High purity alumina demand is far larger than analysts predicted

Mining

High purity alumina (HPA) supply will not meet estimated demand over the next decade — even if every project in the pipeline goes into production.

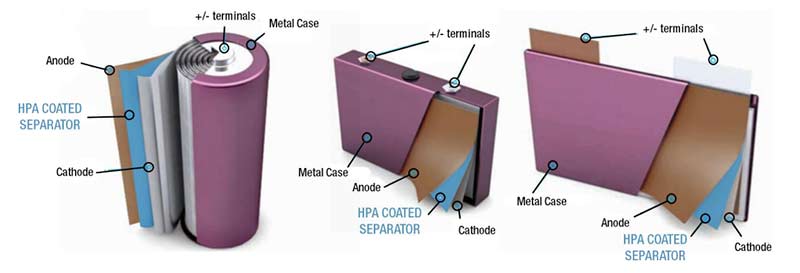

Last year, HPA was a niche industry building some momentum as analysts predicted a lithium-ion battery charged shortfall. That’s because one of HPA’s fastest growing uses is coating the separators that keep apart the cathode and anode electrodes in lithium-ion batteries:

Last week, near term producer Altech (ASX:ATC) released a report by CRU which acknowledged that previous demand predictions were too conservative.

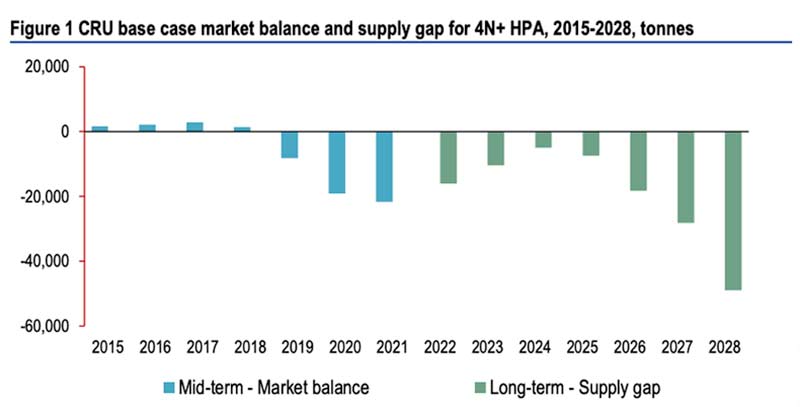

In 2018, CRU estimated that 4N+ (99.99 per cent and higher) demand would grow from 19,000t to 92,900t by 2025. Now, CRU says it could grow at 30 per cent a year to 272,000t in 2028.

The market for HPA in powder form (used in lithium-ion battery separators) could reach 187,000t by 2028 “if sufficient supply were available”.

“The demand for ceramic coated separators in lithium-ion battery applications is genuine and will rapidly proliferate, as more energy-dense batteries arrive to serve the surging electric vehicle (EV) market,” says CRU.

And HPA use in LED production – which is also growing strongly – is moving towards the higher purity stuff which will have “profound (positive) consequences” for the 4N+ market.

But this growth will be constrained by limited supply.

CRU says the large short-term deficit (blue bars) is briefly alleviated by a number of announced HPA hopefuls in the 2022-24 period, before the supply gap begins to increase again in 2025 (green bars), reaching ~50,000 tonnes a year of shortfall by 2028:

This takes into account all projects approaching or at pre-feasibility stage, as well as announcements for any planned changes in production from existing producers.

A spike in 4N+ prices could happen as soon as 2020, CRU says.

This is great news for the handful of ASX-listed high purity alumina players intent on disrupting the status quo.

These Aussie HPA upstarts have a range of development strategies but one thing is consistently clear — they all boast super low operating costs compared to traditional producers.

Last year, WA-based FYI Resources (ASX:FYI) released a pre-feasibility study for its 25-year Cadoux kaolin project, which, with a conservative sale price assumption of $US24,000 ($34,385) per tonne, would deliver a profit margin of about $US17,500 per tonne. That’s industry-leading stuff.

Now, as part of ongoing bankable feasibility studies, the company is building a pilot plant – basically a smaller, cheaper version of the real thing — to refine its process, snare offtake partners, and support project financing.

