You might be interested in

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

Mining

Rock chip revelation: New gold zone at Mako’s Tchaga North returns up to 76.10 g/t

Mining

Mining

Special Report: Pathfinder Resources will light up the ASX boards today after successfully raising the maximum $6m in its IPO and adding the high-grade King Tut gold and cobalt project to its portfolio.

Pathfinder Resources (ASX:PF1) has completed its IPO of 30 million shares at 20c apiece, which gives it a market value on listing of about $12m.

Having also now successfully completed the acquisition of the King Tut gold and cobalt project in the La Rioja Province of Argentina, along with satisfying other key conditions, Pathfinder will start trading on the ASX on Wednesday.

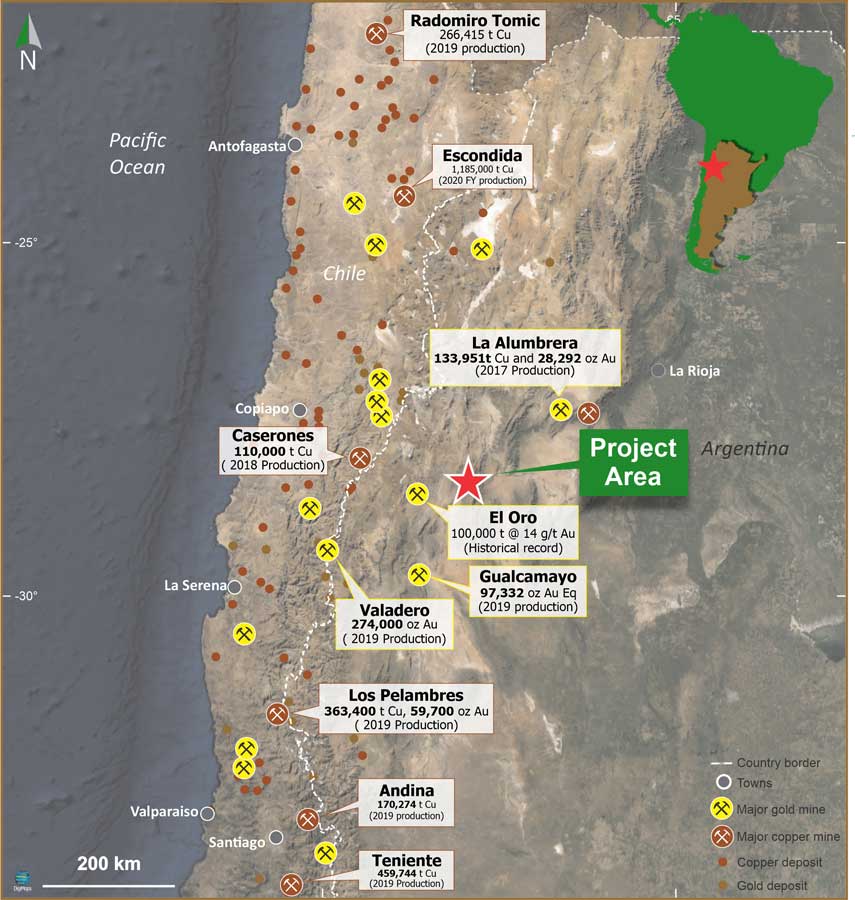

Argentina is geologically similar to Chile, where mining is a major driver of the economy, but Argentina – which spans 2.8 million square kilometres, making it the second largest country in South America – has witnessed significantly less exploration than its coastal neighbour.

The Argentine government wants to change that and has been proactively promoting the country as a favourable mining jurisdiction to foreign investors.

Argentina wants to be known as more than just an agricultural powerhouse and in May 2018 inked an agreement with the Western Australian government to share specialist knowledge, technical skills and regulatory knowhow.

This has presented an opportunity for juniors to break into a region that hosts several Tier 1 multi-million oz gold mines controlled by the majors, in an unexploited area that remains highly prospective for high-grade gold and cobalt mineralisation.

Pathfinder’s King Tut project is located in a region well known for its gold mining and sits not far from Barrick Gold’s Veladero mine, which produced 550,000oz of gold in 2019.

The Gualcamayo mine, which is owned by Colombian company Mineros S.A. and regularly produces more than 100,000oz of gold a year, lies to the south, while across the Chilean border to the north-west lies the Cerro Castle project, which contains 23 million oz of gold in reserves.

The historic King Tut mine produced gold and cobalt at grades of up to 28 grams per tonne (g/t) gold and 2.85 per cent cobalt from both surface and underground workings.

It is also located close to critical mining infrastructure such as power, roads, rail and ports.

Samples collected from the project area in 2018 and 2019 confirmed the significant historic grades, with assays returning up to 37.03g/t gold and 2.56 per cent cobalt from mineralised veins and historic stockpiles.

Mining was undertaken at King Tut briefly in the 1950s and 1980s and records show it produced 38,000t at an average grade of 7g/t gold and 0.86 per cent cobalt.

There is the potential for increased mineralisation width and grade at depth, with channel samples taken from underground galleries during the 1980s returning grades of up to 19.7g/t gold and 2.85 per cent cobalt, within a series of stacked veins individually ranging from 0.2-1.1m thick. The grades from these samples averaged 12.73g/t and 1.48 per cent cobalt.

“It is very exciting to have reached our relisting milestone with our IPO being very well received and our maximum allowable subscription being easily met,” executive chairman Shannon Green said.

“We have secured an historical project in a very exciting jurisdiction that offers our shareholders with potentially an absolutely brilliant upside proposition.

“We have also commenced bringing together our small highly skilled team thus ensuring that we will be driving this project forward from day one.”

With Pathfinder’s focus firmly on advancing the King Tut project, it has mapped out a busy 12 months as it works as quickly as possible to define a JORC-compliant resource.

The company is aiming to start drilling in the first quarter of next year, subject to COVID restrictions in South America, to deliver a resource within its first year.

This article was developed in collaboration with Pathfinder Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.