Mineral exploration — especially gold — is booming right now

Mining

Mining

Australian-based explorers and miners spent $582 million in the September quarter in the search for the next big mineral deposit.

This represents a $14.3 million — or 2.5 per cent — increase on the previous quarter, according to the Australian Bureau of Statistics.

Exploration spending plummeted in NSW, Victoria and Tasmania by 21 per cent, 8.6 per cent, and 17 per cent respectively, but this was offset by big gains in Queensland (21 per cent), South Australia (7.6 per cent), and Western Australia (3 per cent).

Over 60 per cent of total exploration was in Western Australia.

Association of Mining and Exploration Companies (AMEC) chief Warren Pearce told Stockhead that companies and investors are supporting projects in Australian jurisdictions where there is already strong mining activity.

“Queensland actually saw steady growth across coal, gold and base metals, probably reflecting the significant mining activity happening in the State driving further interest and investment — which is also occurring in Western Australia,” Mr Pearce says.

New South Wales, Victoria, and Tasmania are all states with relatively low exploration spending anyway, so the percentage changes look more significant than they actually are.

Still, it is worrying that they aren’t improving from a low base, Mr Pearce says.

Gold was the metal of choice, with a record $174 million – or 48 per cent of the exploration total — spent on gold exploration in Western Australia alone.

Greenfields (or unexplored) exploration spending was up 13 per cent — or $25.7 million — which offset a 2 per cent fall in brownfields (previous explored or mined) exploration, according to the Australian Bureau of Statistics.

But there was still a significant gap between the amount spent on greenfields and brownfields exploration, with 62 per cent of drilling in brownfield locations, Mr Pearce says.

“In the long term, this imbalance must be addressed if Australia is to find the future mines needed to sustain our industry.”

Programs like the Federal Government’s Junior Mineral Exploration Incentive (JMEI) are attracting the much-needed equity capital to increase greenfields mineral exploration, Mr Pearce says.

In Western Australia, the government recently announced $5.3 million funding for 40 exploration drilling projects as part of Round 18 of its Exploration Incentive Scheme (EIS).

These 40 projects were selected from a pool of 73 applications – a 16 per cent increase on the previous round.

This indicated that new exploration projects were still on the rise, state Mines and Petroleum Minister Bill Johnston says.

Recent EIS successes included Bellevue Gold Mining’s gold lode north of Leinster.

“Bellevue Gold’s newly discovered lode, beneath a mining centre that has been closed for 20 years, is likely to see operations restart and deliver jobs to the region,” Mr Johnson says.

The next round for co-funded applications will open in February 2019.

Global exploration is also trending up

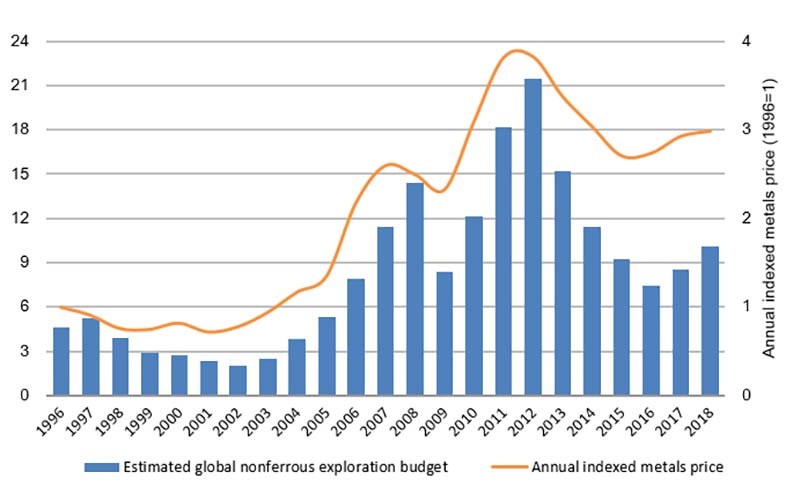

According to a recent report from S&P Global Market Intelligence, global nonferrous – metals that don’t contain iron — exploration budgets increased by 19 per cent to $US10.01 billion for 2018.

And for the first time since 2012 there was been an uptick in the number of mining companies with exploration budgets, an 8 per cent increase to 1651 companies from the previous year.

Mark Ferguson, Associate Director of Metals & Mining Research at S&P Global Market Intelligence, says improved metals prices and margins since 2016 encouraged producers to expand exploration.

Gold exploration budgets benefitted the most from the industry recovery, increasing to US$4.86 billion in 2018, up from US$4.05 billion in 2017.