Resources Top 5: ‘Compelling’ nickel stock bounces as certified company maker joins the team

Mining

Mining

Here are the biggest small cap resources winners in early trade, Thursday March 10.

What a coup.

Julian Hanna, co-founder and managing director of nickel miner Western Areas (ASX:WSA), will join explorer SGQ as general manager for growth and development.

During his 12-year tenure, WSA grew from a $6m IPO to Australia’s No. 1 independent nickel sulphide producer.

In 2013, he joined explorer MOD Resources as managing director. Under his leadership, MOD established a substantial exploration holding in the underexplored Kalahari Copper Belt in Botswana and delivered exploration success through the discovery of the significant T3 and A4 copper deposits.

Sandfire Resources (ASX:SFR) then acquired MOD in 2019 in a $167 million takeover.

Hanna says SGQ has a quality portfolio of projects with similarities to other opportunities he has been involved with.

“The work already completed at the [flagship] Mt Alexander and Paterson Projects underscores their compelling exploration potential,” he says.

“I am excited about returning to a highly promising nickel and base metals exploration story in Western Australia and look forward to contributing to the growth of St George.”

SGQ also announced positive met test work results from high grade nickel, copper concentrates projected from the ‘Stricklands’ deposit at Mt Alexander, where a ‘starter mine’ could generate early cashflow for the company.

The test work confirms potential to produce two separate commercially attractive concentrates:

There are no deleterious elements that could affect the saleability of the concentrates, SGQ says.

“Our mineralisation at Mt Alexander has a unique combination of high-grade nickel, copper, cobalt and platinum group metals which we believe has potential to produce concentrates of exceptional value,” exec chair John Prineas says.

SGQ still hasn’t released a maiden resource from Mt Alexander, despite continued exploration success since buying the tenements from BHP Nickel West for chump change back in 2015.

The $31m market cap stock is down 20% year-to-date. It had $2.8m in the bank at the end of December.

(Up on no news)

Supply constraints and increased demand means phosphate prices are going through the roof, like everything right now.

Phosphate is commonly used in fertiliser, as well as things like food, cosmetics and even LFP (lithium iron phosphate) batteries for electric vehicles.

LFP batteries are cheaper to produce because they don’t use nickel – which just hit $US100,000/t on the London Metals Exchange — or cobalt.

“The current inflated (and unsustainable) metals prices on the LME and its effect on NMC [nickel, manganese, cobalt] batteries have created a mathematical scenario that almost doubles the cost of raw materials in NMC batteries so that they are approaching ~3x that of an LFP battery on a $/kWh basis,” AEV said in a presso to the CRU Phosphates Conference.

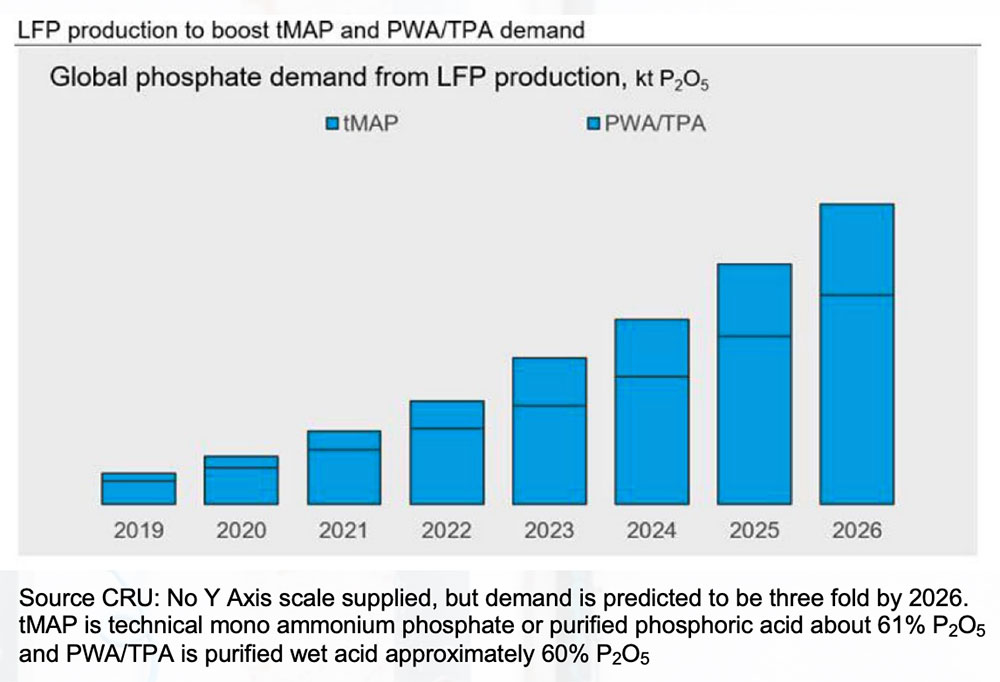

Demand is expected to increase in the coming years at a great rate of knots, it says:

AEV’s advanced but neglected ‘Wonarah’ phosphate project in the NT was dusted off and propelled to the front of its portfolio after prices began soaring late last year.

