You might be interested in

Mining

Resources Top 5: Fortescue is punting on copper with magnanimous Magmatic deal

Mining

Resources Top 4: Koonenberry Gold pulls in big bucks from small caps investor Lion Selection Group

Mining

Mining

Here are the biggest small cap resources winners in early trade, Friday March 25.

The explorer has inked a “transformational” deal to buy the high grade ‘Delphin’ copper project in Chile.

The project is in a prolific copper-producing region home to monstrous mines like BHP (ASX:RIO) and Rio’s (ASX:RIO) Escondida (11.2 billion tonnes @ 0.8% Cu).

Over 15,000m of historical drilling at Delpin has pulled up hits like 86m @ 4.83% Cu from 121m, and 89m @ 3.2% Cu from 122m.

If MAN can replicate those sorts of numbers a re-rate could be on the cards.

Importantly, 90% of this old drilling was concentrated in a tiny 300 x 100m area “with little previous application of modern exploration techniques”.

Mandrake intends to undertake an active exploration program commencing early Q2.

“Historic exploration has identified several different zones of spectacular high-grade copper mineralisation including 86m at 4.83% Cu from 121m in DD-04,” MAN managing director James Allchurch, says.

“We see a clear opportunity to apply modern exploration and interpretation techniques to understand these zones and look to grow them ahead of a maiden JORC resource.”

“Delfin boasts a historical database underpinned by over 15,000m of diamond and RC drilling that has immense potential for expansion given the broad spacing of high-grade intercepts and the fact that only 20% of drilling exceeded 140m depth.”

Delfin also has significant potential for deeper copper porphyryies – like Escondida — given the genesis of copper mineralisation at Delfin has not yet been determined.

Porphyries are multigenerational monsters responsible for ~60 per cent of the world’s copper, most of its molybdenum, and significant amounts of gold and silver.

“Moving forward, Mandrake’s corporate and strategic focus will be on the Delfin Project where we will have boots on the ground in the coming weeks, together with follow up exploration at the Jimperding PGE-Ni-Cu Project,” Allchurch says.

With ~$16.2M cash, MAN says it is fully funded for exploration at both Delfin and Jimperding.

(Up on no news)

SLB has popped up on the radar of Aussie investment manager Terra Capital, which now owns 9.91% of the freshly listed explorer.

The company has 5 copper-zinc projects in South Australia, proximal to major mines and discoveries held by BHP, Oz Minerals, FMG, and Coda Minerals.

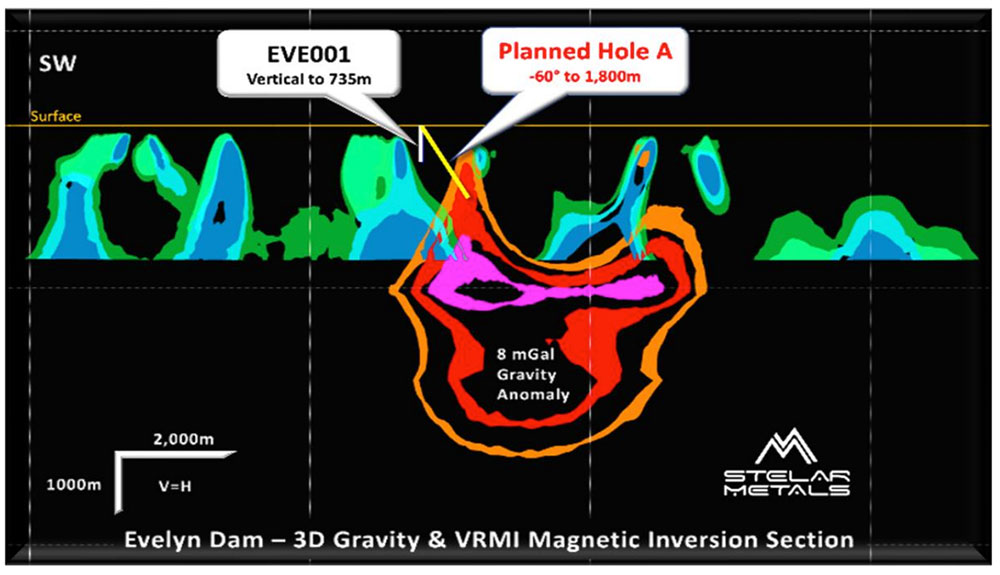

Its main game is ‘Evelyn Dam’; a large, very deep and untested Olympic Dam style IOCG gravity target which was previously owned by both Rio Tinto and BHP.

