You might be interested in

Mining

Riding the tech express: Tomorrow's industries that are driving industrial demand for silver

Mining

Monsters of Rock: Strong commodity prices movement a tailwind for today's reporting stocks

Mining

Mining

The Australian resources sector is a pretty tight-knit community, with many of the same names linked to several companies.

There are very few success stories in the sector, but three names spring to mind of those who have been influential in launching various ASX-listed juniors to new heights.

The first is Klaus Eckhof, perhaps best known for his role as chairman of AVZ Minerals (ASX:AVZ).

Mr Eckhof, who has been on too many mining boards over the past two decades to mention, has developed several projects globally.

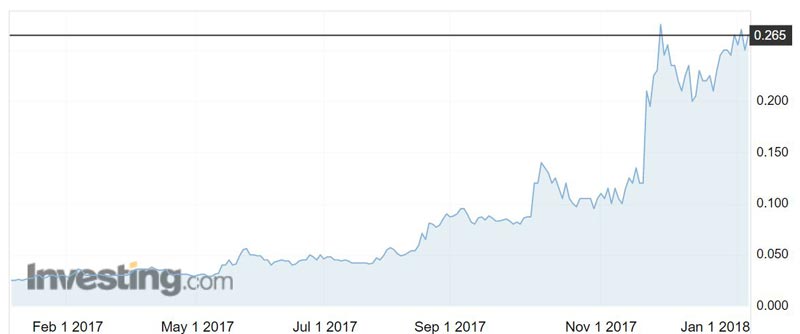

AVZ’s share price has gone from a tiny 1.5c to 25c over the past year, boosting its market value to more than $430 million.

It’s tough to say whether that is because AVZ is developing a lithium project — investors are going nuts over the battery metals at the moment — or whether it is largely to do with Mr Eckhof’s mining “nouse”.

The answer could be in the fact that Mr Eckhof was also recently installed on the board of base and precious metals explorer Argent Minerals (ASX:ARD) after disgruntled shareholders lost confidence in the previous board and voted the directors out.

Even Argent’s directors conceded in early December, just prior to their eviction, that “Mr Eckhof’s skills and track record warrant support of his appointment as a director”.

Another junior explorer, Amani Gold (ASX:ANL) has also tapped Mr Eckhof to help pick up its game.

Just before Christmas, the company named Mr Eckhof, a long-serving director, as its new part-time director for strategy and business development to drive its share price up from the 1.9c it was trading at.

Another influential mining personality is Tolga Kumova — the man best known as former managing director and founding shareholder of Syrah Resources (ASX:SYR), overseeing the company from a tiddler through to an ASX200 mining company.

Mr Kumova’s other interests include Alderan Resources (ASX:AL8), New Century Resources (ASX:NCZ), Hill End Gold (ASX:HEG), Meteoric Resources (ASX:MEI) and Draig Resources (ASX:DRG).

The share price of each of these companies has surged between 260 per cent and 1000 per cent in the past 12 months.

Mr Kumova ranked at number 22 on the Financial Review’s Young Rich List in 2017 with a net worth of $95 million, up from $79 million in 2016, at 39 years of age.

The mining magnate credits his six years with Syrah, which he still holds a stake in, as his best investment yet.

“It’s definitely Syrah, in a sense that I got a massive education,” Mr Kumova told Stockhead.

“I built that many relationships around the world whilst being CEO — from a funding perspective dealing with all the large institutional investors, dealing with all the battery producers, understanding what the investment banks are looking for, what the analysts require.

“All of this factors into actually building a successful business. There’s lots of exploration companies, but not that many mines get built around the world every year.”

Know-how is everything

Mr Kumova’s strategy is to back people.

“My first proper IPO that I really did on my own that I basically went all in on was called Doray Minerals,” he said.

“So it was Allan Kelly and a guy named Heath Hellewell. I backed the guys. I didn’t know Allan Kelly, but I knew Heath from his days with Independence.

“I remember walking into a meeting room with these guys in Perth and none of the Perth brokers would touch them.

“I flew in from Melbourne to visit them and I saw Heath and said: ‘wait a sec, I trust you, I know you know what you’re doing, I’m going to back you’, which is what I did.”

Doray (ASX:DRM), which has a market value of about $93 million today, rocketed from its initial public offer price of 20c to $1.70 in its first year on the ASX. It was dubbed the most successful IPO of 2010. The company went from explorer to producer in just over three years.

“So when everyone was telling me I was crazy and didn’t know what I was doing, I was backing the people, which is what I think is the most important aspect of investing in any of these companies.”

Zinc a good gamble

Mr Kumova is currently mulling other potential investments in the zinc and fertiliser sectors.

“I already have an interest in New Century Zinc,” he said. “Even with being the world’s fifth largest zinc producer, I suspect there is still going to be a shortage, especially with the growth in the first world and all the emerging markets coming at once. So there’s still going to be significant demand for zinc.”

Zinc is used in alloys such as brass, nickel, silver and aluminium solder.

Lastly, probably a man who has seen it all, Mark Creasy is a name spoken often in mining circles (he also has his own Wikipedia page).

Mr Creasy has been credited with some of Western Australia’s biggest mineral discoveries, including the Nova nickel deposit, now owned by Independence Group (ASX:IGO), and the Jundee and Bronzewing gold finds.

The Nova mine was acquired by Independence Group in late 2015 in the $1.8 billion takeover of Sirius Resources.

In 2017, at 72 years of age, the British-born businessman took out the number 12 spot on The West Australian’s Rich List with a net worth of $707 million, up from $604 million two years earlier.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.