You might be interested in

Mining

Gold Digger: Aussie gold miners are raking in $450 per ounce more than they were 5 months ago

Mining

Resources Top 5: Rare earths stocks spark to life as China threatens export ban

Mining

Mining

Labyrinth Resources has struck visual gold in exploration outside its resource at its namesake project in Canada, giving confidence there is plenty more of the rich, high-grade goodness to be found in the Quebec deposit.

The Labyrinth gold project boasts a foreign non-JORC resource to Canada’s NI43-101 standard of 2.1Mt at 7.1g/t at 479,000oz.

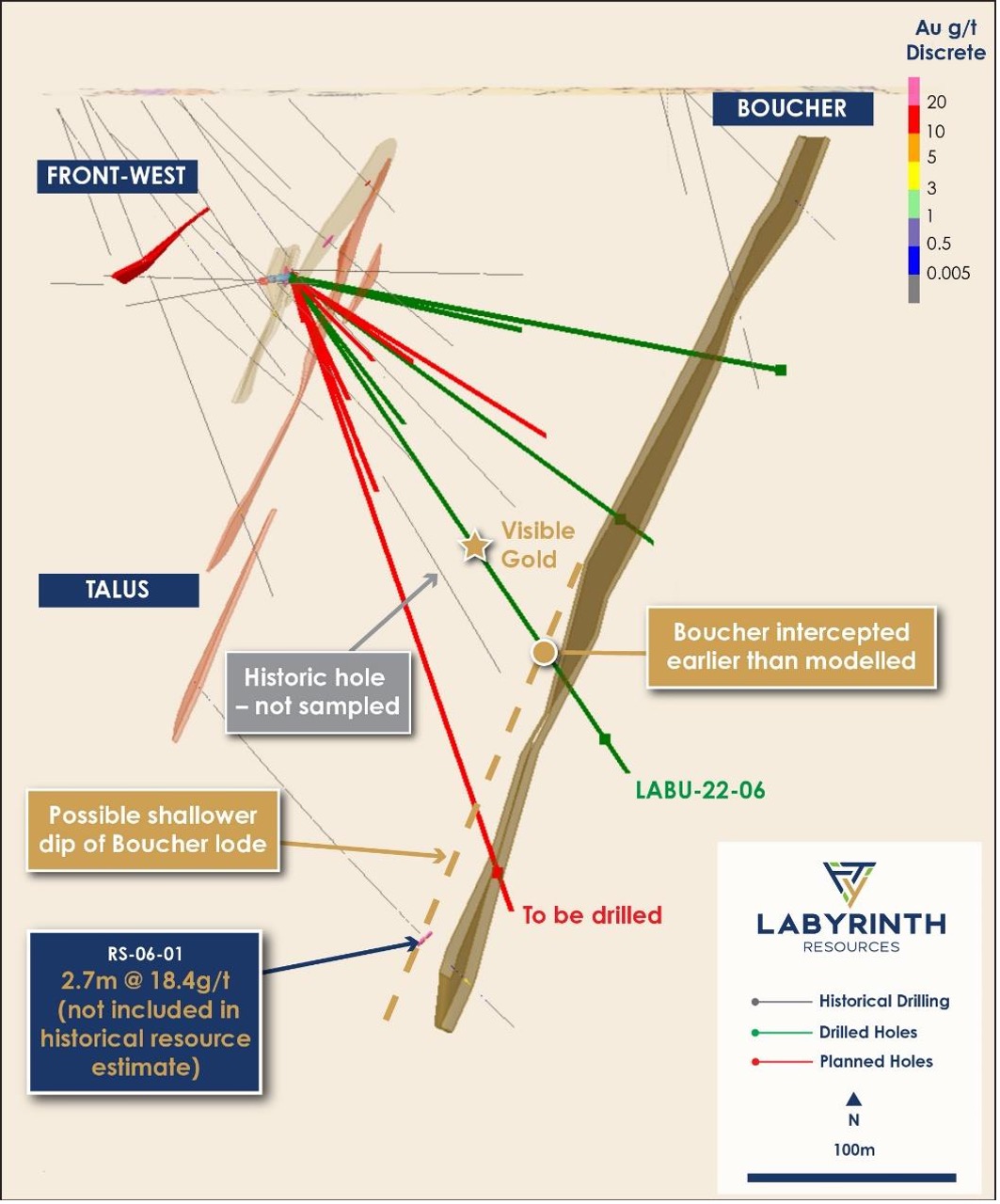

But with a maiden JORC resource on track for delivery in 2022, the visible gold intersected between the known Talus and Boucher lodes is a very good omen, highlighting Labyrinth’s (ASX:LRL) potential to expand known mineralisation and validating its initial appraisal of the asset’s gold bounty.

