You might be interested in

Mining

First lithium carbonate produced at Green River opens pathway for Anson’s success

Mining

Two of a pair: Anson confirms the target clastic zones at Green River are the same as those at its Paradox project

Mining

Mining

Look across the screaming hot lithium sector and valuations are beginning to froth up like a well-steamed cappuccino.

Prices for the key component in lithium-ion batteries, stationary energy storage and in a way the world’s entire transition to clean energy, have increased over 400% in the past year to record levels.

That has sent shares for near-term producers and miners soaring as well, with at least four lithium companies entering the ASX 300 for the first time in March.

But there remains value to be found across the sector. $140 million capped Anson Resources (ASX:ASN) is a prime example.

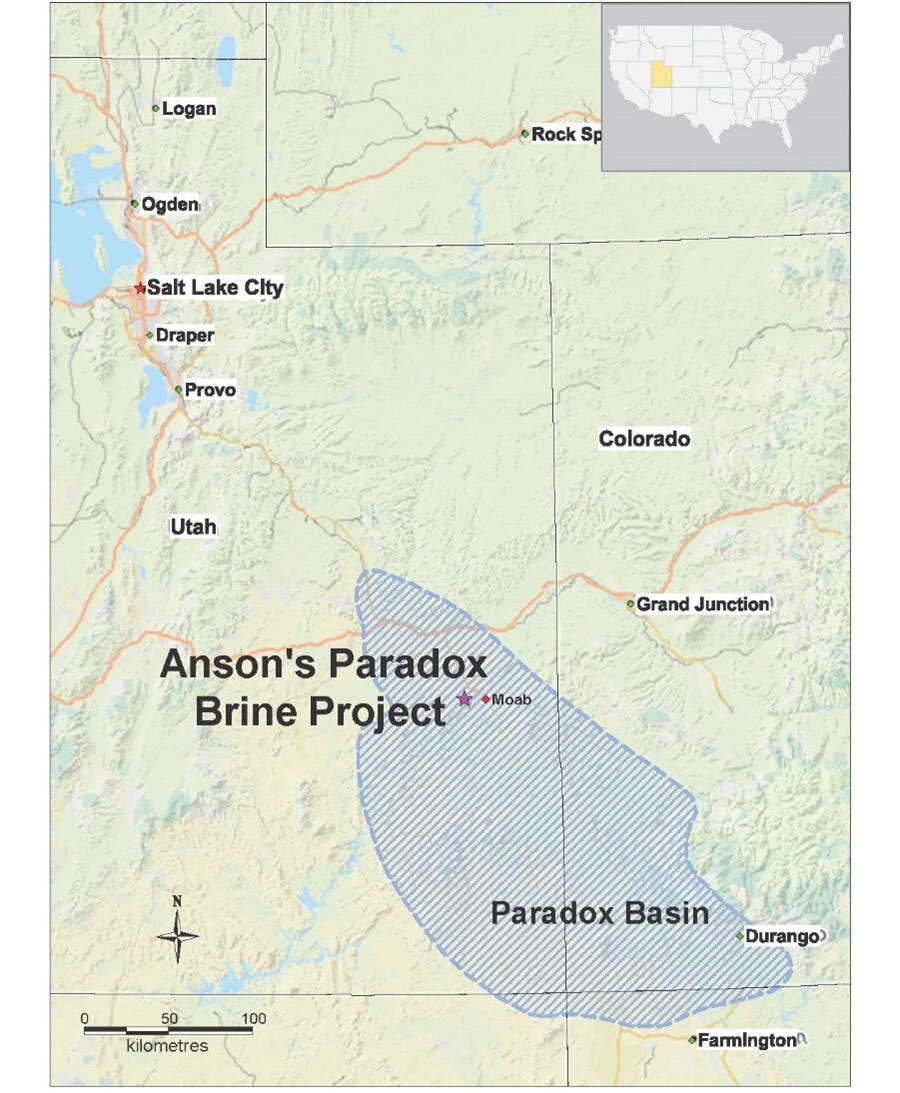

Anson boasts a JORC 2012 resource of 186,000t of lithium carbonate equivalent at its flagship Paradox Lithium Project, covering 95sqkm in Utah on the doorstep of Tesla’s US Gigafactory. And Anson is far more advanced than its market capitalisation suggests.

