Resources Top 5: Investors scoop up cheap copper, gold stocks

Mining

Here are the biggest small cap resources winners in early trade, Monday February 21.

The explorer hit a “phenomenal” 105m at 1.94% copper and 55g/t silver from 46m — including a 16.6m chunk grading 10.2% copper and 316g/t silver – in drilling at the ‘Onedin’ deposit, part of the ‘Koongie Park’ project in WA.

This hole (AORD004), one of seven drilled between November and December last year to max depth of 243m, is ~50m away from drilling which also pulled up nice, thick mineralisation in October last year.

The remaining assays for the seven Onedin drill holes are expected within the next week.

The aim of this drilling is to expand the existing (and already very tidy) Koongie Park resource of 6.8Mt at 1.3% Cu, 4.1% Zn, 0.3g/t Au and 26g/t Ag.

AKN says it has identified multiple drill targets to expand on the existing known resources at both the Onedin and nearby Sandiego deposits.

Both remain open at depth and to the south.

The results from drill hole AORD004 are phenomenal – especially the very high-grade zone of more than 10% Cu from 130m depth, says AKN CEO Paul Williams says.

“Following the excellent results from AKN’s first drilling program reported last year, the company has now clearly identified a significant copper deposit at its Koongie Park project which we now have a 75% interest in,” he says.

“Results such as these from AORD004 set the scene for the commencement of AKN’s metallurgical testwork program on the near-surface Onedin ores.

“In addition, these results should be highly complementary to AKN’s Koongie Park resource upgrade work that has already commenced and with a report likely to be available later this quarter.”

The $18m market cap explorer is up 40% since relisting on the ASX with Koongie Park earlier in 2021. It had $2.5 million in the bank at the end of December.

(Up on no news)

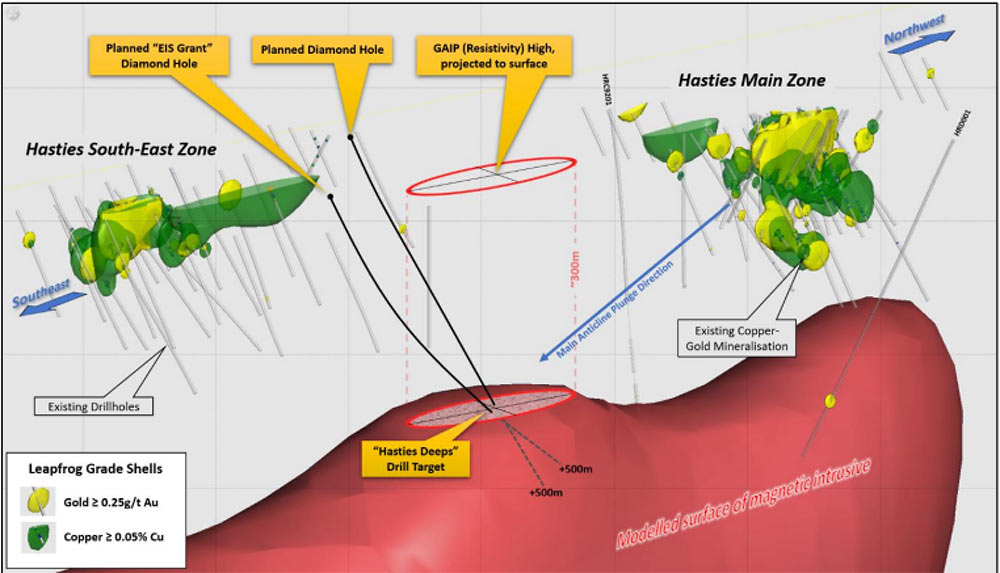

This cheap $5m market cap tiddler has a project called ‘South Telfer’ in the world class Paterson Province, about 12km from the large Telfer gold mine which produced 393,164 ounces of gold and 16,278 tonnes of copper in FY21.

Results from a December drilling program released last week were initially disappointing, with five of seven holes to the northwest of the Hasties Main Zone returned low-level copper-gold “despite intersecting favourable zones of alteration”.

RCR reckons the target is still there; they just missed it somehow.

“The fact that 21STRC033 intersected antimony mineralisation at the end of hole, which is known to be strongly associated with gold at Hasties, suggests we may not be far away,” RCN managing director Gary Harvey says.

Diamond drilling, including the EIS Co-funded drillhole to test the monstrous ‘Hasties Deeps’ target will resume towards the end of February.

A further 8 RC holes for an estimated 2,550m also remain to complete the RC drilling component of the Phase 2 program. The company is consulting with its current drilling contractor to expedite the return of the RC drill rig “and will inform shareholders in due course”.

The explorer is currently trading well below its December 2020 IPO price of 20c per share. It had $2.6m in the bank at the end of December.

The Kalgoorlie explorer has hit thick, high grade gold underneath a salt lake at the emerging ‘Burns’ discovery.

Assay results have been received for 128 holes of a maiden drill program evaluating the eastern extension of the now 2km-long Burns copper-gold corridor.

Significant results included:

Further results are pending.

“These are two outstanding gold intersections from aircore drilling out beneath Lake Randall that further demonstrates the growing scale of the Burns copper gold system,” LEX managing director Wade Johnson says.

“We are fortunate to have the specialised lake rig on site elsewhere on Lake Randall and immediately mobilising back to Burns to scope out the footprint of this new mineralisation.”

In Feb last year a 22-hole drilling program, designed to test both length and depth of the ‘Burns’ system, appeared to hit the motherlode.

The highlight intercept was:

Gigantic. The stock rerated massively, but follow-up drilling initially failed to replicate those eyewatering grades (there are reasons, LEX says).

The $51m market cap stock has since settled back to ~36c per share. It had $6.3m in the bank at the end of December.

(Up on no news)

“Succeed quick or fail fast” is the mantra of junior explorer WSR, which is hunting big gold deposits across a portfolio of nine projects in WA.

That means no poking around moose pasture for years and years. It’s find something, or move on.

On January 31 WSR announced significant hits at the ‘Mt Finnerty’ and ‘Parker Dome’ JV projects with mid-tier miner Ramelius Resources (ASX:RMS), including 5m at 66.7g/t gold from 175m.

RMS can earn up to 75% in these projects by sole funding exploration up to $2m over a three-year period. WSR will hold a free carried 25% until a decision to mine is made.

“The exceptional results at Flinders clearly speak for themselves and demonstrate the high-grade potential of deeper, primary hosted mineralisation,” WSR managing director Karl Jupp says.

“The significant intercept at the Tasman Prospect, approximately 3km south and along strike from Flinders, substantially increases the zone of significant mineralisation.”

Assays from a further 2,442m of regional, first pass aircore in 42 holes are pending.

$5.3m market cap WSR is up 35% year-to-date. It had $2.2m in the bank at the end of December.

(Up on no news)

Bouncing back from recent lows is explorer CBY, which is hunting for copper-gold porphyries in Queensland.

Its main focus is ‘Briggs’, which has an inferred resource of 143 million tonnes @ 0.29% copper at the 500m-long, 500m-deep ‘Central Porphyry’ – one of three intrusive centres at the project.

Recent drilling confirms extensive porphyry copper-molybdenum mineralisation up to 750m away from this existing mineral resource, with several holes terminating in strong copper mineralisation, CBY says.

In August last year, Alma Metals (ASX:ALM) inked a deal to earn up to 70% of Briggs through staged exploration spending over nine years of up to $15.25 million.

Canterbury and Alma Metals are now planning a major drilling campaign to commence mid-Q2.

The share price of $12m market cap CBY is flat year to date. It had just $739,000 in the bank at the end of December.