You might be interested in

News

Market Highlights: Records in sight for gold, Bitcoin; US chipmaker joins S&P500 and 5 small caps to watch

News

Hot Money Monday: Herd mentality and FOMO linked to why momentum trading is such a success

Mining

Mining

Diamond miner Lucapa has unearthed a large 78 carat white diamond at its “Mothae” project in the African nation of Lesotho.

The sizeable diamond was found less than a week after Lucapa (ASX:LOM) told investors commercial diamond recoveries were now underway at its second producing mine.

It is the largest “special” recovered so far from the 1.1-million-tonne-per-annum (Mtpa) treatment plant at the Mothae project.

“Recovering such a diamond this early confirms our confidence in Mothae as a large diamond source,” managing director Stephen Wetherall said.

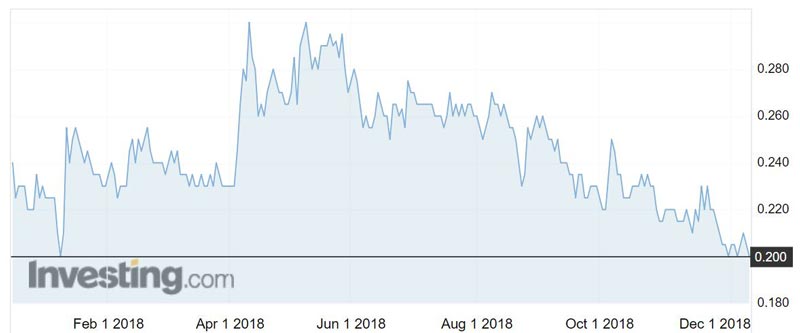

But news of the big find wasn’t enough to spur the share price north. It touched 21c briefly — a gain of 2.4 per cent — before reversing the trend and heading south 2.4 per cent to 20c

Commercial recoveries were originally scheduled for early November, but Lucapa was battling winter snowfalls and high altitudes during the Mothae processing plant commissioning phase.

A second operating shift has now started at the Mothae plant as part of the progressive ramp up to 1.1Mtpa.

Head of investor relations Mark Drummond told Stockhead the large special will be included in the first sale of commercial diamonds next year.

“The first sale will be in first quarter of next year, of commercial diamonds from the site, and we are scheduled to achieve ramp up to nameplate capacity in the first quarter,” he said.

Mothae is Lucapa’s second operating diamond mine.

Its first mine, “Lulo” in Angola, has produced 11 +100 carat diamonds so far, and is the highest US-dollar-per-carat alluvial diamond production in the world, according to Lucapa.

Lucapa made $5.7m from its most recent diamond sale, but it is holding back a number of “premium” diamonds to sell later.

On Friday, the company revealed that it is now officially allowed to sell diamonds from its Angolan mine at international tender.

Up until recently Angola’s restrictive legislation over diamond operations meant foreign investors couldn’t own a majority stake in projects and required all diamonds be sold through a central state-owned government agency.

However, following the election of a new government in August last year the country is seeking more foreign investment in its natural resources, including diamonds.

Angolan President Joao Lourenco has now implemented a new diamond marketing policy.

Lucapa says it will sell its “large” and “exceptional” diamonds from Lulo in January next year.