A preliminary economic assessment last year put a US$203 million price on a first stage development that would produce 2674t of lithium carbonate (and 15,000t of sodium bromine) a year at an attractive NPV of US$468 million and post-tax internal rate of return of 31%.

A major resource upgrade program is currently underway as is a DFS, led by independent consultants Worley. With a final investment decision expected early next year, it is feasible to think Anson could be in production by 2025.

Paradox is also a unique project. While most of the world’s lithium is currently extracted from hard rock mines in Australia or football field-sized evaporation ponds in South America, Anson plans to tap deep lithium rich brines from wells once used to produce oil.

Ever since the reservoirs in the Paradox Basin have been tapped, their lithium rich nature has been known.

Drilling in the 1960s down to around 8000 feet intersected a brine horizon at 6500ft, equivalent to almost 1800m.

Hot and caustic brine was poured back over the drillers and taken for sampling, looking for potash, a fertiliser ingredient commonly produced in Utah.

What they actually found was lithium, bromine, iodine and boron. But lithium was worth peanuts at the time. Today the commodity is seeing an unprecedented boom thanks to its use in lithium-ion batteries for the exploding electric vehicle sector.

That has sent chemical prices to record levels of almost US$80,000/t this year.

In many ways Paradox is, like it says on the tin, a perfect symbol of the ESG shift coming across the mining industry.

The entirely unique lithium project was first drilled for oil some 60 years ago, and oil reservoirs are being tapped within the basin.

The irony is not lost on Richardson that the lithium sorely required for the batteries that power electric vehicles sit beneath the fossil fuels that power the cars EVs will displace.

By re-entering wells once drilled to produce oil, Anson is repurposing that capital in the pursuit of developing a major green energy asset.

“They’re still extracting oil not very far away, but we are using the money that they invested in drilling those wells way back in the ‘60s, ‘70s, ‘80s to do our exploration program and build up a JORC resource,” Richardson said.

“When we go into production, we’ll drill new wells and they’ll be much bigger.

“So an oil well will be around about 4 & 5/8th inches or smaller. And we’ll have wells which are around 10 inches; they’ll be big brine wells bringing a lot of brine to surface very quickly.”

That relatively small footprint, Richardson says, gives Anson an advantage when it comes to ESG and community acceptance compared to conventional brine evaporation lithium projects and large open cut pits.

“So overall our project’s very environmentally friendly because we don’t have a big scar on the Earth’s surface,” Richardson said.

“It’s not open cut, it’s a pipe that’s about 10 inches when it comes out of the ground. It goes back under the ground. It’s mashed up with two other pipes, (the brine) gets buried under the ground so it’s not seen again.

“So we have very little visual impact.”

One of the reasons for that is the incredible amount of pressure in the deep brine resource which helps not only bring the brine to surface at 4500psi, but will be strong enough to pump the brine naturally to a processing plant.

“We don’t need to pump because it has its own pressure and brings it to surface, and even at surface it’s around about 1700psi. By comparison, your car would have 36-37 psi in its tyre,” Richardson said.

“That’s a lot of pressure.”

For that reason the proposed operation will have a number of ESG benefits and features that will reduce carbon emissions compared to other lithium producers.

“We don’t need a pump to bring it up or pump to move it, you’re not bringing trucks in there with diesel to fuel the pumps,” Richardson said.

“So when we do the environmental studies here, that’s the sort of thing that they look at.”

That’s a big thing for offtakers, especially in the United States where President Joe Biden has committed up to US$20 billion in funding to help build an EV and battery metal supply chain to take market share away from the dominant Chinese industry.

“We’re trying to make a better lithium,” Richardson said.

“The project’s more similar to geothermal than it is to hard rock or solar evaporation down in South America. It’s more self-powered, but in a different way.

