Here’s how 100 ASX oil and gas stocks have performed over the past year

Energy

More than half of ASX-listed oil and gas stocks are now ahead over the past year as oil cartel OPEC’s production cuts push up oil prices and local fears of gas shortages drive exploration and new production.

The best performer has been unconventional gas explorer Empire Energy (ASX:EEG) which doubled in price after the Northern Territory ended its moratorium on the controversial practice of fracking in April. It’s up 371 per cent since this time last year.

Horizon Oil (ASX:HZN) and Byron Energy (ASX:BYE) have each tripled in price over the past 12 months. The former is an oil producer and reaping benefits from the price rise, and the latter has brought its US oil assets into production as of this year.

But the key question for investors is which of the 100 or so ASX oil and gas stocks are likely to keep going up — and which are likely to stall.

>> Scroll down to see the performance of 100 ASX’s oil and gas stocks over the past year

Here are five key factors oil and gas investors need to keep in mind over the coming year:

Not enough gas

Australia’s East Coast gas supplies are secure for another few years but nationwide restrictions on unconventional gas mean that is unlikely to last.

Analysts spoken to by Stockhead say the squeeze on locations where unconventional gas can be explored and produced from — currently limited to Queensland and the Northern Territory — will take its toll on gas supplies.

Unconventional gas sources are often difficult to extract and may require controversial techniques such as fracking which is outlawed in some States due to environmental concerns. (More on this later).

Last week the country’s energy planner, Australian Energy Market Operator (AEMO) said the country is set for gas supplies for the energy sector until 2030, but showed total production barely rising in the years to 2022.

Wood Mackenzie analyst Nicholas Browne expects a 10 per cent decline in gas supplies over the next five years as mature fields decline and not enough large new fields are brought online.

“We do see some potential for new production in Australia,” he told Stockhead.

“For the smaller companies this is good if they do have gas production coming in, that gas is undoubtably needed and there is less competition.”

Let the price war begin

Less gas on the market means higher prices.

The government’s threat last year to requisition export gas for domestic supply helped to lower prices from $20 a gigajoule to about $14, but market forces indicate that can’t last.

S&P analyst May Zhong says Australia’s infrastructure shortage of pipelines and compressing stations, the lack of new supply coming on, as well as the moratorium on unconventional exploration would eventually push prices back up.

Wood Mackenzie’s Mr Browne says the shortfall will likely need to be fed by diverting gas from LNG exports — meaning local prices will need to be as good as what those companies can get from the export market — or imports from those offshore markets.

“We do think gas prices are going to head north becaus of that linkage into the wider energy market,” he said.

“Ultimately that is good for producers but bad for buyers and utilities.”

Here’s how 100 ASX oil and gas stocks have performed over the past year:

| ASX code | Company | Price change one-year | Price Jun 26 (intraday) | Focus | Region | Market Cap |

|---|---|---|---|---|---|---|

| BKP | BARAKA ENERGY | 4 | 0.005 | oil and gas | Aust | 13.2M |

| EEG | EMPIRE ENERGY GR | 3.71428571429 | 0.033 | oil and gas | Aust US | 41.8M |

