Indiana has big plans for Minos gold exploration drilling

Mining

Mining

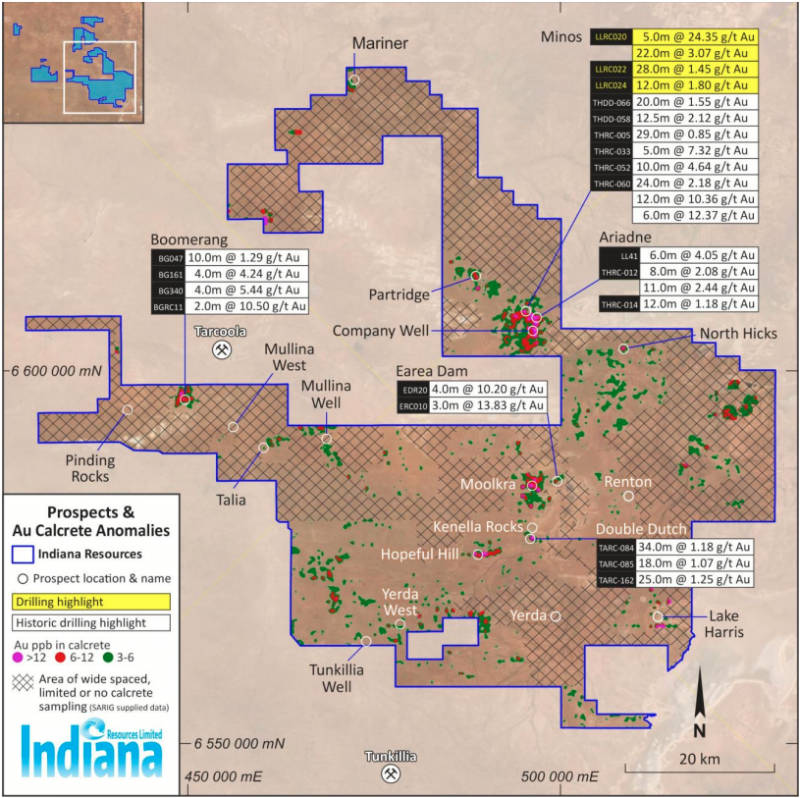

Following the success of maiden drilling at the Minos gold prospect, Indiana has committed to an expanded exploration program to unlock its potential.

Nine of the previous 10 holes drilled had ended in the mineralised shear zone with a top high-grade result of 16m grading 13.12 grams per tonne (g/t) gold from a depth of 37m within a broader intercept of 38m at 6.54g/t gold from 29m.

With results such as this, it is clear why Indiana Resources (ASX:IDA) is committing to a major diamond, reverse circulation (RC) and aircore drilling program to be carried out in April.

The company will kick off the program in early April with the drilling of three diamond holes to provide structural information while testing extensions at depth and a possible extension to the west of the Minos prospect.

This will be followed by a 2,000m RC program of up to 20 holes in late April to follow-up on the previous Minos drilling results while a 3,600m aircore program will test a 4km long corridor from west of Minos to east of Ariadne including 700m of sparsely tested area between the two prospects.

Additionally, a downhole televiewer survey will be carried out on the earlier holes to provide rapid and accurate high resolution orientated images of the drill hole walls to aid structural interpretation.

“Our commitment to immediately ramp up exploration at Minos is a strong demonstration of the company’s enthusiasm for this underexplored area,” executive chairman Bronwyn Barnes said.

“With sufficient cash resources to meet our current programs, and the strong likelihood of an additional $4m to be received in late July, we are fully funded to actively progress activities on the ground.

“Whilst Minos is our primary focus for expanded drilling activities, we are working on other land access approvals in order to expand our exploration activities later this year.”

Indiana has more than 148.5 million unlisted options that can be exercised for shares at 3c each that expire on or before 5 August 2021.

Given that shares in IDA are currently trading at 7.7c each, there is every reason to believe that these options will be exercised.

Minos is certainly promising but it is not all that is on offer at Indiana’s Central Gawler Craton project in South Australia.

Other likely targets include the Ariadne prospect that is located – like Minos – within the central part of the Lake Labyrinth Shear Zone, a 30km long west-northwest/east southeast trending regional structure that is at least 50m to 100m long.

The Partridge and North Hicks prospects are located at the west-northwest and east-southeast extensions respectively.

Indiana has started discussions with Native Title groups for expanded land access across the rest of its acreage.

This article was developed in collaboration with Indiana Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.