Hardey proves the Nelly mine could have much more vanadium than first thought

Mining

Mining

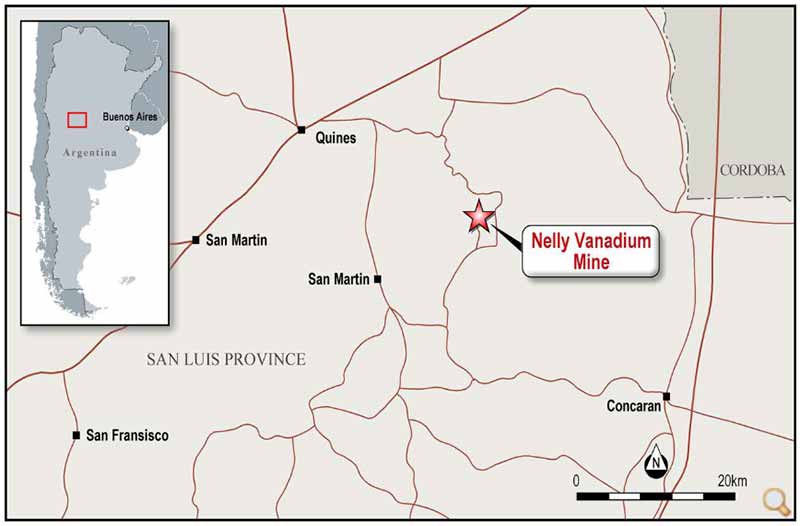

Special report: Hardey Resources is fast demonstrating the exploration upside of its Nelly vanadium mine in Argentina with the discovery a new 1.5km long mineralised vein.

A second open pit – with untapped and/or partially mined mineralisation – and a tenth stockpile 400m from the historic processing plant was discovered on the north-east section of the mine.

This new pit strikes south-west to north-east and is 65m long, 2.5m wide and 3m deep.

More significantly, there was evidence of mineralised vein outcropping 100m before and 250m after the second open pit that aligns with the main open pit south-west of the processing plant.

Hardey (ASX:HDY) now thinks the mineralised vein running through the tenure is at least 50 per cent larger than the 0.9 to 1km it was originally thought to be.

Another bonus is that much of the mineralised vein appears untouched and exposed at surface.

The fact the north-east vein and historic surface workings are an aligned extension from the main open pit south-west of processing plant ruins illustrates the huge exploration potential still apparent within the Nelly vanadium mine tenure.

“The new discoveries in the north-east part of the tenure which confirm the likelihood of an extended mineralised vein that is largely untapped is exciting news,” executive chairman Terence Clee said.

Hardey says this is a significant discovery as further work must be carried out to determine the design of the mineralisation in place and vein dimensions.

This includes detailed surface mapping and a maiden drilling program.

These new findings have given Hardey the certainty it needs to go ahead and complete due diligence on the mine.

Perfect timing

And the company’s timing couldn’t be better with the current favourable outlook for vanadium demand.

On the supply side, China, which supplies around 50 per cent of global vanadium, is using more of its output internally following new rules to double rebar requirements following recent earthquakes.

Rebar is a reinforcing steel used in concrete.

At the same time the Asian heavyweight has shuttered polluting mines, reducing its output by about 10 per cent and igniting a search for new supply chains that includes Australia and Argentina.

Traditionally the steel industry consumes around 90 per cent of global vanadium, but demand from the renewable battery sector is starting to take-off.

Specifically, demand for scalable energy storage is accelerating, reflecting wider renewable energy adoption.

Vanadium redox batteries (VRBs) are an emerging solution and industry watchers predict VRBs could account for around 30 per cent of the global rechargeable battery sector over the next decade.

This expected growth has seen the price of vanadium reach a near-decade high.

This makes the economics of re-opening the Nelly mine favourable, particularly given the substantial legacy stockpiles around the Nelly mine’s historic workings.

A priority for Hardey will be to bulk sample these stockpiles to determine if they are viable as a potential direct shipping ore (DSO) product to generate early cashflow from the project.

DSO requires only simple crushing before it is exported, which keeps costs low.

This special report is brought to you by Hardey Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.