Matador sets about building a multi-million-ounce gold business with top notch team

Mining

Mining

Special report: The man who helped build up Canada’s Roxgold into a $500 million company is now looking to do the same thing with ASX-listed junior gold explorer Matador Mining.

Newly appointed managing director Paul Criddle was previously the chief operating officer of Roxgold, where he was responsible for the development of the Yaramoko gold project in Burkina Faso – one of the world’s highest-grade gold projects.

In the last 20 years, he has been involved in mining operations and development projects in Australia, Papua New Guinea, Tanzania, Senegal, Ghana, Cote d’Ivoire, Guyana and Burkina Faso.

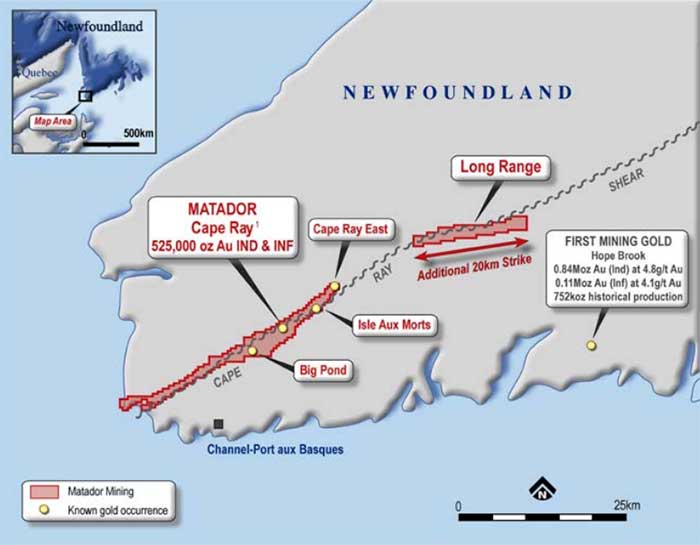

During Mr Criddle’s time with Roxgold he spent about four years in Canada, which is a good fit for Matador (ASX:MZZ) after it recently picked up a gold project, known as the Cape Ray gold project, in Newfoundland (see map below).

“The majority of my experience in the last 15 years is in Africa and a little bit of South America, which can be generally pretty tough jurisdictions,” Mr Criddle told Stockhead.

“So when I got the opportunity to look at Matador, I saw a very sound development opportunity at Cape Ray, but hosted within a first world jurisdiction in Canada.

“Having lived in Canada for four years during my time at Roxgold, it’s a great place to do business and I’ve developed a lot of really good connections there with the investment community as well as the various consultants and providers there.”

Top notch gold project

Matador has put its foot on some highly prospective ground in the same region as a multi-million-ounce gold deposit thanks to non-executive director Grant Davey.

Mr Davey is a mining engineer with 30 years of senior management and operational experience in the construction and operation of gold, platinum, zinc and coal mines in Africa, Australia, North and South America and Russia.

He has worked for mining heavyweights like AngloGold Ashanti and Anglo American.

More recently, he has been involved in venture capital investments in several exploration and mining projects. Other than his recent involvement in Matador he is focused on developing the high grade Canadian zinc opportunity within the ASX-listed Superior Lake Resources (ASX:SUP) and has been instrumental in developing the Panda Hill niobium project as well as the Honeymoon uranium project.

Mr Davey is on the boards of several ASX-listed developers including Superior Lake, Boss Resources (ASX:BOE), Cradle Resources (ASX:CXX) and Graphex Mining (ASX:GPX).

He has been looking for good gold assets in first world jurisdictions for some time.

The hook for him was the fact that Canada is set to be the second largest gold producer this year and the country is largely underexplored due to the recent downturn that saw investors flee from junior explorers.

“The mining juniors haven’t been given much love over the last seven years,” he explained.

“Most of the money in the junior space has been in blockchain, medical marijuana and bitcoin, and the miners have really been neglected.

“What’s happened in Canada is you’ve got these big gold mining companies and then very few mid-tier type miners and not much money going into exploration at the junior end.

“So I saw that as an opportunity.”

Multi-million-ounce opportunity

Mr Criddle describes the Cape Ray project as a “ready-made development story”.

The project already has a half-a-million-ounce resource, which he believes Matador is more than capable of eventually expanding to a multi-million ounce inventory or more.

“The team have managed to put together a very, very interesting land package that encapsulates 65km of the Cap Ray shear,” Mr Criddle said.

“Now what that does is that gives us an extremely large land package along a regionally significant structure that has multiple high-grade gold occurrences along it.”

The Cape Ray project is located along the same Cape Ray Shear as the 3.3-million-ounce Valentine Lake mine owned by Marathon Gold and First Mining Gold’s Hope Brook mine, which historically produced 752,000 ounces.

Marathon Gold has been able to define its large resource in a reasonably short time-frame – about three or four years – starting from the same point the Cape Ray project is at now.

The area also hosts a number of high-grade gold discoveries, with grades of up to 213 grams per tonne uncovered by one company during grab sampling.

“I think it shows that there’s demonstrated potential in the region to build significant gold camps,” Mr Criddle said.

“And at Cape Ray, while we have a really solid starting point with our existing resources that clearly have legs and need some attention to grow them quickly, we also have a large and exciting greenfields land package to explore. Both scopes that we are getting moving on.”

Matador’s strategy is to grow the Cape Ray resource to a multi-million ounce base within the next three years. The company plans to start drilling in August following a re-sampling campaign aimed at identifying drill targets.

This special report is brought to you by Matador Mining.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.