MoneyTalks: Not all graphite is created equal. Here’s an emerging ASX player to watch

Mining

Mining

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today, we hear from Simon Popple of UK-based Brookville Capital.

Graphite is one of the most versatile non-metallic minerals in the world.

It is an excellent conductor of heat and electricity, has the highest natural strength and stiffness of any material, and maintains its strength and stability to temperatures more than 3,600C.

It is also one of the lightest of all reinforcing agents, has high natural lubricity, and is chemically inert with a high resistance to corrosion.

A true wonder mineral.

Graphite prices are a function of two factors, Popple says – flake size and purity.

“Large flake (+80 mesh), high carbon (+94%) varieties often (but not always) command premium pricing, but the ‘ultimate’ pricing [comes from] graphite suitable for EV batteries,” he says.

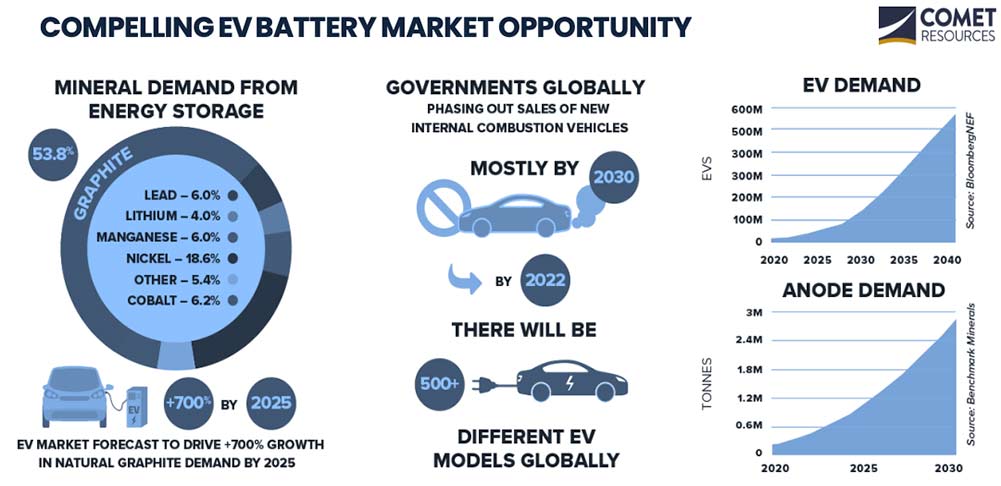

Graphite is considered a key, strategic material in green technology, including advances in energy storage, electric vehicles, photovoltaics, and electronics from smartphones to laptops.

Graphite is also the source of graphene.

However, emerging markets such as India and China have been holding back supplies of graphite for domestic consumption, Popple says.

“China controls most of the world’s graphite production – 70% — with practically none mined in the US and very little in Canada,” he says.

Right now, natural graphite is used mostly in industrial applications.

However, applications such as lithium-ion batteries, fuel cells and nuclear power have the potential to create significant graphite demand in the future, Popple says.

“For example, it takes 20 to 30 times more graphite than lithium to make lithium-ion batteries,” he says.

“The use of lithium-ion batteries is growing rapidly in consumer electronics, and they are also popular in power tools and motor scooters.

“Growth is likely to continue with the increased use of hybrid and fully electric vehicles.

“The lithium battery industry alone is projected to grow between 30 per cent and 40 per cent, with around 20 per cent annual growth in the electric vehicle market (as much as 30kg of graphite can be found in some electric cars).”

But not all graphite is created equal, with most unsuitable for the lithium battery market.

The graphite from Comet Resources’ (ASX:CRL) ‘Springdale’ project in WA is perfect for use in lithium-ion batteries, new test work shows.

The graphite is also appropriate for ‘jet milling’ – a product which, like battery anode precursor material, can achieve premium pricing in graphite markets.

Additional test work will be conducted to optimise these “already impressive” initial test results, the company says.

Popple says the big question is how much more of this high-grade, high-quality graphite do they have?

“I’ve been told (by the company) that the 2.6Mt of the high-grade deposit that they already have is enough to go into production (the caveat being that it needs to be of the same quality as the batches that were tested). This is clearly a risk,” he says.

“Having said that, they’ve only explored around 40% of the property, so there is potential for more high-grade graphite to be found.

“In fact, an airborne EM survey has delineated several other targets on the licence.”

B.R.I.D.G.E. is Popple’s system to carry out quick research on a company and measure risk. It stands for:

BALANCE SHEET – “They had A$2.35m at the end of Q2,” Popple says.

“With [gold] exploration expense in Mexico and graphite test work, they will probably end the quarter about a million lower.

“I’m not sure how long they can last without another capital raise but would expect them to come back to the market in 4–8 months. How much they raise will obviously depend on what their plans are for next year.”

RESOURCES – “The Maiden Inferred Resource was 15.6Mt @ 6% TGC (TGC = Total Graphitic Content) which included 2.6Mt @ 17.5% TGC (this was the high-grade graphite that was tested for battery use),” Popple says.

“The key as far as the market is concerned is to provide greater certainty of this resource.

“The next drilling will largely be ‘infill’, with a view to upgrading at least the high-grade resource into Measured & Indicated (it’s currently Inferred).

“They will also try to extend the resource, in particular, look for areas that may hold further high-grade type material.”

INFRASTRUCTURE – There is good infrastructure around the Springdale Graphite project which is about 150km west of Port at Esperance, Popple says.

“There is also grid power, piped gas and sealed roads nearby. So, capex costs from this perspective are expected to be relatively modest.”

DIVERSIFICATION – Although this is more to do with having a well-diversified portfolio, it’s worth pointing out that they’ve got exposure to graphite, gold and copper, Popple says.

“Should any one of these commodities either ‘take-off’ or ‘dive’, they can adjust their strategy accordingly.”

GRADE – Although the grade of both their gold and copper projects is encouraging, it’s the graphite Popple wants to focus on.

“As things stand, they’ve got 2.6 million tonnes of high grade 17.5% graphite as an inferred resource,” he says.

“Clearly, we want to know how much they can classify as measured and indicated and whether there is any more high-grade ore.

“Drilling can’t commence until Q1 next year – so we’re probably talking May/June next year before we’ve got a better idea on this one.”

EXPLORATION POTENTIAL – What is particularly compelling about this project is that some of the graphite is close to surface, as close as 20m in some areas, Popple says.

“In a nutshell, it’s likely to be a low cost, open pit operation.

“In terms of Santa Theresa (Mexico), drilling has completed and they are waiting on final assays (delays at the labs could mean that we won’t have these until Christmas), there will be an announcement when those are ready.

“Comet are also in arbitration on the ‘Barraba’ Copper project with the Native Title party and hoping for a positive outcome.

“If that happens, they’re hoping to start drilling in Q1 next year.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.