FYI Resources managing director Roland Hill told Stockhead the company had some input into the new CRU report.

“There has been a lot more detailed work in the undertaking,” he says.

“I believe their assumptions are broadly correct and it aligns with what we are witnessing in the one-on-one meetings we have been holding — this is in terms of both volumes and prices.”

But FYI won’t be fast-tracking its development timeline — its committed to getting it right the first time.

“While we see an expedited development timeline (due to some of our natural advantages being in WA and our wholly integrated production model) — we still see that quality and consistency is the overarching requirements for a successful strategy,” says Hill.

READ: The Explorers: FYI’s Roly Hill on HPA demand, disruption, and an industry leading project

Andromeda (ASX:ADN) is currently investigating a simple business model – starting with shipping raw ore from its Poochera project in South Australia to HPA producers in China.

This would reduce initial start-up costs because it doesn’t need to build a processing plant to start making cash.

Andromeda’s aim is to move rapidly into prefeasibility stage after the Poochera scoping study is completed in the first half of 2019.

And it’s already getting serious: in late May, a leading Chinese kaolin processing and supply company visited the Poochera project.

This Chinese company has since expressed interest in progressing discussions for a premium kaolin product “as well as collaborating on potential HPA production in China”, says Andromeda.

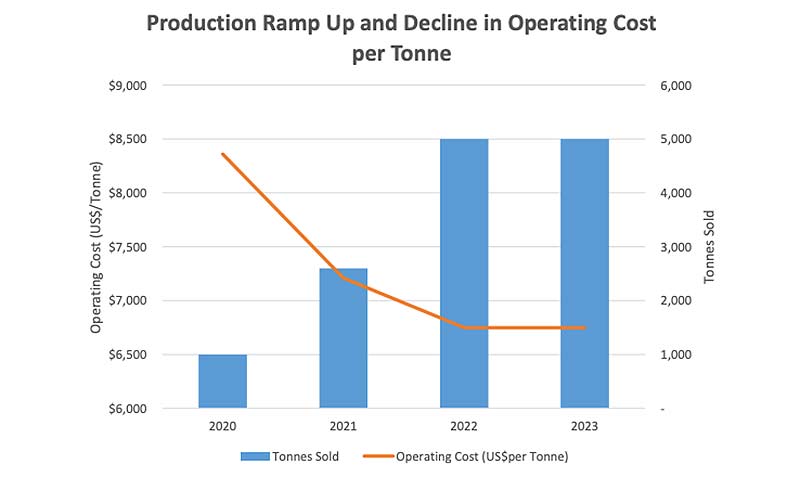

Pure Alumina (ASX:PUA) is now in the process of acquiring Polar Sapphire, a Canada-based company that owns “world-leading” HPA tech. This deal sets it up to be one of the lowest-cost producers of premium grade 5N HPA in the world, the company says.

Polar Sapphire operates a pilot plant in Canada which, until recently, has generated enough HPA for growing customer sales as well as conducting ongoing product development.

Pure Alumina is undertaking a $30m capital raising to fund the Polar Sapphire purchase, as well as the construction of a commercial-sized plant.

In February, Alpha HPA (ASX:A4N) updated its pre-feasibility study on building a $198m process plant to treat a “blended chemical feedstock” from third parties to produce 10,200t per annum of HPA for the battery sector.

This means, unlike its ASX-listed peers, Alpha’s process doesn’t require a mining operation.

Managing director Rimas Kairaitis told Stockhead that the company was talking to a lot of off-takers in China and Europe as pilot plant testing got underway.

“It’s very positive – the demand is incredibly real,” says Kairaitis.

“We are getting very good feedback from battery focused end users, who we are talking to, that are expanding four to six times in the next seven to eight years.”

Kairaitis agrees with CRU prediction of a supply shortfall over the next decade.

“We were forming a similar view to that,” he says.

“Especially in China — the demand in China is out of control.”

There are other separator coatings used currently, but it looks as if they will be replaced by alumina, he says.

“So as more supply comes on stream, it will be used immediately by the market,” he says.

“There’s a lot of research on alumina being the absolute gold standard. It’s very much the preferred material now.”