“It’s something which always comes up (in discussions with potential customers) particularly in the United States, less so in China.

“Earlier on we did some sign some MoUs with Chinese customers. They were less concerned as you’d appreciate but here it is something that they do ask and they’re attracted by the ESG attributes that this project has.”

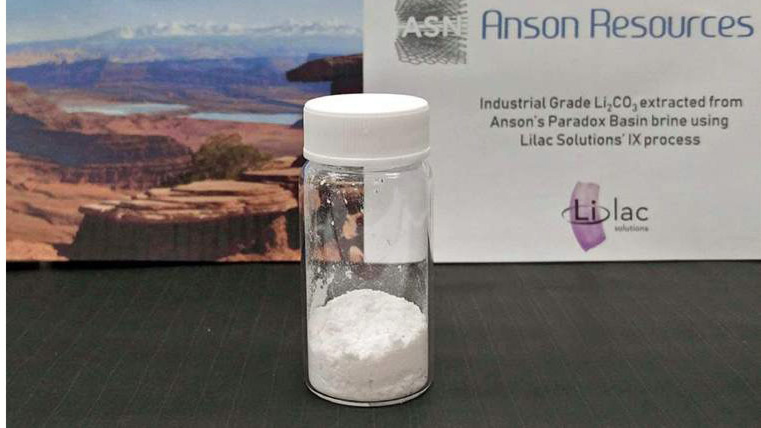

Anson is one of a number of lithium producers looking to move away from land- and water- intensive brine evaporation to direct lithium extraction.

The process is designed to extract lithium straight from the brine source, rather than use the power of the sun to evaporate it into a concentrate.

In doing so, Richardson says the process of extracting the brine is shredded into fractions from an 18-month lead time to just nine hours.

The novel process is one reason Richardson has a degree of confidence about Anson’s potential to be in production by 2025.

“So you use a resin and the lithium is absorbed onto the resin and then you wash it off,” he said.

“In our case we wash it off with water. Some other processes, they use chemicals and acids to wash it off.

“So we end up with a lithium which is suspended in pure water. So you have a cashflow advantage there that you only take nine hours versus 18 months.”

The recovery rates, Richardson says, are also higher. Anson plans to recover 91.5% of the lithium metal from the brine source.

Many hard rock mines – like Allkem’s Mt Cattlin for example – run at recovery rates of around 60%. Given the profitability of that operation at current prices, Anson’s high recoveries are a big tick for their future production plans.

“As you do solar evaporation you’ve got to move the brine from pond to pond as you’re concentrating it and when you do that, when you move things around in all mining, you lose something along the way,” Richardson explains.

“In our case, using a DLE we get a 91.5% recovery rate so it’s also better for your bottom line when you’ve got a lot bigger return or recovery of your material.”

Then there’s the environmental aspect. Richardson says the DLE process will be a key aspect of avoiding the large land use and impact to wildlife posed by extensive networks of brine evaporation ponds.

A new exploration program currently underway is expected to increase the JORC resource at Paradox, with three wells already done and four still to be completed before the DFS is delivered.

Anson sees potential to expand the lithium brine resource both vertically and horizontally.

Current drilling is tapping into the deeper Mississipian unit, a lithium rich zone of between 100-250m of thickness down to 8000ft below surface.

It is aiming at an exploration target of between 1300 and 1800 million tonnes of brine at grades of between 80 and 140ppm lithium and 2000-3000ppm bromine for 553,000-1.34 million tonnes of lithium carbonate and 2.6-5.4Mt of bromine.

Drilling at the Long Canyon #2 well recently hit its target depth, with Anson reporting first brine flow.

Samples from the supersaturated brine were taken for testing from the top of the Mississippian units at a depth of 2345m (7691ft).

Drilling is still going into the thick Mississippian units, which head down for at least 120m, with samples sent for assay and petrological analysis.

Richardson says the next well will be drilled in June with Anson continuing into the area west of the Paradox resource later this year.

This article was developed in collaboration with Anson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.