You might be interested in

Mining

Gold Digger: Don't expect a rally soon but H2 could be golden, agree top analysts

Mining

A single wind turbine can contain up to $350,000 worth of copper. Plus zinc. Plus tungsten...

Mining

Mining

Here’s your top ASX small cap resources winners in morning trade Wednesday, February 3.

KING ISLAND SCHEELITE (ASX:KIS)

Yesterday, the explorer scored a $10m loan from the Tasmanian Government to support redevelopment of the Dolphin tungsten project.

Tungsten is a critical mineral – like rare earths, lithium, and cobalt – and a key input “to industries that are vital to national security”, KIS boss Johann Jacobs says.

“We note that several Western governments have recently identified a crisis in the supply chain for critical minerals, particularly tungsten, for which North America currently has no mines in production,” he says.

“This funding empowers us to continue our development program at Dolphin, which hosts one of the few high quality tungsten deposits remaining in the Western world.

“We have secured this funding at an exciting time for King Island Scheelite, coming shortly after our completion of test work which resulted in significant improvements in recoveries and grade, publication of a Revised Feasibility Study which has boosted the expected project NPV by 65 per cent to $241 million, and our signing of a significant multi‐year offtake agreement.”

(Up on no news)

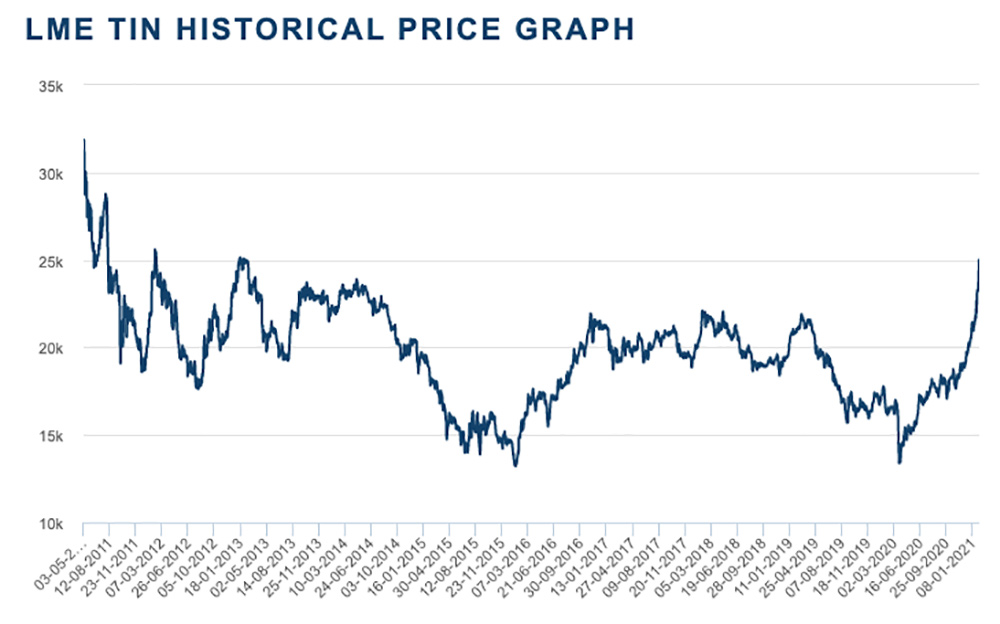

The tin price hasn’t looked this good for eight years:

Which explains Elementos’ solid run over the past month or so.

The explorer’s main game is the Oropesa project in Spain – one of the world’s largest undeveloped, open-cut mineable tin deposits.

But it also has the Cleveland tin-copper project in Tasmania, “a significant resource amenable to both open cut and underground mining”, the company says.

In December, Legacy — a small WA gold-iron ore explorer – made big, high volume gains on speculation it was looking to fire up its Mt Bevan magnetite iron ore project again.

No, it said. Our focus is moving the small 184,100oz Mt Celia gold project in the Eastern Goldfields into production.

New drilling at the Yilgangi gold deposit near Mt Celia has returned thin but very high grade, near surface intercepts like 1m at 10.9 g/t and 1m at 17.8 g/t.

“We are encouraged with these results as it provides further confidence of additional mineralisation in the area and more importantly a potential linking of known mineralisation into a larger geological system,” Legacy chief exec Rakesh Gupta says.

“The Yilganji deposit could act as a satellite deposit to the Mt Celia project.”

White Rock Minerals (ASX:WRM) will acquire small scale gold miner AuStar in a friendly all share deal.

AuStar shareholders get 0.78 White Rock shares for every AuStar share held — a~ 47 per cent premium based on the last trading price of AUL shares on February 1.

The AuStar Board unanimously recommends the offer.

White Rock technical advisor Dr Quinton Hennigh says the acquisition gives White Rock control over one of the high-grade gems of the Victorian gold fields.

“As the acquisition is not expected to significantly impact White Rock’s current exploration momentum in Alaska, it gives White Rock shareholders exposure to a potentially high-value year-round exploration asset in one of the most prolific gold belts on earth,” he says.

“Along with this comes the element of production at Morning Star which White Rock plans to ramp up to underpin White Rock’s cash flow going forward.

“Such an acquisition opportunity comes along rarely and is expected to help White Rock build a solid foundation upon which to grow.”

(Up on no news)

Has WA explorer Nelson hit the golden motherlode near Kalgoorlie?

A first ever diamond drilling program at the Woodline project’s Redmill, Grindall and Socrates prospects is due for completion this month.

“Work carried out by Nelson at Socrates has returned several significant gold intersections, suggestive of a large gold system,” Nelson said in January.

“The company believes that Grindall, Redmill, and Harvey each have the potential to host a Tropicana scale gold deposit.”