New Kids on the Block: Do these kaolin explorers have the right stuff?

Mining

Mining

A handful of ASX-listed kaolin players broke into the market in 2018, intent on disrupting the emergent (and exciting) high purity alumina (HPA) industry.

This now-established gang of HPA-focused small caps are using kaolin clay as a feedstock, which results in super low operating costs compared to traditional producers of HPA.

The main markets here are lithium-ion batteries and LED production.

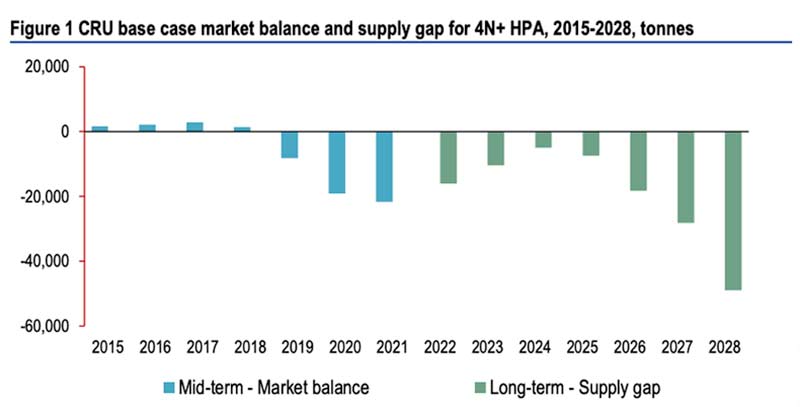

In July, a CRU report concluded that HPA supply would not meet estimated demand over the next decade — even if every project in the pipeline goes into production.

But kaolin clay also has a wide range of other industrial uses, like paper and paperboard, fiberglass, ceramics and paint.

In 2018, the global industrial kaolin market was estimated to be worth $US5.4 billion (~$8 billion), with estimates of CAGR growth out to 2025 of 8.8 per cent.

And so a new thematic is emerging.

The most recent surge in kaolin’s popularity was triggered by Andromeda Metals (ASX:ADN), which is investigating a simple business model – starting with shipping raw ore from its Poochera project in South Australia to buyers in Asia.

This would reduce initial start-up costs – and time to production — because Andromeda doesn’t need to build a processing plant to start making cash. Just dig and deliver (to start with, anyway).

The market liked the story. A year ago, Andromeda had a share price of about 0.5c for a market capitalisation of ~$5m. Today, it is trading at about 4.8c for a market cap of almost $70m.

The main markets for halloysite are the ceramics and also the petroleum industry as a catalyst for fluid catalytic cracking, but there are emerging uses in things like nanotube technologies and cancer therapeutics.

A bunch of exploration plays have recognised kaolin’s fresh potential in recent months, picking up prospective projects right across Australia.

METALSEARCH (ASX:MSE)

Market cap: $14m

Gold and base metals-focused Metalsearch jumped 85.7 per cent when it announced the acquisition of the Abercorn HPA project in Queensland in August.

Metalsearch said the Cynthia kaolin prospect in particular offered the capacity to produce HPA and “marketable volumes of higher-grade feedstock”.

It says the project could potentially even be a direct shipping ore (DSO) operation – similar to Andromeda — given it is close to two existing ports.

DSO refers to minerals that require only simple crushing before they are exported, which keeps costs low.

RED MOUNTAIN MINING (ASX:RMX)

Market cap: $6m

In October, Red Mountain Mining signed a binding agreement to acquire the historic 84sqkm Mt Kokeby project, about 99km southeast of Perth.

Red Mountain says old drilling hit high-grade kaolin with more than 30 per cent alumina content, making the project a potential candidate for a low capex, DSO operation for early cashflow.

This is supported by the project’s close proximity to rail and all-weather roads that provide access to container handling at Fremantle port and bulk handling at Kwinana.

Mt Kokeby also has exploration upside, Red Mountain says, as significant areas of the Murray deposit remain untested.

LATIN RESOURCES (ASX:LRS)

Market Cap: $1.4m

Lithium explorer Latin jumped 77.8 per cent in late October after signing a deal to acquire private company Electric Metals, which owns the 54sqkm Noombenberry halloysite project near Perth.

Once it gets drilling approvals, Latin will move forward with its objective of developing a maiden JORC resource at Noombenberry in the first quarter next year.

ARCHER MATERIALS (ASX:AXE)

Market Cap: $25.6m

In August, graphite explorer/quantum computing chip developer Archer released a maiden exploration target for its Eyre Peninsula HPA project (EPHPA), about 115km from Andromeda’s project in South Australia. Drilling has now commenced.

“The project is ideally situated close to existing rail, power, gas and other significant infrastructure which will aide further exploration and possible project development,” Archer chairman Greg English says.

“In addition to the presence of a large kaolin exploration target, the confirmation of the presence of halloysite at both the Franklyn and Eyre Peninsula projects increases the potential of these projects.”

ACCELERATE RESOURCES (ASX:AX8)

Market Cap: $1.67m

A few days ago, former gold-cobalt explorer Accelerate entered into a binding agreement to buy Halcyon Resources, which owns the Tambellup kaolin project near Perth and ‘the Griffin Process’– an innovative production method to process kaolin to HPA.

Tambellup presents unique opportunities, Accelerate says. Near term, it is prospective as a near-surface, potentially low-cost kaolin project, targeting the Asian market, and it includes silica sand as a potentially marketable co-product.