| GLL | GALILEE ENERGY | 2.73737373737 | 0.37 | oil and gas | Aust | 69.2M |

| BYE | BYRON ENERGY | 2.48958333333 | 0.335 | oil and gas | US | 226.0M |

| HZN | HORIZON OIL | 2.11111111111 | 0.14 | oil and gas | Asia | 182.3M |

| FDM | FREEDOM OIL AND | 2.09782608696 | 0.285 | oil | US | 264.0M |

| BPT | BEACH ENERGY | 2.00362976407 | 1.655 | oil and gas | Aust, NZ | 3.9B |

| SEH | SINO GAS & ENERG | 1.85 | 0.228 | gas | China | 487.3M |

| OEL | OTTO ENERGY | 1.65384615385 | 0.069 | oil | US | 105.6M |

| COI | COMET RIDGE | 1.64 | 0.33 | gas | Aust | 219.9M |

| HE8 | HELIOS ENERGY | 1.20833333333 | 0.053 | oil | US | 75.0M |

| STO | SANTOS | 1.0101010101 | 5.97 | oil and gas | Asia, Aust | 12.6B |

| BAS | BASS OIL | 1 | 0.004 | oil | Asia | 10.4M |

| LKO | LAKES OIL NL | 1 | 0.002 | oil | Aust | 57.6M |

| PCL | PANCONTINENTAL | 1 | 0.004 | gas | US, Africa | 21.0M |

| TEG | TRIANGLE ENERGY | 0.98 | 0.099 | oil | Aust | 21.6M |

| BRU | BURU ENERGY | 0.95652173913 | 0.315 | oil | Aust | 136.1M |

| ATS | AUSTRALIS OIL & | 0.886363636364 | 0.415 | oil | US | 371.0M |

| PVE | PO VALLEY ENERGY | 0.85 | 0.037 | gas | Italy | 22.0M |

| STX | STRIKE ENERGY | 0.774193548387 | 0.11 | gas | Aust | 120.4M |

| FZR | FITZROY RIVER | 0.733333333333 | 0.26 | oil and gas | Aust | 23.0M |

| CVN | CARNARVON PETROL | 0.708860759494 | 0.135 | oil and gas | Aust | 159.8M |

| EXR | ELIXIR PETROLEUM | 0.666666666667 | 0.06 | oil | US | 13.3M |

| SXY | SENEX ENERGY | 0.653846153846 | 0.43 | oil and gas | Aust | 629.6M |

| MEL | METGASCO | 0.628571428571 | 0.057 | gas | Aust | 22.3M |

| CE1 | CALIMA ENERGY | 0.6 | 0.048 | oil and gas | Canada | 26.7M |

| NGY | NUENERGY GAS | 0.538461538462 | 0.04 | gas | Asia | 59.2M |

| EMP | EMPEROR ENERGY | 0.5 | 0.003 | gas | Aust | 2.7M |

| GGX | GAS2GRID | 0.5 | 0.003 | oil and gas | PHP France | 3.4M |

| UIL | UIL ENERGY | 0.481481481481 | 0.04 | gas | Aust | 9.1M |

| FAR | FAR | 0.479452054795 | 0.108 | oil and gas | Africa | 600.8M |

| AOW | AMERICAN PATRIOT | 0.470588235294 | 0.025 | oil | US | 6.7M |

| BUL | BLUE ENERGY | 0.469696969697 | 0.097 | oil and gas | Aust | 112.0M |

| BRK | BROOKSIDE ENERGY | 0.444444444444 | 0.013 | oil | US | 12.9M |

| PVD | PURA VIDA ENERGY (suspended) | 0.378378378378 | 0.051 | gas | Africa | -- |

| TDO | 3D OIL | 0.368421052632 | 0.052 | oil and gas | Aust | 11.9M |

| TAP | TAP OIL | 0.344827586207 | 0.078 | oil and gas | Aust | 33.2M |

| OSH | OIL SEARCH | 0.301684532925 | 8.5 | oil and gas | Papua New Guinea | 13.0B |

