.

Following in Hastings’ footsteps are a suite of earlier-stage rare earths explorers doing big things – including Dreadnought Resources (ASX:DRE), Frontier Resources (ASX:FNT) and Kingfisher Mining (ASX:KFM).

The latter of that trio last week released results from its MW2 target, located along a 54km corridor associated with the rare earths-rich Chalba Shear Zone, which it said pointed to “the emergence of an exciting and previously unrecognised REE region”.

Why does that matter for Voltaic? The Chalba Shear Zone extends directly into its Paddy’s Well/West Well battery metals project area.

Kingfisher reported one interval as high as 7.13% total rare earth oxides at MW2, and currently has rigs back on the ground.

Inbound CEO Michael Walshe told Stockhead on the back of Hastings’ Yangibana production progress, his company believes there is a significant opportunity for all explorers in the region to capitalise on what could be a new Australian mineral province.

“Now it’s established that there will be a rare earths project there, all the players in the region – those like Dreadnought, Frontier or Kingfisher or ourselves – if we find any significant deposits we won’t have to build our own processing plant at a huge cost,” he said.

“Essentially, Hastings has done the heavy lifting, having had eight years of cracking the mineralogy and now operating with a proven flow sheet – we hope to be beneficiaries of that down the track.

“Rare earth elements (REE) have a reputation for being a tricky, niche commodity because processing can be challenging, and the market is opaque in terms of pricing. However, the like of Hastings and Lynas have managed to overcome this stigma and demonstrated that Australia can compete globally as a major REE producer”.

Walshe said Hastings’ work at Yangibana had demonstrated that Gascoyne REE mineralisation was quite unique in a global context; whilst the head grade may be comparatively lower in terms of total rare earth oxide (TREO) content, the sought-after Neodymium and Praseodymium (NdPr) fraction is much higher. Moreover, the ore has much cleaner metallurgy when compared to peers.

Well, essentially, it’s about strong magnets. NdPr magnets are critical components of many green technologies including wind turbines and electric vehicles.

And while West Well and Paddy’s Well may be at an earlier stage than some of the other exploration projects in the region, the initial geological indicators from the ground suggest Voltaic is onto something.

“One distinct attribute of these projects is that they have outcropping ironstones within the project area, which both Hastings, Dreadnought and Kingfisher have found to be rich in REEs, and have used them to target drilling” Walshe said.

“Previous explorers at Paddy’s Well found the same outcropping ironstones, but at the time they were looking for uranium. Rare earths were certainly not the focus and as such they weren’t even assayed for REE. Coupled with this, we have identified positive geophysical indicators that match other known REE deposits in the region, and provide us with an early suite of target areas to follow up.

“As a result, we feel there’s a lot of scope for us as rare earths first movers in our large tenement package.”

It’s not just rare earths that Voltaic has an eye for in the Gascoyne.

The company will also prioritise exploration work at the Ti Tree lithium project contiguous to the Malinda lithium project, the majority of which is being sold into private hands by West African focused gold explorer Arrow Minerals.

Drill intercepts at Malinda include hits of 23m at 0.98% lithium oxide, 2m at 1.71% and 1m at 2%. Ti Tree is interpreted to lie within a prospective corridor for lithium pegmatites, and is also prospective for REEs, as well as base metals, uranium and gold.

The project is 50km south of Hastings’ Yangibana rare earths project.

The potential for a rare earths province in the Gascoyne should turn plenty of heads given the geopolitical and strategic importance of the minerals in the current climate.

China currently dominates the world’s rare earths landscape, particularly in processing, and last year moved to amalgamate three state-owned rare earths enterprises into one mammoth company.

The western world’s response has been to pump funding into local projects in a bid to diversify the global mix of the crucial metals. Recent significant investments in ASX-listed plays include:

Put simply, the numbers would suggest it’s a good time to be exploring a prospective rare earth project in a stable western jurisdiction.

Voltaic will also list with a trio of prospective gold projects in the prolific Meekatharra gold province, which has produced more than 35 million historic ounces.

The Bundie Bore, Bluebird South and Cue gold projects each sit within trucking distance of established operations such as Westgold’s Bluebird and Tuckabianna mills, and around 150km from gold mines at Mt Magnet and Murchison.

The projects are also proximate to Australian Vanadium’s (ASX:AVL) namesake project, as well as Technology Metals Australia’s (ASX:TMT) Gabanintha vanadium project.

These gold projects are worth watching, with field work planned for the first six months post re-listing.

Boasting an experienced board with a track record of success, Voltaic expects to relist at the end of July. The company will issue its prospectus with an offer price of 2c per share post consolidation and existing shareholders in Eon given the opportunity to take part in a priority issue and boost their stake.

“With most new fresh IPOs there’s a lot of cheap stock that gets dumped after listing, and there’s essentially none of that here because all funding has been done at the same price, 2.0c” Walshe said.

“We expect that should make for quite an attractive proposition for new shareholders – low EV, really exciting projects in highly prospective locations and a great deal of upside.”

This article was developed in collaboration with Voltaic Strategic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.