Marvel Gold closes in on 1-million-ounce gold inventory in Mali

Mining

Mining

Special Report: In just a short amount of time Marvel Gold has gone from project acquisition to an almost 1 million oz resource in Mali.

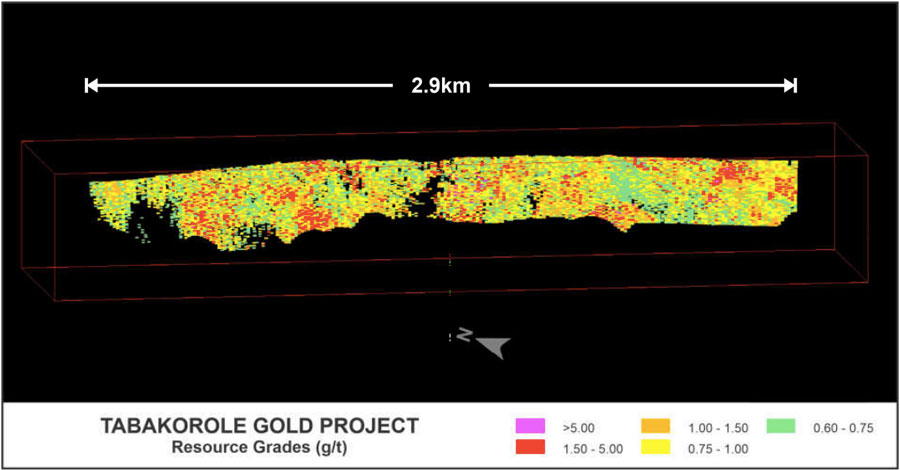

Marvel Gold (ASX:MVL) has grown the resource at its Tabakorole project in Mali to 910,000oz at 1.2 grams per tonne (g/t) gold, marking a 54 per cent increase in ounces and a 20 per cent increase in grade 32 per cent of which sit in the higher confidence indicated category.

Additionally, 43 per cent, or 390,000oz, of the resource sits within 100m of surface, which Marvel says increases the confidence for an open pit operation.

Marvel says the deposit demonstrates consistently thick zones which indicate the potential for a relatively low mining strip ratio. This means the company won’t have to move as much waste dirt to get to the good stuff and costs will be much lower.

Managing director Phil Hoskins said the significant improvement in the resource for the Tabakorole project beat Marvel’s expectations.

“From the outset, we firmly believed that a revised approach to resource modelling, together with the incorporation of results of both our recent drilling and historic drilling, presented an opportunity to grow the Tabakorole mineral resource,” he said.

“To have delivered the maiden JORC resource of almost 1 million ounces of gold is an exceptional result that has validated our approach and confirmed the opportunity at Tabakorole.”

Investor interest was piqued by the news, with shares climbing nearly 9 per cent to an intra-day high of 6.3c.

Marvel Gold (ASX:MVL) share price chart:

Marvel only acquired the Tabakorole project in June and immediately started drilling.

In August the company announced hits from resource drilling including 38m at 2.1g/t gold, including 14m at 4.7g/t gold, from 145m.

Not long after that Marvel picked up some more gold prospective ground from Oklo Resources (ASX:OKU).

In the space of just a few months Marvel has gone from brand new Mali gold explorer to having a war chest of almost 1 million ounces.

Since acquiring the project interest, Marvel has completed 1,544m of diamond drilling which, in combination with the 2010-2014 drilling, has been included in the current resource estimate.

Mineralisation at Tabakorole has so far been defined over a 2.9km strike length.

But there’s plenty more exploration upside.

Marvel says there are numerous opportunities for resource expansion, with 600m of aircore delineated strike to the northwest, which delivered top hits including 6m at 6.2g/t gold, remaining ‘open’.

Open is a good thing for explorers because it means they haven’t found the edges of this potentially massive system yet.

Mineralisation also remains open to the southeast and at depth.

“We have known mineralised strike extensions to follow up whilst the deposit remains open at depth,” Hoskins said.

“Combined with recent transactions that have increased our landholding at Tabakorole to 375sqkm and the demonstrated regional prospectivity, we are confident that further resource growth can be achieved.

“We look forward to starting stage-two drilling in the December quarter.”

Marvel was recently flagged by resident Stockhead expert Guy Le Page as a hot stock to watch.

The company’s projects are located on the Bannifin shear zone, which looks analogous to the 7 million oz Morila mine, Le Page said.

“It seems to have the right geology around it. There’s a historical resource that was published that’s going to be upgraded — about 10 million tonnes at just over a gram for about 350,000oz.

“But I’m pretty sure they’ll be able to improve on that with the next few rounds of drilling.

“Yet another West African gold story that’s getting a run in this gold market. I think that’ll be one to watch as you see the gold price recover.”

This article was developed in collaboration with Marvel Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.