Resources Top 5: Julimar ‘nearology’ hype is still running red-hot

Mining

Mining

Here’s your top ASX small cap resources winners in morning trade Wednesday, December 2.

Since Chalice Gold Mines (ASX:CHN) uncovered the company-making Julimar discovery in March this year, a tsunami of small caps have flooded the surrounding region near Perth.

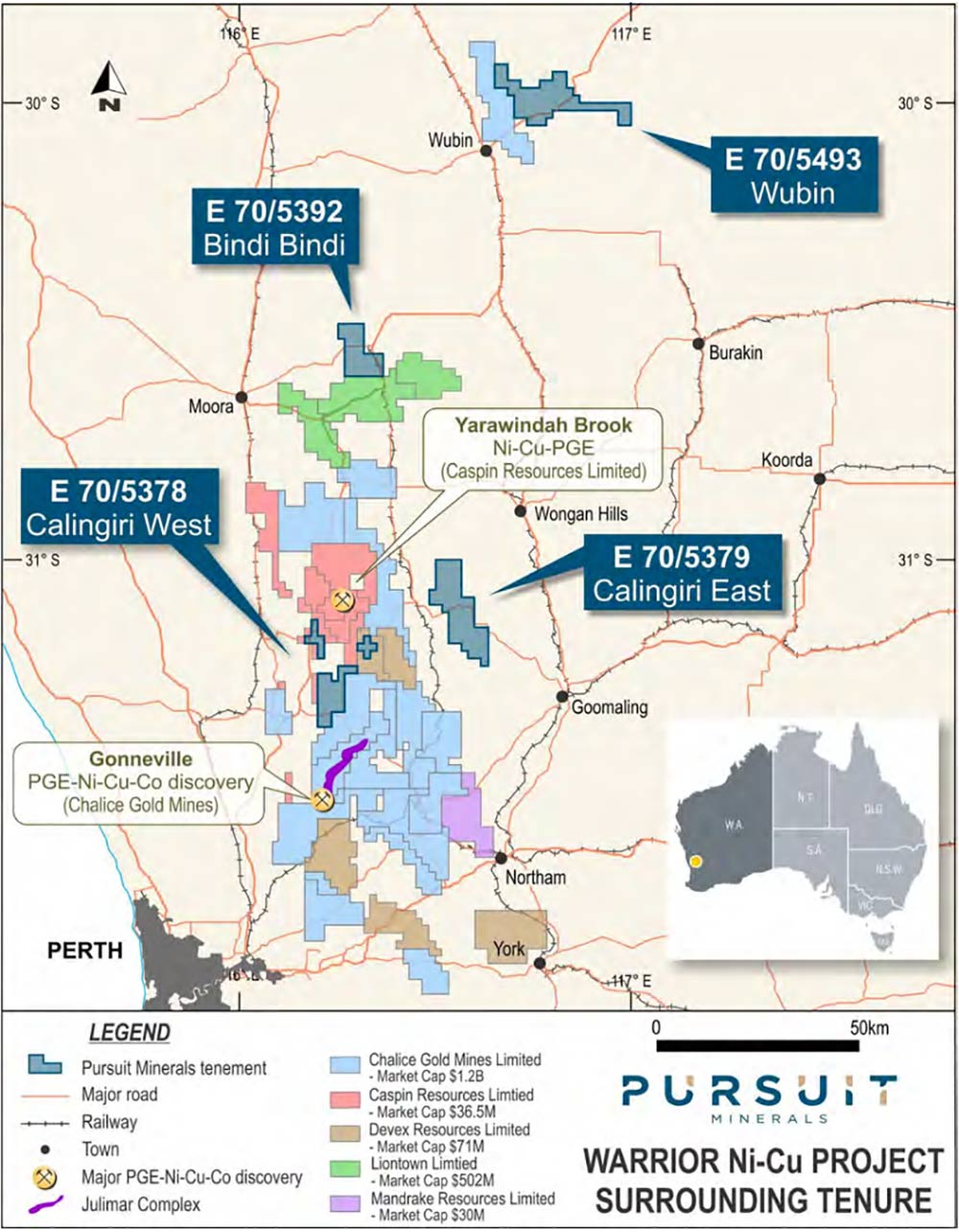

Former vanadium play Pursuit Minerals (ASX:PUR) is the latest explorer to ride the ‘nearology’ (being ‘near’ a big discovery) train.

Pursuit is buying the ‘Warrior’ project tenements, which begin ~20km from Julimar:

“Chalice’s discovery of PGE-nickel-copper mineralisation in the Gonneville intrusion has opened up the West Yilgarn province for a new style of mineralisation which has world-class potential,” Pursuit managing director Mark Freeman says.

“[The] four tenements which comprise the Warrior project contain a number of aeromagnetic anomalies whose characteristics are similar to the magnetic expression of the Gonneville intrusion.”

The ~$13m market cap stock was up +40 per cent in morning trade.

Australian Vanadium (ASX:AVL) has signed a non-binding offtake agreement – crucial for attracting finance — for future production from its namesake project in WA.

The potential buyer is specialty chemical producer U.S. Vanadium, which wants to lock in 2,000 tonnes of V2O5 per annum — ~20 per cent of AVL’s planned production.

“There is an increased emphasis on security and provenance of supply chains globally and AVL has been fielding significant investor interest from Europe and the US,” says managing director Vince Algar.

“The relationship with USV also validates AVL’s strong technical capability and the company’s considered approach to its feasibility studies.”

The Narndee project – where Aldoro Resources (ASX:ARN) is hunting major nickel-copper-PGE deposits like Nova-Bollinger, Voisey’s Bay and Julimar — will be a major focus “from now and into 2021”.

Red Hill Iron (ASX:RHI) owns a large, low grade iron ore project in WA.

The explorer listed on the ASX in 2005, trading at big volumes and at prices north of $6 per share.

The share price has shrunk dramatically since then to ~23c on the perception that the Red Hill Iron Ore Joint Venture (RHIOJV) “is a stranded project of modest grade and high impurities”, said chairman Josh Pitt in November.

The modest grade, high impurity part is true — but this project is also cheap to mine, and iron ore is booming.

“[We] have had some preliminary discussions about how to advance that opportunity,” Pitt says.

“We anticipate more positive news in the months ahead.”

And if you believe the pundits, uranium could have a breakout year in 2021.

One of the beneficiaries could be Berkeley Energia (ASX:BKY), which is battling through the approvals process to build its contentious Salamanca uranium mine in Spain.