Hudson hawk: Victorian gold revival is on the cards thanks to this diabolically good Aussie gold hunter

Mining

Mining

Victoria’s gold fields were once the richest in Australia but had languished for a long time until the success of the Fosterville mine sparked a new wave of interest.

Some 80 million ounces of gold were extracted from the central and north central Victorian goldfields, much of this during the period between 1851 to 1896 that left the countryside pockmarked with mine workings.

Interest in these fields waned during World War One, when most of the men went off to the fields of battle and when by their return, the attention had turned to Western Australia.

The fields were forgotten for decades, but for a brief window during the 1980s and 1990s, where a lot of shallow drilling was carried out on oxide gold but no deep drilling.

Remember this fact, it’s important later.

This sorry state of affairs would have continued were it not for the Fosterville mine that, after a tough period dealing with refractory gold, stumbled on the sweet, two-ounce per tonne gold riches of the Swan Zone that made it famous as the world’s highest-grade gold mine.

A bit of a mad scramble for prospective ground ensued, with the Geological Survey of Victoria estimating that up to 75Moz of gold could still be present in the central and north central goldfields.

It is a story Melburnian Michael Hudson – executive chairman of Toronto-listed Mawson Gold – is intimately familiar with, given he’d actually picked up a package of tenements in the Victorian gold fields some 20 years ahead of the curve.

Speaking to Stockhead, Hudson joked he was only 20 years too early about promoting the Victorian gold story and vested the projects into Panaegis Gold Mines, of which he was the second largest shareholder when it listed in 2006.

He then took his skillset and founded a number of companies on the TSX including Mawson Gold, which went on to discover a million ounces of gold in Finland over the last three years.

With the Finland project now starting to go into early stage permitting and mining studies, Hudson returned his attention to a suite of projects Mawson picked up in Victoria from Nagambie Resources (ASX:NAG), the immediate successor to Panaegis that he played such a big role in all those years ago.

“I’m an explorationist and love discovery and that’s what really turns my crank. It is what I love doing,” he admitted.

Over the last 18 months, Hudson and his team have spent $6m on those projects to test their belief that success in the Victorian goldfields would require targeting the right style of mineralisation.

“You really have to be looking for the right kind of gold in Victoria because it has been a disaster in the past with nuggety and refractory gold,” Hudson explained.

Needless to say, they were proven right and made a number of significant discoveries.

This in turn led the decision to bring the assets back home with Mawson Gold spinning them out into Southern Cross Gold, which is currently pursuing a listing on the ASX.

So just what is Southern Cross Gold focusing on that has delivered success?

“There are two very different styles of gold in Victoria, there’s the Bendigo-style and then there’s the Fosterville-style which we call epizonal in style,” Hudson – who will serve as the new company’s managing director – told Stockhead.

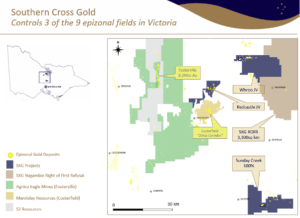

“We are focused exclusively on the epizonal fields, of which there are only nine historical examples in Victoria. Two of those are Fosterville and Costerfield, which are in the top seven highest grade gold mines in the world, and we have secured three of the remaining seven.”

Remember how the explorers in the 1980s and 1990s only drilled shallow holes?

This is where Hudson believes they failed, saying that the key to Victorian gold riches is to drill deeper underneath the historic workings and more recent, shallow drilling.

“That’s the philosophy and we have been drilling and applying modern techniques to the gold fields. What the old timers mined is certainly continuing at depth – great depths at times – and along strike and that’s how we are going to build new mines,” he added.

Southern Cross Gold does have an advantage over Fosterville with Hudson noting that the targeted high-grade free gold mineralisation in the company’s projects is probably closer to the surface.

The previous mining activity in the region also has the added benefit of pointing out where the high-grade zones with free gold are located.

Southern Cross Gold is dangling three projects that it has already put 12km of drilling into over the past 18 months before prospective investors.

These are the flagship Sunday Creek project, which the company owns outright, as well as the Redcastle and Whroo joint ventures.

The historic mining trend at Sunday Creek extends over 10km. The company, along with a smaller amount of drilling by oxide explorers, has only been drilled within a single kilometre in the southwestern corner of the project that has nonetheless drawn 70% of the company’s drilling.

And there’s a good reason for it.

