Marmota goes back to the future with Junction Dam uranium acquisition

Mining

Mining

With the increasingly bullish outlook on uranium, timing appears perfect for Marmota (ASX:MEU) to return to its uranium roots with the acquisition of the Junction Dam uranium tenement.

Marmota started out as a uranium explorer and spent more than $8m by 2014 on uranium exploration to earn 100% of the uranium rights on Junction Dam, prior to putting further exploration on ice following Fukushima. Marmota has subsequently been in the news for its Aurora Tank gold discovery that has been yielding multiple outstanding gold intersections over 100g/t gold over 1m.

With the resurgence of uranium, Marmota has now acquired the entire Junction Dam tenement from Teck Australia, Eaglehawk Geological Consulting and Variscan Mines (ASX:VAR) which ensures that it now has complete control and ownership. The previous tenement owners have received a 5% net profits royalty on production from a future Uranium mine on the Junction Dam Tenement.

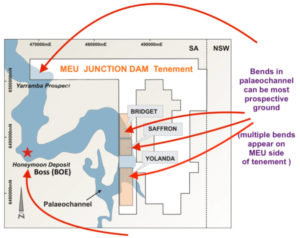

The Junction Dam tenement already has a JORC resource of 5.4 million pounds of uranium oxide at an average grade of 557 parts per million U3O8 within the Saffron deposit, similar to the average grades at the adjacent Boss mine.

Junction Dam is immediately adjacent to Boss Energy’s (ASX:BOE market cap $550m) Honeymoon tenement where solid progress is being made on bringing the existing Honeymoon uranium plant – one of just four permitted plants in Australia – back into operation. Importantly, this plant will require additional resources to achieve economies of scale to lower the cost of production and extend mine life, a resource that Marmota conveniently has.

The Junction Dam tenement bookends both sides of the paleochannel that runs through the Boss Honeymoon uranium plant. Marmota had previously defined a uranium JORC resource to the east of Honeymoon mine and has identified an untested target to the north, adjacent to Boss’ Jason’s uranium resource, as a high-priority for follow-up.

There’s also plenty of room for growth with the company’s previous work having outlined an exploration target of between 22 million and 33 million pounds of U3O8 at grades of between 400ppm and 700ppm.

All this comes at a time when uranium term contract prices rose last week with TradeTech’s mid-term price indicator for September 30 rising US$8 ($11) per pound to US$43.57/lb, indicating that recent spot price increases may be grounded in reality.

“Marmota started life as a successful uranium explorer. The company is extremely fortunate to still have these assets, and I find it enormously exciting to be returning to our origins in the uranium space,” chairman Dr Colin Rose said.

“The acquisition of the Junction Dam tenement makes Marmota, for the first time, masters of our own destiny in the uranium space. It is the first and critical step for the company to realise value of this outstanding asset for our shareholders.”

This article was developed in collaboration with Marmota, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.