Resources Top 5: Copper hits, two lithium stocks and a near-term uranium miner

Mining

Here are the biggest resources winners in early trade, Thursday December 30.

(Up on no news)

The TSX-ASX listed company has a portfolio of projects across the uranium-rich Athabasca Basin in Saskatchewan, Canada.

NXG’s main game is the advanced ‘Rook I’ project, which hosts the high-grade Arrow uranium deposit.

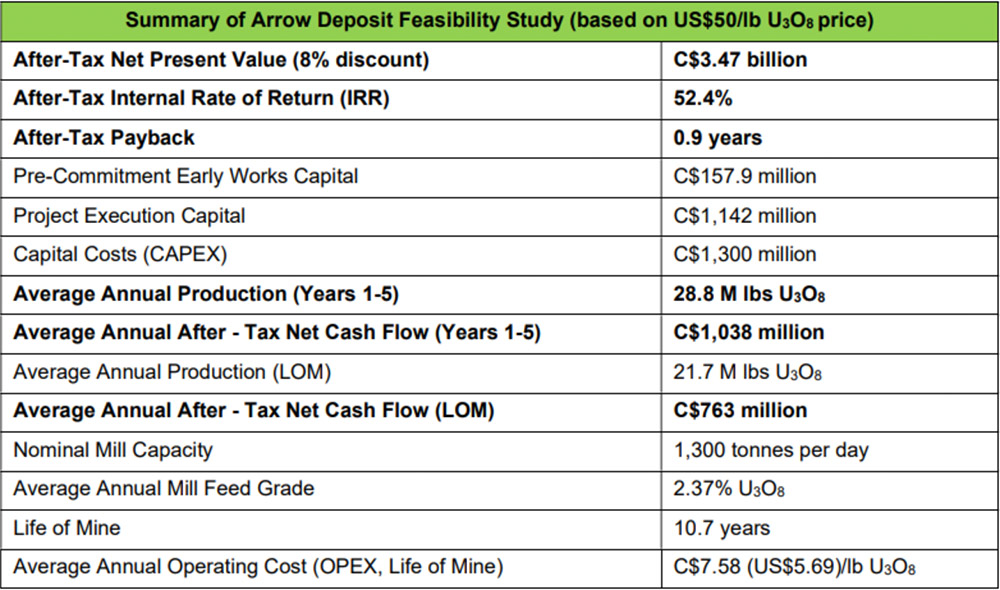

A February feasibility study – a detailed look at the economics of building a mine — was based on processing 4,575,000t of uranium grading 2.37% U3O8 (probable Mineral Reserve) from Arrow.

233.6 million pounds of U3O8 would be produced over an initial 10.7-year mine life, the company says.

Here are some of the key numbers, which look pretty damn good despite the high startup cost:

In November, NXG transitioned into the next stage of project development with the start of ‘front end engineering design’ (FEED).

FEED focuses on technical requirements and costs to build the project. This stage is scheduled for completion in Q3 2022.

“In parallel, the drafting of the project’s Environmental Impact Study and licensing workstreams nearing completion, together with regional exploration targeting new zones of potential ‘Arrow-type’ mineralisation, further exemplifies the NexGen team’s commitment to the successful execution of multiple workstreams,” CEO Leigh Curyer said.

The $CAD2.65bn market cap stock is up 8.5% over the past month.

(Up on no news)

SPQ is now up ~43% since announcing visual copper and disseminated copper over much of a 659m-long hole at the ‘Bottletree’ porphyry copper-gold prospect last week.

The strongest copper mineralisation occurs over a 200m interval, the company says. All-important assays are pending.

And this isn’t even the main target at Bottletree — a large, interpreted copper-gold porphyry system located 500m west.

“It must be noted that these copper-mineralised zones are a secondary target and appear to be mere outer zones of mineralisation, or ‘leakage’ related to potentially, a much larger porphyry copper-gold system,” SPQ managing director Peter Hwang says.

“The next program at Bottletree, aimed for the end of Q1, 2022, will be extensive and will target the interpreted porphyry system and the ‘satellite’ copper zones, including further drilling at the copper zone associated with the chargeability anomaly.”

Together with deep drilling at Bottletree, SPQ aims to deliver up to two JORC compliant copper mineral resource estimates early in the new year; one at Wyandotte and the other at the larger ‘Cockie Creek’ copper prospect.

It is also aiming to get the small – but potentially lucrative — ‘Steam Engine’ gold project in Queensland into production.

(Up on no news)

Copper-gold focused HMX has one of the best exploration teams in the business.

It includes chairman Russell Davis (founder of Gold Road Resources (ASX:GOR)), MD Daniel Thomas (former business development manager at Sandfire Resources (ASX:SFR)), and non-exec director Ziggy Lubieniecki, a geologist credited with the discovery of GOR’s +6.5Moz Gruyere gold deposit.

The focus is the ‘Mt Isa’ project in QLD, where HMX has a two-pronged focus: increase its inventory of >400,000 tonnes of copper through near mine exploration, as well as hunting for large scale Iron Oxide Copper Gold (IOCG) deposits.

In August, copper giant Sumitomo Metal Mining inked a $6m deal to earn into 60% of a 290sqkm area at Mt Isa.

An upcoming drilling program will test several compelling targets, HMX said early December.

(Up on no news)

The lithium stock formerly known as Altura Mining continues to edge higher after relisting on the ASX earlier this month.

1MC’s current management is a slimmed down version of the Altura team which built and operated its namesake lithium project, now owned by neighbour Pilbara Minerals (ASX:PLS).

Coming out of 16 months in suspension, 1MC now has a couple of new lithium exploration projects on the go, including ‘Mallina’ in WA’s Pilbara and the ‘Fish Lake Valley’ brines project in Nevada, USA.

The company raised about ~$8.5m prior to its relisting at 0.5c per share.

Those investors that got in at 0.5c would be happy, with the current share price up 240% on those levels. It goes without saying that longstanding investors remain deep in the red.

(Up on no news)

The lithium explorer is well down on its crazy September peak of 93c per share but remains comfortably above its July IPO price of 20c.

BMM, recently spun out of EV Resources (ASX:EVR) — is focused on the ‘Rekovac’ lithium project in the little-known jurisdiction of Serbia.

The project “has similar geological settings” to Rio Tinto’s world-class Jadar discovery, the company says.

Following a small drilling campaign — which hit lithium mineralisation in two holes – surface mapping was conducted over the whole project area to dial in on some drill targets.

Data obtained from the mapping program has been analysed to assist with site selection as part of the proposed drilling campaign in 2022, BMM says.