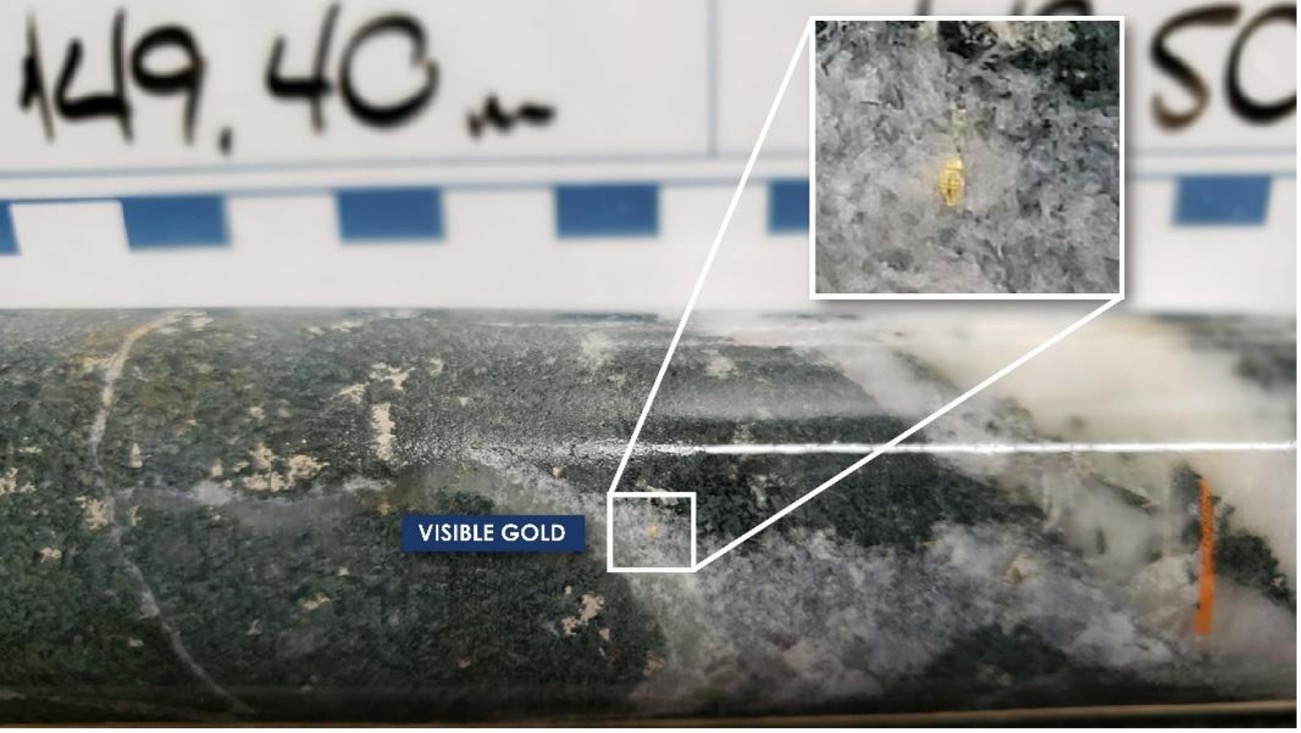

The visible gold was found in hole LABU-22-06 at a depth of 149.5m deep among quartz veinlets. They were identified in a currently unmodelled zone between Talus and Boucher, supporting Labyrinth’s assessment of the major upside potential of its resource.

