Pilbara Minerals sees ‘strong upward trajectory’ in lithium chemicals prices

Mining

Mining

Australian lithium company Pilbara Minerals (ASX:PLS) has seen a marked improvement in spodumene concentrate prices and reported a spot cargo sale to China at $US655 dry metric tonnes (dmt).

The price detail was contained in a letter of credit the company received in March ahead of the dispatch of the shipment of spodumene concentrate in April.

Pilbara Minerals said the headline price of $US655/dmt ($849/dmt) implied in the letter of credit had highlighted “the recent strong upward trajectory in pricing”, according to its March quarter report.

“Lithium chemicals pricing continued to significantly improve during the quarter, which is now starting to be reflected in the price received for spodumene concentrate sales,” said the company.

The price quoted for the spodumene concentrate cargo for shipment to China is toward the upper end of a market range for March at $US550 to $US700 dmt, according to price reporting agencies.

Strong demand for spodumene concentrate is emerging from existing and new customers such as chemical companies in the form of purchase enquiries, it said.

“A further strong uplift in lithium chemicals pricing has been seen within China, with independent market analysts Benchmark Mineral Intelligence recently noting that lithium carbonate prices have almost doubled so far this year to $US11,700 per tonne, in reaction to supply shortages,” said Pilbara Minerals.

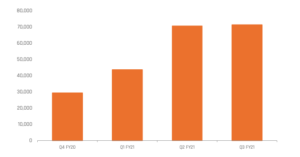

The company achieved record production in the March quarter of 77,820 dmt, which equates to an annualised rate of 311,000 tonnes for its spodumene concentrate product, up from 63,712 dmt in the December quarter.

“There was a significant increase in mining activity during the quarter to support both higher customer demand, tailings management facility development and haul road construction works on site,” said the company in its market update.

Pilbara Minerals has started construction work on an expansion of its Pilgangoora production plant in WA to lift capacity to ~380,000 dmt per year, from 330,000 dmt per year currently.

Spodumene concentrate shipments for the company were 71,230 dmt in the March quarter, compared with 70,610 dmt in the December quarter.

The March quarter’s shipments are in the middle of its production guidance which ranged from 67,000 to 77,000 dmt.

The company’s final shipment for March was delayed for two weeks after a fire on a ship at a cargo berth in the port used by Pilbara Minerals.

Pilbara Minerals said it expects to increase its product shipments in the June quarter in line with a continued strong improvement in lithium market conditions.

“Based on customer feedback and other market enquiries, Pilbara Minerals expects these conditions will continue and forecasts shipped tonnes for the June quarter to be in the range of ~75,000 and 90,000 dmt of spodumene concentrate,” it stated.

Tantalite concentrate sales of 47,831 pounds were also achieved in the March quarter, a rise on the December quarter’s 18,540 pounds.

A trial parcel of ore was processed from the Altura Mining’s (ASX:AJM) lithium project in the recent quarter, after Pilbara Minerals acquired the project for $248m in January.

Australia’s lithium sector has recently seen some consolidation activity with two companies, Galaxy Resources (ASX:GXY) and Orocobre (ASX:ORE), this week announcing a $4bn merger.

An offtake agreement has been executed with Yibin Tianyi Lithium Industry Company of China that included a $US15m prepayment to fund improvements to its Pilgangoora plant.

In exchange for the prepayment, Pilbara Minerals has agreed to supply the Chinese company with an additional 40,000 tonnes per year of spodumene concentrate, in addition to its existing five-year offtake for 75,000 tonnes per year.

The company completed the March quarter with a cash balance of $112m including $8.3m of irrevocable letters of credit for shipments carried out in March.

Also last month, Pilbara Minerals launched a new sales and marketing platform for its spodumene concentrate production that was developed by Perth-based firm GLX Digital.