Iron ore just hit its highest level since early 2017

Mining

Mining

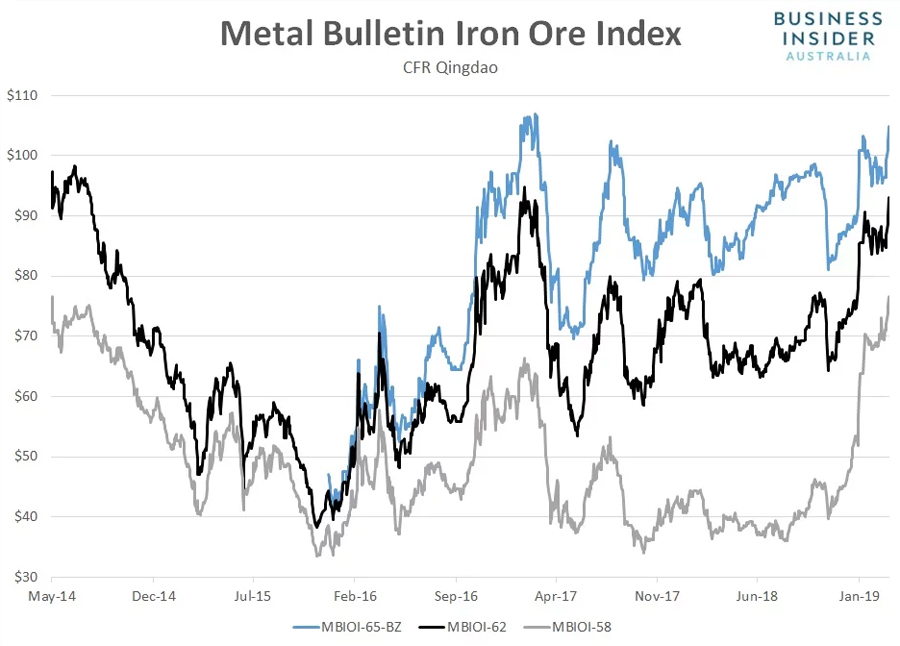

Iron ore prices have risen to fresh multi-year peaks, notching up yet another 2% plus gains across all major grades on Wednesday.

The benchmark price for 62% fines surged by 3.5% to $93.08 a tonne, according to Metal Bulletin. It now sits at the highest level since February 22, 2017, having rallied 45% from late November last year.

58% and 65% fines also surged higher, settling at $76.56 and $104.80 a tonne respectively, up 2% and 2.3% from Tuesday.

As seen in the chart below, 58% fines has rallied significantly harder than mid and higher grades since late last year, helped by supply disruptions in Brazil and Australia — the world’s largest iron ore seaborne exporters — along with less onerous environmental restrictions governing industrial output in northern China.

58% fines has rallied 93% since late November, and now sits at levels not seen since May 2014.

Wednesday’s surge also saw 65% fines settle at the highest level since March 2017.

The price action in spot markets was mirrored by Dalian iron ore futures which finished Wednesday’s day session at 690.5 yuan a tonne, it’s highest closing level since trade in Chinese futures first began in 2013.

At one point futures hit limit-up, meaning the only thing preventing further gains were contract rules prohibiting it. It was that kind of a session.

The surge in physical and spot markets coincided with news that activity levels across China’s non-manufacturing sectors improved at the fastest rate since January 2018 in March.

Broader activity across China’s private sectors also improved the fastest pace since the middle of last year, indicating that attempts from policymakers to stimulate economic activity are working.

Along with bullish data and ongoing speculation surrounding the outlook for Brazilian and Australian seaborne supply, stronger steel prices in China also helped to boost sentiment towards the outlook for demand.

Rebar and hot-rolled coil futures traded on the Shanghai Futures Exchange lifted to 3,879 and 3,825 yuan a tonne respectively, adding to the gains seen earlier in the week.

“I think there’s still room for [iron ore prices] to go up, maybe around $5 to $6 a tonne more from the current level,” a Shanghai-based trader told Reuters. The trader said current iron ore demand from Chinese steel mills is “good”.

Given the scale of the move seen across iron ore price grades over the past week, adding to the massive gains seen late last year and in early 2019, analysts are now scrambling to make upward revisions to the price forecasts in the year ahead.

“Iron ore is looking a lot tighter than we envisaged three weeks ago in our most recent price forecast,” said analysts at Credit Suisse.

“Based on the new supply guidance we assume a 30-40 million tonne iron ore supply shortfall for 2018 that could draw deeply on port inventories. With steel mills remaining destocked, our $80 a tonne price forecast for the year is now looking too low.”

Ian Littlewood, commodity researcher at Barclays Bank, was another to upgrade his price forecasts for the year ahead based on supply-side constraints.

“Higher prices are justified and we raise our full year forecast to $75 a tonne from $69 a tonne previously,” he said. “However, we retain the view that prices will move lower through the year as supply begins to recover.”

Hinting the price surge in spot markets may pause for breath on Thursday, Dalian iron ore futures reversed some of its earlier gain in overnight trade on Wednesday, closing the session at 678 yuan a tonne.

Coking coal and coke contracts also eased lower, suggesting recent weakness in coking coal markets may continue into Thursday’s trading session. In contrast, rebar and hot rolled coil futures were almost unchanged from the day session close.

While the rally in iron ore prices may pause for breath in the near-term, recent gains have been a big factor behind the lift in Australia’s international trade surplus over recent years. In February, the value of Australian iron ore exports hit the highest level on record, contributing to the record trade surplus of $4.8 billion achieved during the month.

Along with similar growth in the value of Australian coal and LNG exports, it’s been a major factor behind the improvement in Australia’s budget position, helping to boost government revenues. In turn, that’s allowed the government to announce income tax relief for many Australian workers, as announced in Tuesday’s Australian federal budget by treasurer Josh Frydenberg.

“The lift in prices is boosting Australia’s national income, which is flowing through to higher tax revenues, providing the government with additional fiscal flexibility as evident in the recent budget updates,” said Andrew Hanlan, senior economist at Westpac Bank.

Other economists, based on recent price movements, believe there may be even further upside to come from a revenues perspective.

“Australia is presently riding the wave of higher export volumes, buoyant commodity prices and an Aussie dollar content to sit in the low 70 cent region — it’s a tasty trifecta,” said Gareth Aird senior economist at the Commonwealth Bank.

“We think that this commodity story has further to run… so a further upside surprise to the Government’s coffers looks probably.”

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.