| PSA | PETSEC ENERGY | 0.3 | 0.195 | oil | US | 64.1M |

| ENB | ENEABBA GAS | 0.285714285714 | 0.009 | gas | Aust | 4.7M |

| AJQ | ARMOUR ENERGY | 0.285714285714 | 0.09 | gas | Aust | 36.5M |

| SUR | SUN RESOURCES | 0.25 | 0.005 | oil and gas | US | 3.0M |

| ELK | ELK PETROLEUM | 0.234375 | 0.079 | oil | US | 120.7M |

| HPR | HIGH PEAK ROYALTY | 0.2 | 0.06 | oil and gas | Aust | 9.3M |

| WPL | WOODSIDE PETRO | 0.185490802819 | 34.48 | oil and gas | Aust | 32.7B |

| IPB | IPB PETROLEUMI | 0.166666666667 | 0.021 | oil and gas | Aust | 3.4M |

| GRV | GREENVALE ENERGY | 0.125 | 0.027 | oil | Aust | 2.5M |

| SEA | SUNDANCE ENERGY | 0.1 | 0.066 | oil and gas | US | 460.1M |

| CUE | CUE ENERGY RES | 0.0754716981132 | 0.057 | gas | Aus, Asia | 41.9M |

| CTP | CENTRAL PETROL | 0.0431654676259 | 0.145 | gas | Aust | 102.5M |

| CRM | CARBON MINERALS | 0.0416666666667 | 0.125 | gas | Aust | 2.4M |

| APA | APA GROUP | 0.0276392352452 | 9.89 | gas | Aust | 11.6B |

| RLE | REAL ENERGY CORP | 0.0112359550562 | 0.09 | gas | Aust | 23.0M |

| GGE | GRAND GULF ENERG | 0 | 0.003 | oil and gas | US | 2.3M |

| JKA | JACKA RESOURCES | 0 | 0.002 | oil | Africa | 1.2M |

| KEY | KEY PETROLEUM | 0 | 0.009 | oil | Aust | 12.1M |

| NSE | NEW STANDARD ENERGY | 0 | 0.004 | gas | Aust | 3.9M |

| NWE | NORWEST ENERGY | 0 | 0.003 | oil and gas | Aust | 10.1M |

| IVZ | INVICTUS ENERGY | 0% | 0.04 | gas | Africa | 7.5M |

| TMK | TAMASKA OIL & GA | 0 | 0.003 | oil and gas | US | 5.9M |

| WBE | WHITEBARK ENERGY | 0 | 0.007 | oil | Aust | 6.9M |

| COE | COOPER ENERGY | -0.0188172043011 | 0.365 | oil and gas | Aust | 592.4M |

| RAW | RAWSON OIL AND G | -0.0909090909091 | 0.04 | gas | Aust | 3.9M |

| GAS | STATE GAS (listed Oct 2017) | -0.1 | 0.18 | gas | Aust | 24.3M |

| TOU | TLOU ENERGY | -0.117647058824 | 0.105 | gas | Africa | 37.5M |

| KPL | KINA PETROLEUM | -0.117647058824 | 0.075 | oil and gas | ASia | 28.7M |

| ODY | ODYSSEY ENERGY | -0.125 | 0.056 | oil and gas | US | 18.3M |

| MAY | MELBANA ENERGY | -0.133333333333 | 0.013 | oil | US | 21.7M |

| KAR | KAROON GAS AUSTR | -0.1640625 | 1.07 | oil and gas | Brazil, Aust | 262.8M |

| ADX | ADX ENERGY | -0.166666666667 | 0.01 | oil and gas | Italy, Romania | 11.3M |

| INK | INDAGO ENERGY | -0.166666666667 | 0.075 | Oil | US | 13.1M |

| ETE | ENTEK ENERGY | -0.190476190476 | 0.017 | oil and gas | US | 5.5M |

| MMR | MEC RESOURCES | -0.2 | 0.02 | oil | Aust | 6.6M |

| GBP | GLOBAL PETROLEUM | -0.212121212121 | 0.026 | oil and gas | Africa | 5.3M |

| LIO | LION ENERGY | -0.225 | 0.031 | oil and gas | Indonesia | 4.4M |

| ICN | ICON ENERGY | -0.28 | 0.018 | oil | Aust | 10.8M |

| BUY | BOUNTY OIL & GAS | -0.285714285714 | 0.005 | oil | Aust Africa | 4.8M |

| XST | XSTATE RESOURCES | -0.285714285714 | 0.005 | oil and gas | US | 3.9M |

| 88E | 88 ENERGY | -0.304347826087 | 0.032 | oil | US | 155.6M |

| ENX | ENEGEX | -0.318181818182 | 0.015 | oil and gas | Asia | 1.2M |

| OEX | OILEX | -0.333333333333 | 0.002 | oil and gas | Aust Asia | 4.0M |

| TPD | TALON PETROLEUM | -0.375 | 0.005 | oil | US | 5.1M |

| ABL | ABILENE OIL AND | -0.428571428571 | 0.004 | oil and gas | US | 1.6M |

| CEL | CHALLENGER ENERGY | -0.5 | 0.012 | oil and gas | South Africa | 4.7M |

| PGS | PLANET GAS | -0.5 | 0.004 | oil and gas | Aust, US | 2.2M |

| PGY | PILOT ENERGY | -0.5 | 0.025 | oil and gas | Aust | 1.6M |

| EWC | ENERGY WORLD COR | -0.507462686567 | 0.165 | gas | Asia, Aust | 305.3M |

| WOF | WOLF PETROLEUM | -0.555555555556 | 0.012 | oil and gas | Mongolia | 8.6M |

