You might be interested in

Mining

Variscan Mines hits the high-grade notes as latest drilling backs San Jose resource model

Mining

Variscan Mines identifies new drill targets in comprehensive geological assessment of San Jose

Mining

Mining

Here are your top ASX small cap resources winners in morning trade Monday, November 23.

GME Resources (ASX:GME) leads the winners on some shallow, high grade gold hits at the Fairfield deposit in the Goldfields region of WA.

The 720m drilling program was designed to define and expand a small, shallow, gold ‘exploration target’ of 90,000 to 135,000 tonnes grading 2 to 3 g/t gold.

An exploration target is an early estimate – or educated guess – about the size, grade and mineability of a deposit prior to drilling.

Highlights from this drilling included 10m at 2.9 g/t from 13m (including 4m at 5.4 g/t).

This intercept is particularly interesting because the mineralisation is ‘open’ (it keeps going) “and opens up potential for extension of the deposit to the north which is untested”, GME says.

Young kaolin and silica sand company Suvo Strategic Minerals (ASX:SUV) will buy Australia’s only significant kaolin mining and processing operations.

Suvo – which listed on the ASX in August this year – will pay French multinational Imerys S.A. $2m for three mining leases and a processing plant, ~ 40km from Ballarat in Victoria.

The assets have been producing and selling kaolin products to paper, coatings, paint and specialist industries (including rubber and pharmaceutical applications) since 1972.

In 2019, 25,000 tonnes of kaolin products generated revenues of $13m and before tax earnings of $2.1m.

Suvo has enjoyed a great first few months on the ASX, up +370 per cent since early August.

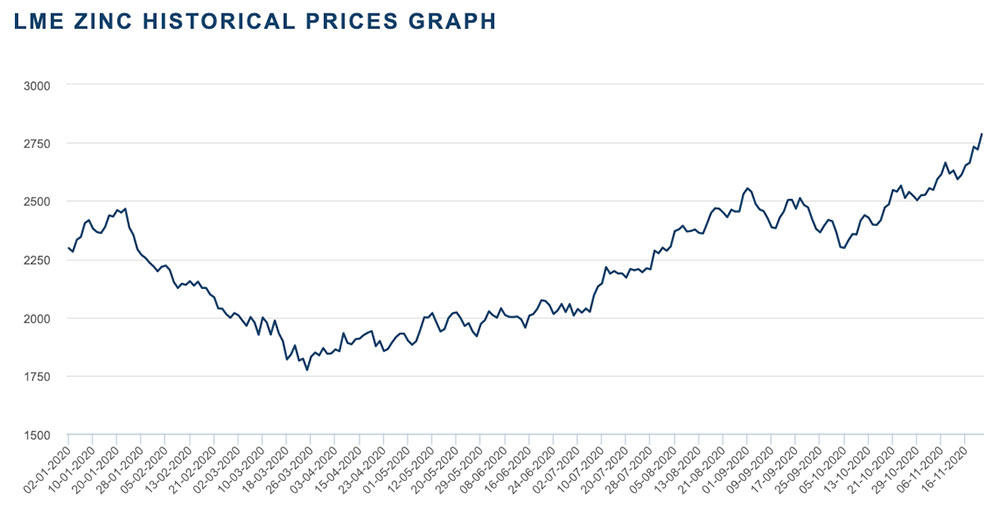

Zinc isn’t sexy, but prices have been running hot:

A survey has just uncovered high grade zinc outside Variscan Mines’ (ASX:VAR) historic San-Jose-Novales mine in Spain.

“The 3D survey provides us with a clear, digital picture of the extent of historical mining activity at the San Jose mine,” managing director Stewart Dickson says.

“It does confirm that significant high-grade zinc mineralised intersections from historical drilling campaigns remain unmined, some of which present viable targets for the imminent drilling campaign.”

A maiden drilling program designed to test priority targets is commencing this month.

Greenvale Mining (ASX:GRV) – formerly Greenvale Energy – has done a ‘reset’ in 2020, selling a problematic gold project in the US and acquiring the Georgina iron oxide-copper-gold (IOCG) project in the Northern Territory.

It also has very rare torbanite deposit in Queensland, which has the potential to produce bitumen, light crude, and activated carbon (for emissions purification).

Zeta Resources (ASX:ZER) invests in other exploration and mining companies.

Following the successful sale of its majority stake in Bligh Resources in July 2019, the biggest change in Zeta’s portfolio during the year was the increased shareholding in Horizon Gold (ASX:HRN).