Iron oxide copper gold ore deposits (IOCG) — like BHP’s Olympic Dam mine or more recent Oak Dam discovery — can be tremendously large, and simple-to-process concentrations of copper, gold and other economic minerals.

A single hole drilled by Rio in 2018 (EVE001) missed the main anomaly. SLB don’t intend to make the same mistake:

SLB’s other copper projects include Torrens (about 40km from Olympic Dam), Barratta, and Gunson.

The company’s Linda Zinc Project in the Flinders Ranges is considered prospective for MVT and Beltana-Kipushi type zinc-lead mineralisation as well as Zambian style copper mineralisation.

(Up on no news)

This Chalice Mining (ASX:CHN) spinoff is chaired by Mark Bennett, discoverer of the Nova nickel discovery.

It has three key projects to tackle: Pyramid Hill (VIC), Viking (WA), and Mount Jackson (WA).

Pyramid Hill — CHN’s No 1 focus before it hit the motherlode at Julimar – is highly prospective for high-grade gold deposits like the nearby, world-class Fosterville mine.

Since 2018, CHN has completed ~124km of drilling across the ~5,000sqkm project, defining four large scale prospects.

They include ‘Karri’, which is defined by shallow gold hits up to 34g/t over ~4km of strike, and ‘Banksia’, a giant 10km-long anomaly which returned hits up to 8.7g/t.

In January, FAL launched into +5,500m of diamond drilling across the Karri and Ironbark prospects, which will run until April 2022.

(Up on no news)

A nice little surge from this phosphate play, despite it raising a paltry $325,000 yesterday via placement of 25m at 1.3c – well below the current share price.

The micro-cap stock has bounced around a bit but is currently up 150% since dusting off its advanced 550Mt ‘Wonarah’ phosphate project in the NT in November last year.

Wonarah, currently one the largest and highest-grade phosphate projects in Australia, has been in the portfolio since 2007.

It reached advanced feasibility study level in 2013 before the company acquired a more advanced, production-ready project in Senegal, it was shuffled to the basement.

It was dusted off and propelled to the front of its portfolio after prices began soaring late last year.

A new scoping study (the first proper look at the economics of building a project) is now investigating the development of Wonarah to produce critical end products for LFP (lithium iron phosphate) batteries.

(Up on no news)

Another phosphate play making gains today as fertilizer prices go through the roof.

AGR is currently trying to get its Três Estradas Phosphate Project (‘TEPP’) and Andrade Copper Project (‘Andrade’) into production.

The two projects are near each other in the Southernmost Brazilian state of Rio Grande do Sul.

The TEPP – considered a project of importance by the Brazilian government — is expected to produce 306,000tpa over 18 years following a three-year ramp up.

It will cost just $8m to build.

AGR’s natural phosphate fertiliser products, Pampafos and Lavrato have now been tested on the following Brazilian crops; soybean, rice, corn (maize), oats and wheat, “with all tests returning excellent results”, the company said early Feb.

“Domestic interest in Aguia’s Direct Application Natural Phosphate continues to grow with more offtake agreements anticipated,” it says.

Meanwhile a drilling program has kicked off at Andrade to improve confidence in, and potentially expand, the copper resource.

This will help the company develop a more detailed mining and processing plan and refine its economic model.

In March 2021, an early-stage project study and updated resource shows “positive economics” for development.

Results show an impressive 67.1 per cent internal rate of return (IRR) on a 1mtpa copper sulphate (salt) operation over 14 years.

Average earnings before tax would be almost $20m a year – and it would cost just $10m to build the thing.

The $23m market cap stock is up 20% in 2022. It had $5.1m in the bank at the end of December.