Potash might be crowded, but Highfield says it will build its Muga potash project

Mining

Mining

As Stockhead columnist Tim Treadgold pointed out last week: potash is a crowded game, particularly at the small end of town, but that is not holding back Highfield Resources (ASX:HFR).

Juniors have a few options when it comes to taking a project into production — they can bring in a partner to help do the heavy lifting, they can take it as far down the path to production as possible and then sell it off to a larger more experienced player or they can build it themselves.

Besides Highfield there are 17 other ASX-listed small caps playing in the potash space.

Here’s a list:

Scroll or swipe to reveal table. Click headings to sort.

| ASX CODE | COMPANY | PRICE NOV 25 | YTD % RETURN | MARKET CAP $M |

|---|---|---|---|---|

| AMN | AGRIMIN | 0.46 | -32 | $92.7 |

| ARE | ARGONAUT RESOURCES NL | 0.004 | -82 | $7.8 |

| APC | AUSTRALIAN POTASH | 0.088 | 21 | $31.5 |

| BCI | BCI MINERALS | 0.175 | 25 | $67.8 |

| CXM | CENTREX METALS | 0.044 | -62 | $13.6 |

| DNK | DANAKALI | 0.62 | -16 | $167.3 |

| DAV | DAVENPORT RESOURCES | 0.039 | -61 | $6.4 |

| EMH | EUROPEAN METALS | 0.36 | 20 | $54.3 |

| FYI | FYI RESOURCES | 0.057 | -5 | $10.6 |

| GPP | GREENPOWER ENERGY | 0.011 | -73 | $2.6 |

| HFR | HIGHFIELD RESOURCES | 0.67 | 4 | $230.7 |

| KLL | KALIUM LAKES | 0.47 | 63 | $179.5 |

| ORE | OROCOBRE | 2.505 | -22 | $669.9 |

| PIO | PIONEER RESOURCES | 0.014 | -7 | $19.6 |

| RDM | RED METAL | 0.1275 | 33 | $27.6 |

| RWD | REWARD MINERALS | 0.15 | 50 | $24.4 |

| SO4 | SALT LAKE POTASH | 0.8 | 74 | $205.4 |

But Highfield, with the backing of big private equity player EMR Capital, has set its sights firmly on building its Muga potash project in Spain.

While chairman Richard Crookes says all options are on the table, he stressed Highfield was not courting any potential suitors right now.

“There’s no doubt in my mind that we’re going to build the project,” he told Stockhead in a recent interview.

“I think if a strategic company — another potash producer — came along and wanted to participate in some way then we’d obviously consider that. Everything’s on the table but we’re not showing the project off to anyone.

“The major shareholders want to see the project built. They see maximum value being created by building the project.”

Crookes said EMR Capital, which owns 30 per cent and is a cornerstone investor, promised it would continue to chip in its share of any pro rata equity that Highfield might raise.

“They’re very committed to seeing the project built,” he said.

Highfield has quite a bit of cash right now, $44m in the bank to be precise, and it has beefed up its potash expertise to better position itself to take Muga through to production.

The team includes an ex-COO of Potash Corp, an ex-CEO of Glencore and a man with lots of experience building mines.

And in June this year, Highfield named a new project construction director.

“If you look at the current configuration of the team, and I’m specifically thinking about [managing director] Peter [Albert], he’s got a very, very strong record in building projects,” investor relations manager Olivier Vadillo told Stockhead.

“That’s what he is, he’s a mine builder. So I think bringing him onboard was a very clear indication that the plan is to build this project.

“I think now we’ve got our environmental approval the next milestones are clear. We know what we’re doing, we’re very confident in the project, we’re very confident in the output, so I think the plan is to get this up and running.”

Potash comes from salts that contain potassium in water soluble form. It is used as a fertiliser.

There are two commonly used fertilisers – muriate of potash (MOP) and sulphate of potash (SOP).

MOP is the most common (around 90 per cent of the world’s potash) and is used on a variety of crops. However, the more chloride-sensitive crops like avocados, coffee beans and cocoa require SOP – which fetches a premium price to MOP.