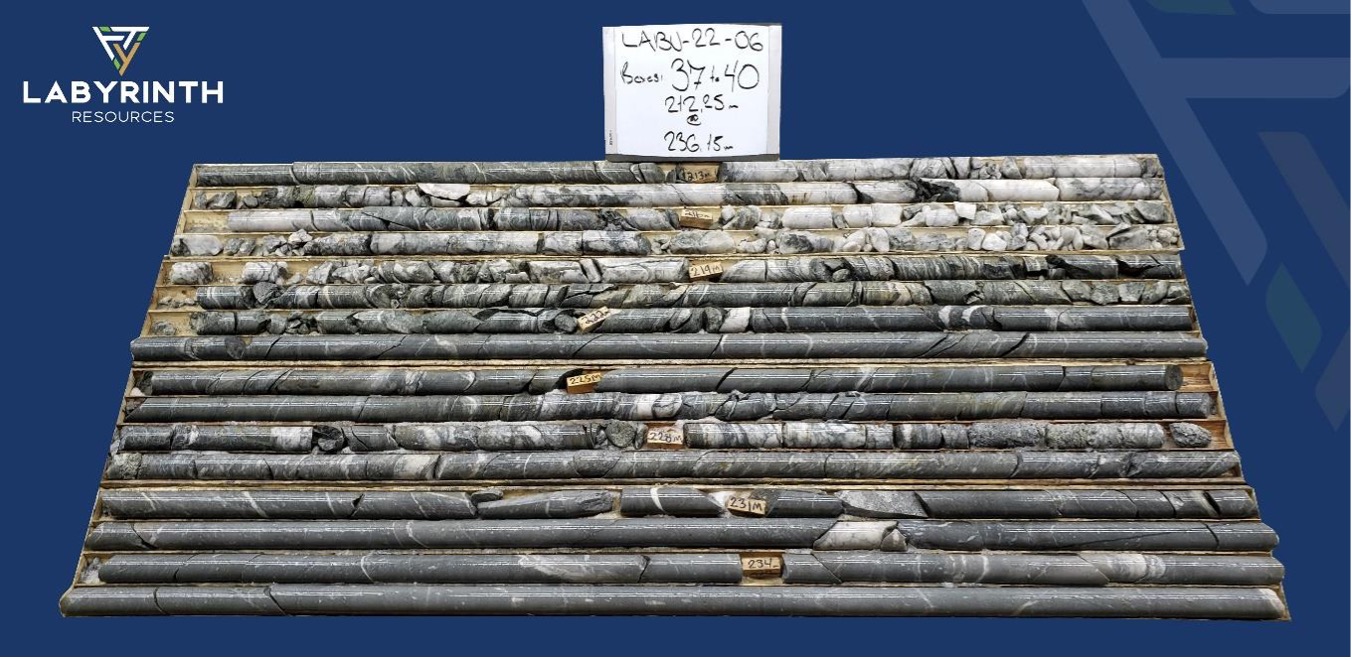

So far a little over 2000m of diamond drilling has been completed in a maiden 5000m underground drill campaign.

All eight initial holes have intercepted the targeted Boucher lode at its planned depth, with core displaying a well developed quartz vein with pyrite and chalcopyrite.

It ranges from 1.5m to 6m wide with at least one significant alteration assemblage of sericite and carbonate up to 18m wide.

“The results look highly promising at this stage and support our strategy to establish a significant high-grade JORC Resource later this year,” Labyrinth CEO Matt Nixon said.

“We continue to hit the key Boucher lode with every hole and we have also intersected mineralisation outside the Resource, allowing us to modify the design of our maiden drilling program and ensure we also include targets within the mine sequence of the known McDowell and Talus lodes.

“This all bodes very well for the maiden JORC Resource and we look forward to receiving the first assays in coming weeks”.

The underground sampling program conducted by Labyrinth has been designed after a review of historical data in an attempt to deliver a maiden JORC 2012 compliant resource for the mine and improve its geological understanding.

These include ore drives that remain unmapped despite the presence of mineralisation on the rock faces.

Take the current face of the McDowell 110 East ore drive, where the previous mine owner had commenced development activities right before Labyrinth picked up the mine, the first place Labyrinth is conducting sampling.

Mineralisation can be seen right in the face, with a historical intercept of 1.4m at 9.1g/t including 0.46m at 22.3g/t located 60m along strike.

The 90 and 130 levels also have current face positions with visible mineralisation at distances of 165m and 100m further along strike respectively, providing strong indications of potential for future immediate lateral ore development extensions in the historic underground mine workings.

The 110 East samples have also been prioritised with the assay laboratory along with the diamond drilling at the Boucher and Talus lodes.

Canada boasts a number of other world class gold domains including the highly-prospective Abitibi region, so it’s little wonder the company is looking to strengthen its foothold in the district.

Labyrinth has agreed to pick up seven claims in Ontario from a private owner adjacent to its current tenure across the border in Quebec.

It will come at a good price as well, with Labyrinth to tip in consideration of C$7000 cash and a net smelter royalty of 2.5%, which it can buy back at its discretion within the next 48 months for $50,000 for each 0.5%.

This article was developed in collaboration with Labyrinth Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.