You might be interested in

Mining

Resources Top 5: Right on Cue… Cyprium Metals makes high-grade copper-gold hit

News

Closing Bell: ASX breaks three day losing streak as Limeade lifts 300% on $112 million takeover

Mining

Mining

Yesterday, the Victorian government suddenly lobbed in a shock 2.75 per cent royalty on gold production, which will take effect from January 1 next year.

Mineral royalties are payment to the owner of mineral rights – in this case the community — for the privilege of extracting the mineral from the ground.

Industry group AMEC says it was not aware of any consultation between government and industry prior to the royalty rate being announced.

The Minerals Council calls it a “job-wrecking mining tax grab” which will “cost jobs in regional Victoria, threaten investment and hit the mining industry hard across Victoria”.

The market responded to the news by selling down a number of Victoria-focussed miners and explorers on Monday.

But Victoria is currently the only Australian jurisdiction without a gold royalty in place. So, is this a big deal or a beat-up?

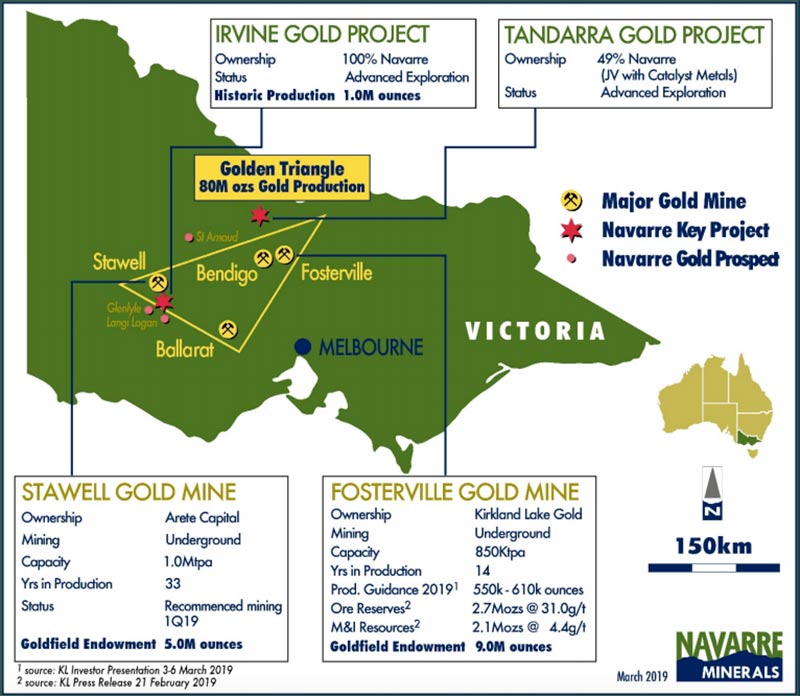

Victoria’s heyday as a leading gold jurisdiction is long past.

But Kirkland Lake Gold’s recent success at the Fosterville gold mine, which has seen it emerge as one of the lowest-cost and most profitable gold mines in the world, brought Victorian gold back into vogue.

The 7 million ounce, 300,000oz per annum Fosterville is one of the world’s highest-grade gold mines and is currently the largest gold producer in Victoria.

READ: Motherlode — Pics of the top 10 gold strikes of 2018

The Global Survey of Victoria has previously said that the area around Bendigo, about two hours from Melbourne, could hold up to about 32 million ounces of gold.

This has attracted a host of explorers eager to repeat this success by finding new multi-million-ounce deposits.

But AMEC chief executive Warren Pearce says this 2.75 per cent royalty rate represents a significant increase in the cost of mining and reduces the attractiveness to invest in Victorian gold exploration.

“The rate is higher than in Western Australia (2.5%), but lower than in other states,” Pearce told Stockhead.

“However, when considering royalty rates, states need to take into account the overall cost of doing business, and the operating environment for companies.

“Our view is that the state government should abandon this proposal and consult with industry, so there can be a proper assessment of the impact any such proposal will have on the industry.”

Hedley Widdup, director of Lion Selection Group, says the royalty — despite bringing it in line with other jurisdictions — is a big deal for many of the state’s gold miners.

“The Fosterville [operation] looks strongly profitable at the moment, but they are far from typical – I suspect the typical gold miner in Victoria will find this makes life unnecessarily hard and they will have to decide what to cut to afford it,” he told Stockhead.

“I don’t think it would be just absorbed by profit margins.”

Plenty of people have gone looking for another Fosterville, encouraged by the find – but with little success so far, says Widdup.

“The regularity with which such lodes are found speaks to their scarcity, so I think Fosterville-encouraged exploration will fade,” he says.

“Victorian gold is typically harder to estimate and explore for than a lot of other gold styles.

“This makes for operations which have short periods of wonderful profitability which are hard to anticipate and depend upon, but more normally operations can be tight.

“Exploration/development capital is highly mobile and has no obligation to spend itself in Victoria, and its owners are extremely wary of governments who serve up surprises like this without consultation.”

“Victoria is already a hard jurisdiction to attract mining investment to.”

But explorer Navarre Minerals (ASX:NML) offers a different view.

Navarre, which boasts Kirkland as one of its largest shareholders, is a Victoria-focussed explorer targeting multi-million-ounce gold deposits.

Managing director Geoff McDermott believes the impacts of the royalty have been overstated.

The delivery [by the Government] wasn’t the best, and there seems to be a bit of outrage over the way it was announced,” he told Stockhead.

“But you’re talking about a small royalty on gold production. The minerals in this state belong to the citizens in this state – we just see it as one way to compensate them.”

And the state government is still “pretty good on the front end”, says McDermott.

Like a $15 million-dollar target funding initiative, designed to boost greenfields exploration, which he calls “one of the better programs in Australia”.

McDermott says high quality Victorian explorers are still a good investment; regardless of any royalty increase.

“My view is that it’s not a great impost,” he says.

“The bigger issue is getting a social licence to operate, as well as the gold price/exchange rate outlook.”