Today the four biggest producers are Canada, Russia, Belarus and China — in order of their market size. Between them, they are responsible for 76 per cent of the world’s potash.

Highfield will be selling MOP from its Muga project, which lies right in the heart of an intensive agricultural region called Navarre, which is well known for its vegetables and wine.

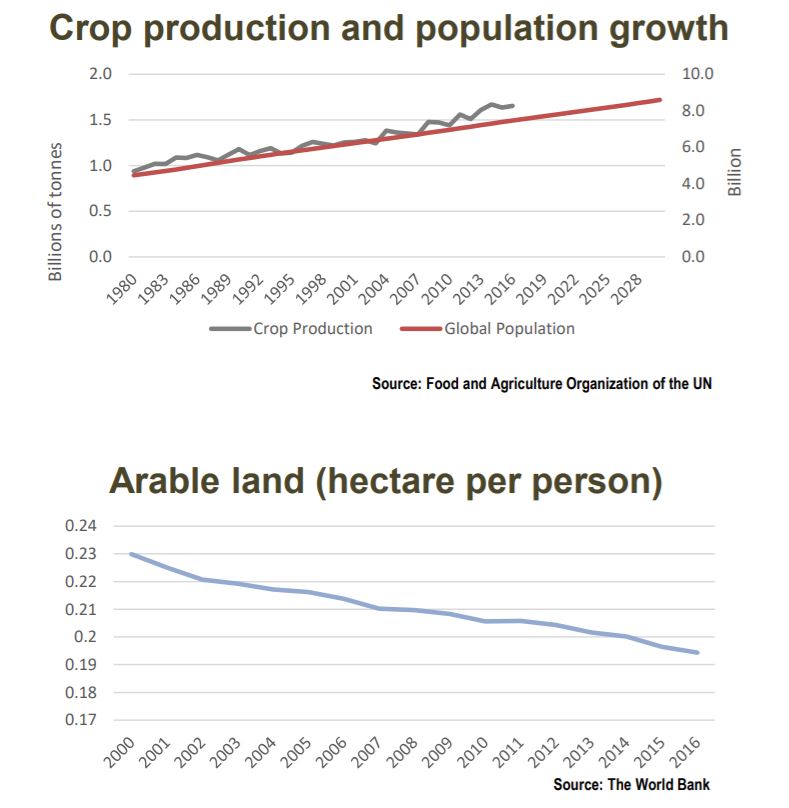

Potash demand is on the rise, with arable land per person decreasing steadily over the years, which means there is an increased need for higher crop yield and the fertilisers that can achieve that.

Global potash demand climbed 22 per cent between 2012 and 2018.

The consensus view by potash market analysts is around 2.5 to 3 per cent growth each year, but one market watcher predicts the global potash market could grow at a higher compound annual growth rate of over 4 per cent between 2019 and 2023.

At the same time, several big potash mines are being mothballed or facing production cuts.

The two major producers in Europe are both slashing production. German heavyweight K+S is cutting its production profile by 300,000 tonnes, while Israel-headquartered ICL, which owns the Iberpotash mine in Spain, is dialling back by 180,000 tonnes.

“There’s short term volatility [in the potash price] of course, but the trend is generally stronger for longer based on the back of a constrained and disciplined supply, controlled by seven major producers,” Crookes said.

Highfield says the tight local European supply due to mine closures and high cost local producers have maintained the European price premium.

The Muga project will start out producing 500,000 tonnes each year, eventually expanding to 1 million tonnes each year.

Highfield’s main market focus will be Europe and Brazil.

The company recently inked a memorandum of understanding with big Swiss trader Ameropa for half of Muga’s planned output.

Highfield also has several other MoUs that it is working to convert to formal agreements and certainly no shortage of buyer interest.

Read: Being the only ASX potash player in Spain is paying off for Highfield

The next step is to secure the mining lease, which Highfield is working on now.

“Those papers will be submitted before the end of the year and then it’s in the hand of the regulators to then tick the box on that,” Crookes said.

“At the same time we are working on the application for the various construction permits power, water, rail.”

Now read: Here’s why potash stocks won’t stink in 2020