New Age wants to offload its 50pc stake in a massive tin-tungsten project for $5m

Mining

Mining

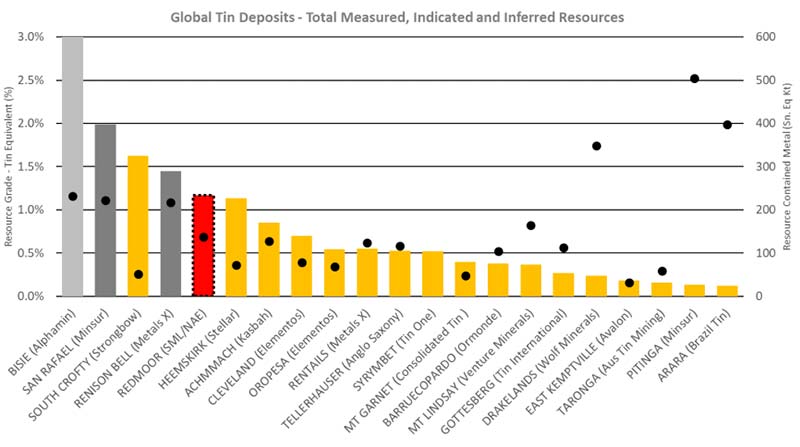

Just weeks ago New Age Exploration (ASX:NAE) called Redmoor the largest, second highest grade undeveloped tin-tungsten underground mining project in the world.

Now the explorer, which had $982,000 in the bank on 14 March, says it wants to sell its 50 per cent stake to JV partner, AIM-listed Strategic Minerals, for $5 million.

New Age acquired Redmoor in 2012, and entered into JV with Strategic Minerals in 2016.

Strategic largely funded a 2017 drilling program to earn its 50 per cent share.

The $6.2 million market cap New Age will use the cash to focus on developing the Lochinvar coking coal project on the English/Scottish border and the Otago gold project in New Zealand.

It also plans to pursue “other value-add opportunities”.

New Age exec director Joshua Wellisch calls the sale “an excellent outcome”.

“The board believes the transaction was at an opportune time in the development cycle of the project, whereby a substantial value for the asset was realised, while mitigating risk,” he says.

“The sale may be subject to approval by NAE shareholders at a general meeting, we consider this will be forthcoming within six weeks and we look forward to finalising the transaction.”

New Age chairman Alan Broome is also chairman at Strategic Minerals.

New Age says that after making the board aware of the Redmoor opportunity, he excused himself from any further dealings with the sale and any voting at board level in both companies.

The explorer’s share price was unchanged at 0.7c in early trade.

NOW READ: You probably never thought tin would be part of the EV revolution