| RRS | RANGE RESOURCES | -0.571428571429 | 0.003 | gas | US | 22.8M |

| ROG | RED SKY ENERGY | -0.6 | 0.002 | oil and gas | US | 1.2M |

| SPB | SOUTH PACIFIC RESOURCES | -0.6 | 0.006 | oil | Papua New Guinea | 993.1k |

| SAN | SAGALIO ENERGY | -0.615384615385 | 0.005 | oil | Kyrgyzstan | 1.0M |

| SGC | SACGASCO | -0.625 | 0.03 | gas | Aust | 7.7M |

| WEL | WINCHESTER ENERG | -0.6625 | 0.027 | oil | US | 7.7M |

| E2E | EON NRG | -0.666666666667 | 0.008 | oil | US | 3.3M |

| TNP | TRIPLE ENERGY | -0.71875 | 0.045 | gas | China | 1.9M |

| JPR | JUPITER ENERGY | -0.74 | 0.065 | oil | Asia | 10.0M |

| FPL | FREMONT PETROLEU | -0.740740740741 | 0.007 | oil | US | 4.8M |

| OXX | OCTANEX | -0.870588235294 | 0.011 | oil and gas | Asia | 3.0M |

| CNX | CARBON ENERGY | -0.895833333333 | 0.125 | gas | Aust | 8.4M |

| PRL | PETREL ENERGY | -0.909090909091 | 0.002 | oil | Uruguay | 3.5M |

Frack off

A major reason for that lack of production — and rising prices — are the moratoriums on hydraulic fracturing, or fracking, for unconventional gas.

Unconventional gas is seen as the main gas opportunity in Australia today.

Unconventional covers shale gas, coal seam gas and tight gas — gas that is trapped in small holes in rocks which requires massive fracking, or hydraulic fracturing, to release it.

Only Queensland and Northern Territory — with some restrictions — allow fracking which is one of the only ways to access unconventional gas.

Ms Zhong says Australia is not short of gas reserves but so long as governments fear to open areas up to unconventional exploration that gas is stuck in the ground.

Anyone close to infrastructure is onto a winner

The East Coast is where Australia’s biggest gas demand lies.

