You might be interested in

Mining

Monsters of Rock: Strong commodity prices movement a tailwind for today's reporting stocks

Mining

Reporting Rodeo Pt. 2: Here's how analysts think another 7 mid-tier ASX miners performed in the March quarter

Mining

Mining

Barty is out, the Dream Team had a mare losing to France in the basketball, a boat stalled the start of the men’s triathlon and a Dutch road cyclist celebrated winning the women’s race only to find out someone else was a whole minute up the road.

There have been plenty of shocks and surprises already at these unusual crowd-less Tokyo Olympics.

Not so among the big miners today who all scored a solid day, bar the major gold miners.

There was a clear leader ahead of the pack though, with Lynas Rare Earths enjoying a ~10% spike on a record quarter.

BHP and Rio paced the ASX200 with BHP again holding around record highs as the Materials sector gained 1.12% and the ASX finished the day unchanged.

Lynas mines rare earths but took out the gold against the rest of the ASX200 today with an extremely positive June Quarter update powering it to a +10% spike.

Lynas was here last week after getting the Government to tip in some R&D funds for a new cost-saving process to produce rare earths concentrate at its proposed Kalgoorlie refinery.

It was back today after producing 3778t of rare earths oxides in the June Quarter, which was down on the 4463t produced in the March Quarter. Production of its best product, magnet ingredient NdPr was up to 1393t from 1359t in the previous term.

But it was a ramp up in sales and, more importantly prices, for its product that had the market excited.

Lynas boasted record revenue of $185.9 million and sale receipts of $192m, with average realised prices of $39.1/kg almost double those the company was receiving a year ago.

Copper is trading a bit above the US$9450/t level at the moment on LME 3 month delivery rates.

The lovechild of Owen Hegarty’s Oxiana and Zinifex 13 years ago, OZ has taken on a life of its own as the owner of the Prominent Hill and Carrapateena copper-gold mines, providing one of the largest and purest exposures to the “metal of the future” on the ASX.

It also owns the West Musgrave project in remote climes near the WA-SA border and a swag of projects in Brazil including the producing Antas mine.

OZ is yet to report its June quarter performance but expects to produce 120,000-145,000 tonnes of copper and 190,000-215,000oz of gold in FY2021 at AISC of US$1.30-1.45/lb (up on its initial cost guidance of US$1.10-1.25/lb).

Shares in the $7.5 billion-capped South Australian miner hit decade long highs of $27.09 in May as the copper price hit record levels, before coming down with the price of the red metal.

A ~5% gain today pulled it back above $22, up to ~60% 12 month improvement.

Alumina Limited was demerged from Western Mining Corporation back in 2003.

Shareholders enjoy a 40% stake in the Alcoa World Alumina and Chemicals business, which is majority owned and managed by American mining giant Alcoa.

A couple weeks ago Alcoa reported its quarterlies, with Alumina’s share dividend from the AWAC business rising from $62 million to US$74.9m.

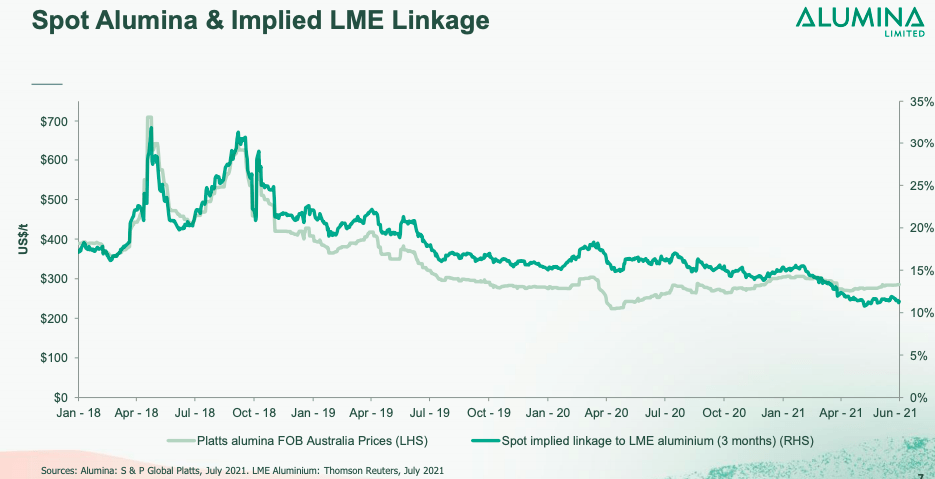

Earnings from operations themselves were down despite strong production, with Alumina CEO Mike Ferraro saying high handysize freight rates had led to subdued alumina prices and margin contractions.

Mt Gibson Iron is yet to report its June Quarter results, but they are expected to be better reading than its March Quarter, when overburden stripping dominated its Koolan Island activities.

It won’t enjoy contributions from the new Shine project in WA’s Mid West until the current September Quarter, but for any iron ore producers (even lower grade, higher cost operators like Mt Gibson) the prices seen in the June Quarter would have been more than welcome.

Mt Gibson is up around 4% year to date.