Resources Top 5: Viking treasure hoards, green hydrogen, and a strong lithium debut

Mining

Mining

Here are the biggest small cap resources winners in early trade, Friday, July 9.

$20m market cap QEM is +150 per cent since announcing plans to study “green hydrogen opportunities” at its Julia Creek vanadium and oil shale project in Queensland.

Green hydrogen burns cleanly and emits only water, making it the ‘holy grail’ of renewable energy.

Today, QEM said the first phase of the pre-feasibility study indicated suitability of wind farms to power green hydrogen production on site.

“The results of the wind farm stage of the study brings QEM another step closer to becoming a pioneering Queensland producer of green hydrogen,” QEM Managing Director Gavin Loyden says.

“… our path towards green hydrogen, commencing with investment in on-site renewable energy generation, is the optimal one to deliver long-term value for QEM.”

“This is further supported by QEM’s potential to become a supplier of green energy into the proposed $1.5 Billion Copperstring 2.0 high voltage transmission line development, adjacent to our Julia Creek project,” he said.

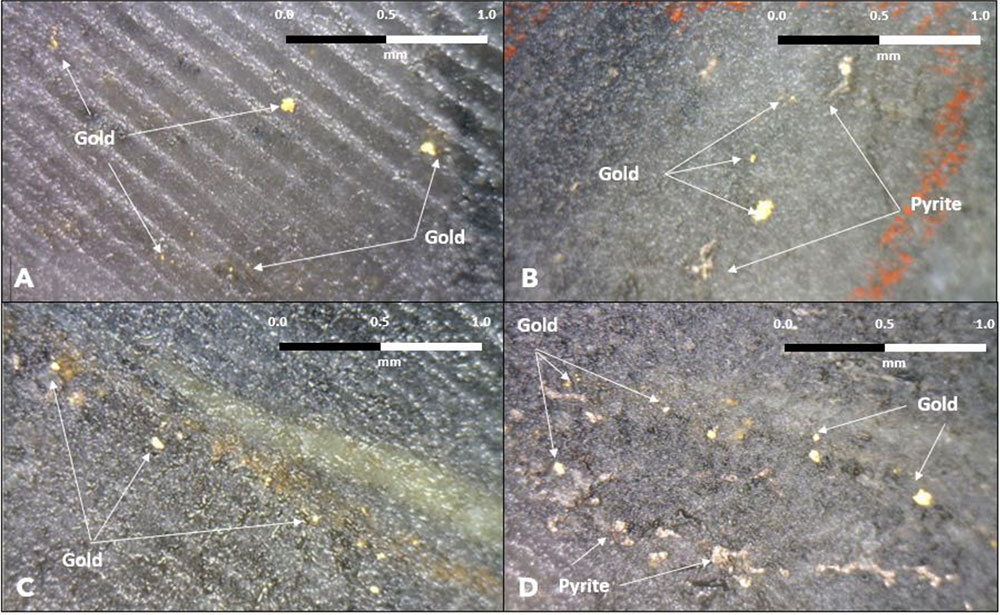

Visible gold!

Gold flecks were sighted “at several intervals” in two drill holes while testing the depth extents of the historic ‘First Hit’ mine.

Only these two holes of the 6 holes reported have been revisited, the $20m market cap explorer says.

“I am excited to be able to report that we have now shipped all of our core to Perth and commenced a follow up review of key intersections from the drilling completed on First Hit,” Viking boss Julian Woodcock says.

“These holes form part of the depth extension drilling and provide positive encouragement for the continuation of mineralisation at depth for First Hit.”

Prior to closure in 2002 due to depressed gold prices below $US320/oz, First Hit produced ~30koz ounces of gold at an average grade of ~7.7g/t gold.

It was only mined to around 220m deep, so uncovering visible gold specks at ~325m and ~327m in hole VDD013 and ~300m and ~303m respectively in hole VDD015 highlights the orebody’s potential to keep going.

This $15m market cap minnow is hunting Olympic Dam-style IOCG deposits at ‘Mabel Creek’ and gold at ‘Comet Ridge’, both in South Australia.

A never-before-used-on-the-project sampling technique has now defined a significant new 2km by 800m gold anomaly at Comet Ridge.

Tighter-spaced sampling on this new target will get underway in about 3 weeks, with follow-up drill testing of this target, ‘Comet’, and ‘Target 14’ gold prospects to kick off in the coming months.

The ASX’s newest lithium and base metals play jumped out of the gate on its debut.

$10m market cap Charger is exploring in some popular neighbourhoods.

The ‘Coates’ nickel-copper-PGE project is just 30km from Chalice’s (ASX:CHN) Julimar discovery.

Meanwhile, the ‘Bynoe’ lithium and gold project in the Northern Territory is surrounded by tenements owned by advanced project developer Core Lithium (ASX:CXO).

Is this foreshadowing?

DGO Gold (ASX:DGO) – known for making substantial investments in De Grey Mining (ASX:DEG) before it hit the motherlode at Hemi – has just increased its stake in Yandal from 14.26% to 19.9%.

Yandal currently has up to 4 rigs spinning at the ‘Gordon’s’ gold project in WA, with a bunch of assays pending.