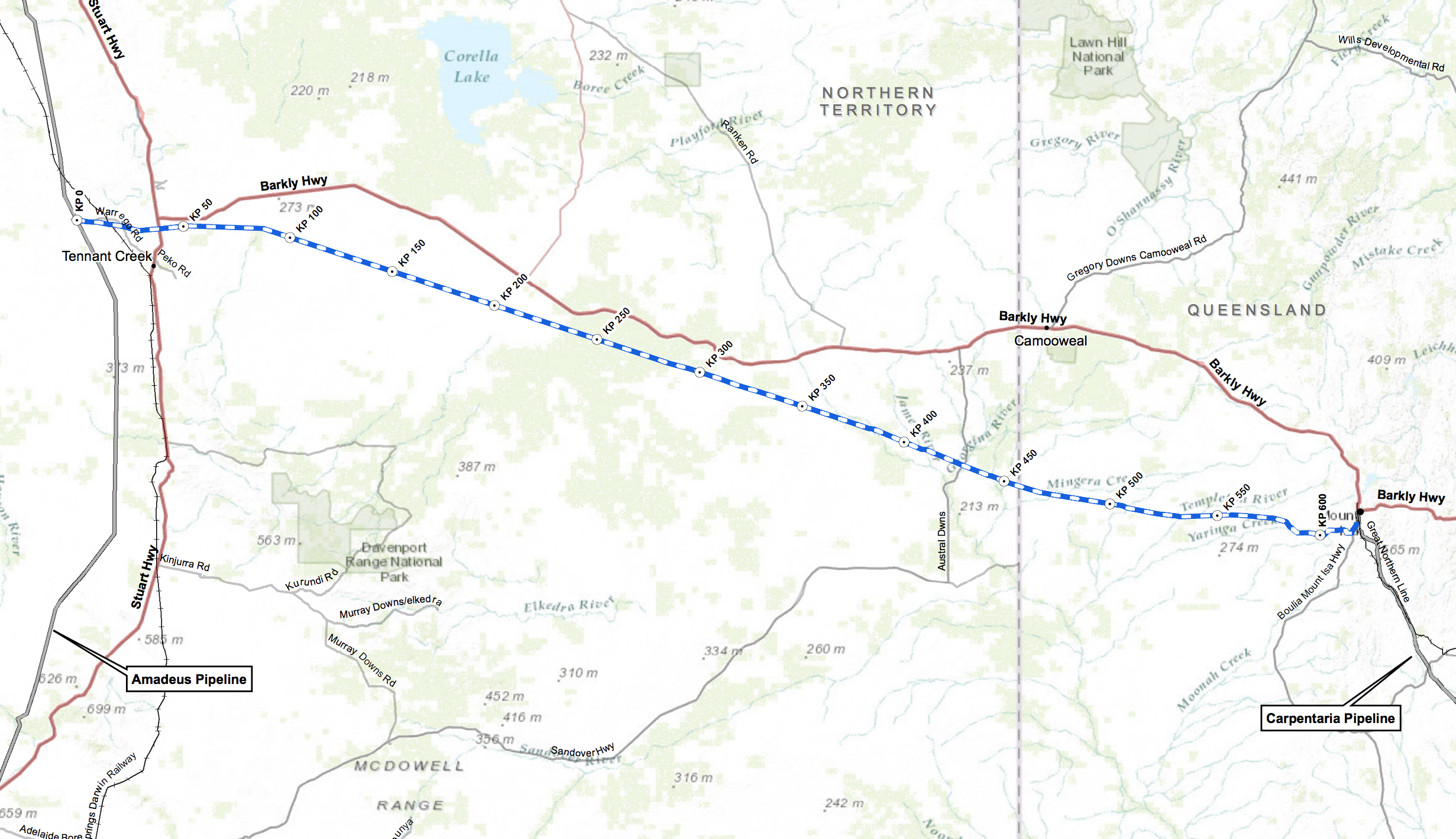

As a result, companies with assets near Australia’s minimal gas transportation infrastructure, such as the soon-to-be-finished Northern Gas Pipeline that will deliver Northern Territory gas to the coast, could be well placed to take advantage of any future price upswings.

For example, on Monday Northern Territory company Central Petroleum signed a deal to supply Incitec Pivot’s Gibson Island fertiliser plant with 20 TJ/d of gas.

Its gas fields are close to the Northern Gas Pipeline, due to be up and running in December, which will deliver its gas to the East.

Armour Energy (ASX:AJQ) and Empire Energy (ASX:EEG) are two other Northern Territory companies with land close to pipeline infrastructure.

Building on OPEC’s latest promise

Oil and gas companies led the ASX upwards this week after promises at OPEC last week to lift production — but not by too much — caused relief in the market.

“Because of the recovery in the oil prices, the companies’ internally generated cash flows now are higher than what they were in the past two years, so in theory that should give them enough internally generated cash flows to fund exploration activities which may translate into more discovery and production,” S&P’s Ms Zhong told Stockhead.

OPEC committed to reducing compliance to the 2016 production cuts agreement from 158 per cent to 100 per cent.

It’s a 1 million barrels a day increase over the next six months, which has eased market concerns about a supply oversupply or undersupply, and likely prevent any unsustainable price swings.

Brent crude, the European and Asian standard, touched $US74.92 at close of business on Tuesday as this graph shows:

The US WTI oil benchmark hit $US68.31 at close of business on Tuesday:

Mergers and acquisitions

Wood Mackenzie analyst Angus Rodger says while merger and acquisition activity began humming in 2017, all was quiet in Australia until the start of this year.

He says it’s the higher oil price putting more cash into producers’ pockets, and continued uncertainty on both Australia’s East and West Coasts about supply and demand.

Companies like Senex (ASX:SXY) and Central Petroleum are looking to get gas to market in a hurry and that is driving foreign private equity interest here.

Just last month Key Petroleum sold part of a licence area in Queensland to some Americans.

Key Petroleum boss Kane Marshall told Stockhead at the time he was seeing more interest from Americans in particular in lower risk gas assets that could supply the East Coast gas market.

Mr Rodger says Australia has good regulations and is a transparent market, and crucially does not have any National Oil Companies to make things complicated.