“We started drilling in and around the old mines and we found the old timers mined at about an ounce to hundreds of grams per tonne, at around a metre wide, which is typical high grade vein mining,” Hudson said.

“But we found 5 to 20m thick zones which are between 2g/t and 5g/t. The old timers never looked at that, and there’s a much bigger halo to these zones.”

The real prize came after eight to nine months of drilling when the company drilled big step-outs of about 300m to 400m in depth that struck literal gold.

This is best highlighted by the recent 3m intersection grading a tasty 41.4 grams per tonne gold and 12% antimony within a broader 11.7m zone at 12.4g/t gold and 3.6% antimony from a depth of 362m that was returned in December. The deepest hole 420 metres from the surface has just been released and grade 5.6 metres @ 9.2 g/t gold and 0.8 % antimony.

“The Victorian gold systems just seem to get better at depth and we have been finding that.” Hudson said, adding that these results have seen over half a kilometre of strike so far.

“So there’s opportunities to drill out multiple high grade shoots.”

To further highlight just how lucrative Sunday Creek could be, Hudson noted that Newmont – the world’s largest gold company and 7% owner of Mawson – considers three drill holes that exceed 100 gram metres in any one coherent body to be a bona fide discovery.

“We have eight of these 100 gram metre holes that have been drilled into this project already at such an early stage. So the widths and grades are good and stack up very favourably,” he added.

“It can get a lot bigger with another 9km of the trend without a single drill hole, you don’t want to explore things that are postage stamps in this business.”

The company’s next project is the Whroo joint venture with Nagambie that was originally thought to be just 10km long by known historical workings in Victorian Government records.

That was until Hudson’s team broke out their LIDAR cameras and mapped out some 35,000 old workings that stretched out over a strike of 14km.

After determining where the largest historic mines were, the company then went ahead to drill at Whroo – one of the larger historic epizonal fields – and returned multiple high-grade gold and antimony, albeit thinner structures beneath the pit including 49.7 g/t gold over 0.6 metres.

“And that’s where Sunday Creek was about 18 months ago,” Hudson said.

“We have a high-grade intersection down at 200m beneath an old pit and mine workings that went to 100m. We are looking to replicate the success at Sunday Creek.”

Southern Cross Gold’s final project is Redcastle, which is interpreted to be an extension of the +2Moz Costerfield mine corridor that is only 7kms away to the south. Costerfield is also one of the top five antimony producers in the world. The intercepts the company hit at Whroo look very similar to the veins that are profitably mined at Costerfield.

Antimony – which the astute reader will remember was also intersected at Sunday Creek – is a common secondary commodity in epizonal gold deposits and is a valuable by-product given that it is a strategic metal.

Thus far, the company has drilled 16 holes at Redcastle and intersected gold in every single one of them, though Hudson reckons the highest-grade heart of the system has yet to be found.

“We have six walk up drill targets to go back to, and completed a lot of geophysics and soil sampling, it is the third project but where we are still looking for the high grade gold sweet spots that were mined closer to surface.”

With its suite of prospective projects where exploration has delivered what Hudson describes as some of the best results in Victoria, and the same team that found a million ounces in Finland, it is no surprise that investors are already knocking on the door.

“We raised pre-IPO capital in the week just before Christmas, we were looking for $2m, we got bids for just over $3m, and ultimately, we took $2.73m,” he added.

“We are fully funded, the drill rig is spinning and it is not going to stop during the whole IPO period so we will have a lot of drill holes ready to go to the assay lab. We will already have a news flow built in.”

Southern Cross Gold is looking to raise between $8m and $10m in its initial public offering, which will give the company a market capitalisation of $32m (and an enterprise value of $22m) if it raises $10m.

This valuation places the company at the lower quartile of its peers though the quality of its projects might deliver a re-rating should its anticipated pipeline of news bear golden fruit.

To top it off, the company is a major shareholder of Nagambie with 10% interest, which is currently worth about $2.7m.

This stake brings with it a first right of refusal on Nagambie’s entire tenement package, which stretches out over 3,000sqkm in central Victoria, and also potential access to a processing plant that Nagambie is building with Golden Camel at an the old mine site.

The company is hosting an event “Renaissance of the Victorian goldfields” in Melbourne on 22 March which people can register to attend free by registering via the southercrossgold.com.au website.

This article was developed in collaboration with Southern Cross Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.