Poseidon strikes potential nickel supply deal to proposed Kalgoorlie battery materials refinery

Mining

Mining

Poseidon is on the front foot with an early-stage deal that could see it supply nickel concentrate to a proposed new battery materials refinery in Western Australia.

Poseidon Nickel (ASX:POS) has signed a memorandum of understanding with Pure Battery Technologies (PBT), which has mapped out plans to build and operate a battery material refinery hub in Kalgoorlie, WA.

Under the MoU, the two companies will investigate the suitability of nickel concentrate from Poseidon’s Black Swan and/or Lake Johnston projects as feed for the refinery.

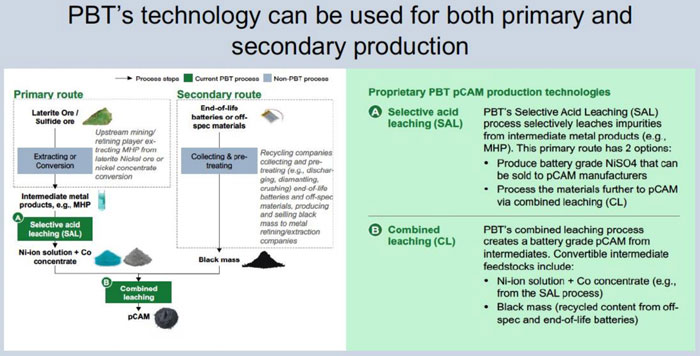

Queensland-headquartered PBT, which has a nickel and cobalt refining operation in Germany, wants to build a refinery in Western Australia that will produce precursor cathode active material (pCAM) battery metal products.

Studies will initially focus on a starting output of up to 50,000 tonnes per annum of pCAM, with the potential for expansion over time to also be considered.

“We look forward to working with PBT to determine if our potential concentrate production could be feed for PBT’s proposed refinery, should we decide to proceed with development of our projects,” managing director and CEO Peter Harold said.

“This could be a great way for us to improve the payability of the nickel in our concentrates and improve the margins of our projects.”

Poseidon recently decided the most economically attractive option for the company was to refurbish the 1.1-million-tonne-per-annum capacity processing circuit at Black Swan and “fill the mill” to maximise nickel production.

A final investment decision is slated for May 2022, with first concentrate production targeted for December the same year.

A rapidly growing number of battery makers are requiring more and more nickel in the cathodes of their batteries because it improves the efficiency and extends the driving range of electric vehicles.

Analysts at Wood Mackenzie believe the size and substance of the nickel market is going to mutate over the next two decades.

Presently ~70% of the nickel market is funnelled into stainless steel (an end market up 14% on its own this year) while just 7% goes into battery precursor.

By 2040 battery precursor will be 30% of that first use end market, with stainless steel shrinking, in percentage terms at least, to just 53%.

But that is only half the story. While there are concerns increased nickel pig iron production in Indonesia and the sale of South East Asian nickel matte into the battery market could flood the market, demand is still expected to outstrip supply, leading to sustained deficits from 2025 on.

A market that ranked around 2.4Mt in 2020 is set to inflate more than 100% to 4.9Mt by 2040.

“Based on current market fundamentals, we expect the deficits running through to 2030 will support annual average prices approaching US$19,440 per ton or US$8.80 per pound in the old money by 2026, followed by even higher prices of around US$21,000 through to 28-29,” Angela Durrant, WoodMac principal nickel analyst, said recently.

“By then four straight years of metal inventory drawdowns will shrink global stocks towards 100 days of consumption … a level not seen since 2005, when prices also averaged US$19,980 per tonne.

PBT commercialised and patented the Selective Acid Leaching (SAL) process, which has been commercially proven to produce high-quality, more affordable nickel and cobalt battery materials with a lower environmental footprint.

The technology can also be used to recycle existing lithium-ion battery materials.

This article was developed in collaboration with Poseidon Nickel, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.