You might be interested in

Mining

As Chalice scales record highs on its monster Julimar resource, how are its nearologist friends going?

Mining

These 12 ASX explorers are betting that Julimar 'nearology' is more than just a common post code

Mining

Mining

Special Report: COVID-19 has thrown a spanner in the short-term outlook for nickel, an increasingly important battery metal. But longer-term demand trends remain very positive, especially for explorers and miners located in Europe – a future global battery and electric vehicle manufacturing hub.

In a late March note, RBC Capital Markets said that it remained positive about the longer-term fundamentals for nickel in the face of the global COVID-19 pandemic.

“It remains a key element for battery storage and will be increasingly relevant during the play out of the EV thematic,” it said.

At the same time, the average amount of nickel per EV increased by 28 per cent to 12.9kg.

That’s just the average amount — there’s a massive +75kg of nickel in every 2019 Tesla Model S.

It’s also important to split total annual nickel supply — currently about 2.6 million tonnes — into class 1 and class 2. Class 1 (low impurity) nickel is ideal for batteries; class 2 used in steel is not.

Nickel is usually found in two main ore types – sulphide or laterite.

Sulphides (class 1) are much cheaper and easier to turn into battery grade nickel sulphate than nickel laterites and fetch a higher price.

But supply of nickel sulphides is also declining because of a lack of new discoveries.

Medium term, Fastmarkets estimates that 500,000 tonnes of refined nickel will be used annually in lithium-ion batteries for EVs by 2025.

CRU reckons the battery sector’s use of primary nickel will reach 870,000 tonnes by 2030, and 1.5 million tonnes by 2040, while a July 2019 report from BNEF predicts demand will surge to 1.8 million tonnes of contained metal by 2030.

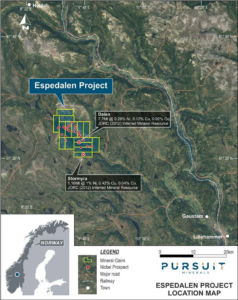

In February, Pursuit Minerals (ASX:PUR) entered into an option and purchase agreement for three highly prospective nickel sulphide projects in Norway.

The explorer already has a running start.

Previous exploration has confirmed the presence of high-grade nickel on all three projects, while the Espedalen project’s Stormyra and Dalen prospects already boast established resources.

“A company called Blackstone Ventures spent $30-$40m on exploration, drilling a lot of holes, and ultimately defined a number of resources,” Pursuit’s Technical Director Jeremy Read told Stockhead.

“We have all their data and benefit from all the work previously done on these projects.”

Pursuit’s aim initially is to extend the higher-grade portion of these resources.

Stormyra, for example, is currently a 1.16-million-tonne resource grading 1 per cent nickel and about 0.5 per cent copper.

But there’s a part in the middle that runs to 2-3 per cent nickel.

“It is currently modest in terms of its size, but it does have good grade,” Read says.

“There are some intersections running at 6 to 7 per cent nickel in the middle of that deposit.

“It’s not closed off — the centre higher grade part of the resource is still quite open. It’s a million tonnes at the moment, but who knows how big it will get, once we start drilling to follow the high grade intersections.”

As soon as Pursuit is able to get back into the Norway it will complete a detailed mag survey to ‘dial in’ on the best drill targets. It will also investigate some other drill intersections that are just “sitting there”.

“There are 10 drill holes on Espedalen that have more than 5m thicknesses of 1 per cent nickel that have never been followed up,” Read says.

“This could just be the tip of the iceberg.”

NOW LISTEN: Explorer’s Podcast — Europe’s battery boom, regional supply needs and how Scandinavia will lead the charge