A scoping study (the first proper look at the economics of building a project) is now investigating the development of Wonarah to produce critical end products for LFP (lithium iron phosphate) batteries.

AEV has appointed a dedicated project manager and discussions with strategic downstream industry participants are also ongoing, it says.

The $20m market cap stock is down 15% year-to-date. It only had $900,000 in the bank at the end of December, which means some sort of cap raise is probs imminent.

The manganese explorer has reported a “game changing” +170% resource upgrade at the flagship ‘Oakover’ project in the Pilbara to 172 million tonnes at 9.9% Mn.

The total resource across its Oakover and ‘Hill 616’ projects increased by 90% to 229 million tonnes – growth which FRB says is “well above initial expectations” and provides a compelling opportunity to establish a long-life manganese operation.

The stock is now pivoted from a rapid start-up strategy to focus on developing a profitable, long life mining operation.

Scoping studies – the first proper look at the economics of building a mine – are expected to kick off shortly on a +20-year operation.

“This resource has come in well beyond our expectations and speaks volumes to the broader potential of Oakover and the opportunity to establish a major WA manganese operation,” FRB MD Peter Allen says.

“The size of the MRE [mineral resource estimate] upgrade provides us with a compelling opportunity to pivot from our current Rapid Development Program strategy and focus instead on completing the relevant studies to assess Oakover as a 20+ year operation, producing both manganese ore and higher-value manganese sulphate.

“While this is a shift from our early cashflow strategy, we think the size of the resource and simple near surface gently dipping geology provides a simple pathway to production that now warrants financial assessment that is anticipated to ultimately deliver superior value to shareholders.”

Importantly, FRB will be able to leverage the work already completed on the rapid development workstreams to quickly complete the necessary Scoping Studies, Allen says.

The $18m market cap stock is down 13% year-to-date, and well off highs of 76c per share in March last year. It had ~$1.6m in the bank at the end of December.

(Up on no news)

This $7m market cap gold tiddler has drifted badly since hitting a peak of 19c per share in late 2020.

It is hoping to turn things around with a recent acquisition called ‘Woomera’, which is close to Coda Minerals’ (ASX:COD) recent Emmie Bluff IOCG discovery in South Australia.

IOCG (iron oxide copper gold) discoveries — while often super deep — are big, lucrative, and rare as hens’ teeth.

Gravity modelling work completed during the December quarter defined several high priority IOCG drill targets at Woomera.

PTR is focused on achieving the necessary approvals to allow drill testing of these targets “as soon as practicable”.

PTR has also uncovered and enlarged three promising gold anomalies at the nearby ‘Comet’ project, which is near the mothballed Challenger gold deposit (1.2Moz @ 5.1g/t), and 30km from Marmota’s (ASX:MEU) recent high-grade ‘Aurora Tank’ gold discovery.

This ground has been historically hard to explore due to the 5m–20m of ‘new’ soil cover which obscures any potential deposits at depth.

Additional drilling at Comet was scheduled to kick off late last month. Any day now.

At a smidge under US$60/lb, the uranium spot price is now at its highest point since 2011.

Good timing for GTR, which today reminded investors that drilling at its ‘Thor’ uranium project in the US remained on track to finish mid-March.

The 100 hole, ~15,000m program has already confirmed that the mineralised system, first discovered in 2021, keeps going, exec director Bruce Lane says.

“Once this initial phase of drilling is completed next week, we look forward to a detailed analysis of the full set of results which we anticipate will help demonstrate the project’s economic potential,” he says.

“We believe there is a bright future for ISR mining in Wyoming due to a supportive state government coupled with surging global demand for emissions free electricity.

“[This] corresponds with surging global demand for emissions free electricity and a corresponding rapid global growth in nuclear power production, occurring at a time when the global uranium market is experiencing a large and entrenched supply deficit that looks set to worsen.”

In situ recovery (ISR) mining involves dissolving minerals in the ground and pumping a pregnant solution to the surface where the uranium can be recovered.

$25m market cap GTR is down 23% year-to-date. It had $4.7m in the bank at the end of December.