Here’s an EV report that mentions the rise of range anxiety – for drivers unable to find a petrol station

Mining

Mining

A new report from industry think-tank IDTechEx looking at the electric vehicle market from 2020 to 2030 has found plug-in hybrid models will continue to lose market share to pure-play electric models.

And it makes some pretty wild calls about what that means for the auto industry in general, including:

But it’s the other “anxiety” that the report mentions that should be raising some eyebrows – “range anxiety”. No, not the range anxiety EV drivers feel; the range anxiety non-EV drivers will be feeling when they’re running out of fuel and can’t find a petrol station anywhere near a city.

Dr Peter Harrop, who led the work, said that increasing emission bans for vehicles entering CBDs in Europe and plummeting petrol station numbers meant the days of the combustion engine — whether hybrid or otherwise, are numbered.

“Those buying internal combustion vehicles hope the city and country bans will not apply to hybrids. However, they face increasing range anxiety from the number of gas stations plummeting – Experian Catalyst reports a drop of 35% in UK gasoline stations since the year 2000 – whilst charging stations increase,” he said.

Wild.

But don’t get excited yet. It would be a tad irresponsible to make a correlation between the drop in filling stations in the UK with any rise in EV use.

In 1970, the UK was home to some 37,500 petrol stations, so the largest drop by far came in an era when electric vehicles didn’t even exist on UK roads.

The fall has largely been attributed to the shift from independent retailers to supermarket forecourts. And the little guys simply can’t buy fuel in large enough wholesale volumes to be competitive.

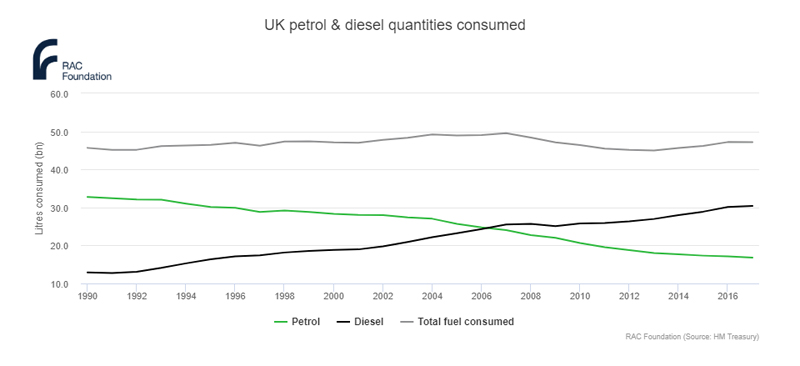

In fact, total fuel consumed has been unchanged for at least 20 years:

But the report, “Electric Vehicles 2020-2030”, will no doubt cause some comment in the coming weeks after it has been dissected by those who can afford the US$12,500 price point.

There’s talk of Mobility as a Service, traction battery systems, multifunctional robot shuttles, mobile “zero gensets” and solar powered inflatable fixed wing aircraft.

As for the call that plug-in hybrids will be obselete by 2030, it noted that people who did buy hybrid vehicles largely ignored the plug-in part of the vehicle and ran them on petrol instead.

In this context, it’s expected car manufacturers offering a pure electric option will be set to capture the market.

“Hyundai Kia, for example has one year waiting lists for its excellent pure-electric cars,” Dr Harrop said. “They will clear that delay, releasing pent-up demand. Others will rapidly copy that success.”

Overall, it’s yet another pointer to the fact that the ongoing appetite for pure electric against hybrid models spells good news for lithium-ion batteries, and the companies that supply the raw materials needed to create those batteries.

It fuels a bullish outlook for the battery minerals sector, with Global Market Insights recently forecasting annual lithium-ion battery market growth of 12 per cent year on year to 2024 — coming off a base of $US24 billion ($34.5 billion).