Guy on Rocks: The apocalypse and gold = a marriage made in heaven

Mining

Mining

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

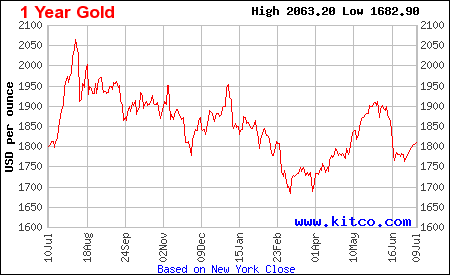

Last week saw a strong rebound in gold on the back of a weak US dollar, rebounding 1% for the week finishing at US$1,808/ounce. Last week, in fact, saw incremental upticks every day with gold now up 3% since mid-June of this year.

I’m recommending Peter Grandich of Peter Grandich & Company to be made an honorary Western Australian citizen (he is too good to be considered an Australian citizen) on the back of his US$4,000 call on gold, he considers will be driven by a 1990’s Japanese style stock market implosion in the US, stagnation then recovery.

He considers we are in a “financial bubble to end all bubbles,” which will manifest itself in “a decline that will surpass or equal some of the worst declines ever in the history of the U.S.”

According to Grandich, the average American has less than $100,000 saved for retirement and, according to Grandich, you need US$2.7 million for a comfortable retirement. Unfunded retirees in combination with an ageing population could wreak havoc on the US economy.

With the amount of French champagne being consumed here in WA at the moment his estimates of US$2.7 million for a comfortable retirement might be a bit conservative.

Anyway, I do enjoy a robust discussion on the apocalypse as it makes me feel all warm and fuzzy assuming his call on gold is correct. As Willy Wonka said, “you should never never doubt what nobody is sure about”.

Copper finished the week up over 2% closing at US$4.30/lb, up 2.1% late in the week on the back of a weaker dollar. Despite the strong performance of copper, the forward curve remains negative. One of my big calls for 2021, uranium, remains range-bound at or around US$32 so I am thinking it has to break out some time!

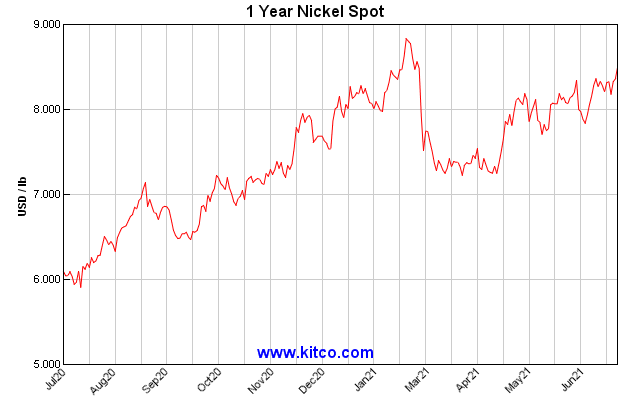

My old friend nickel has also had another strong week closing up 10c at US$8.49/lb with FPX Nickel’s (TSX-V: FPX) CEO Martin Turenne highlighting the concentration of nickel in countries such as New Caledonia and Philippines as giving rise to increasing jurisdictional risks, something I have been on about for some time.

The mood in New Caledonia has been volatile as an independence vote looms later in 2021. Early this century the region’s nickel reserves were estimated at 11% of the world’s total. The Philippines is also a significant nickel producer but has had a bumpy track record with managing its mining regulations, making the country hard to invest in.

Talk of “peak iron” from analysts is now at fever pitch in the wake of a crunch on China’s steel mill margins with iron ore up 46% this year to US$214/tonne.

Chinese domestic hard coking coal is up 57% to US$303/tonne and Australian hard coking coal (adversely affected by China import bans) up 95% to US$199/tonne.

US prime scrap is also up 67% to US$650/tonne. Margins in making HRC are now down to US$165/tonne. So, while I have a problem with analysts talking down any commodity price, I could have my arm twisted to say that there is probably limited upside in the iron ore price in the near term.

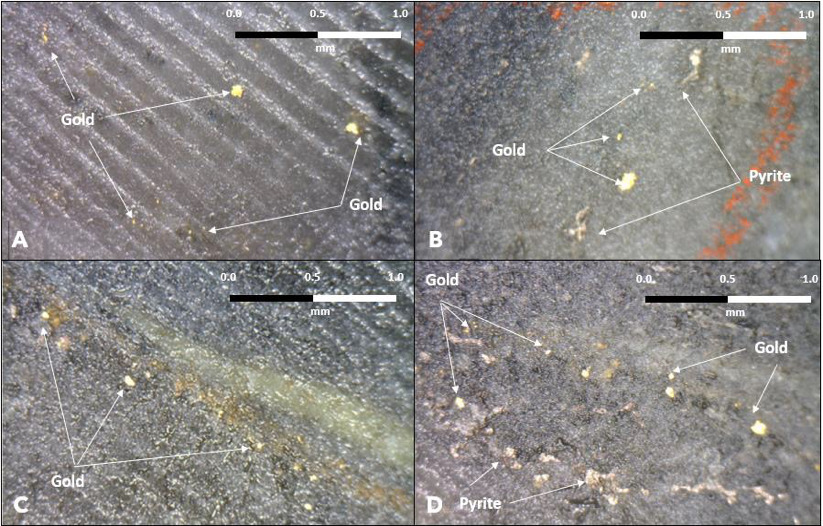

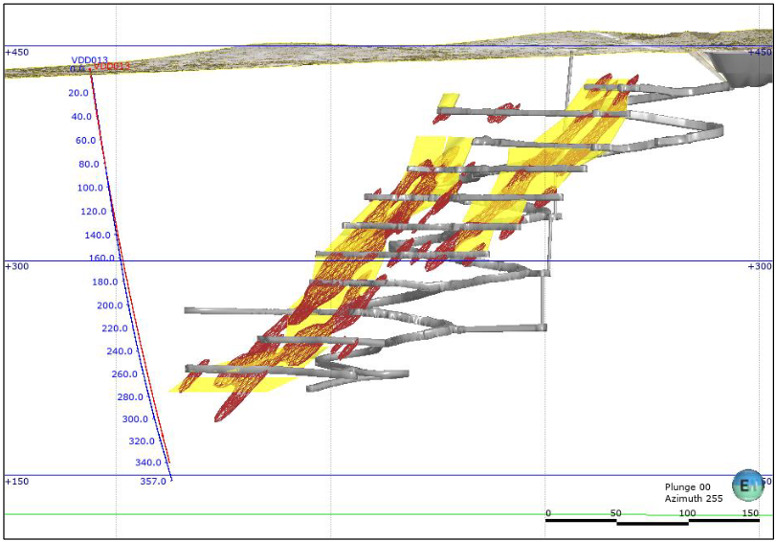

The market is eagerly awaiting assays from diamond drilling beneath Viking Mines (ASX:VKA) high grade First Hit mine (figure 5) with visible gold (figure 4) sighted in VDD013 at 325.1m and 327.5m and VDD015 at 300.2m & 303.0m.

I am starting to see a number of proposed magnetite developments coming out of the woodwork — Mindax’s (ASX:MDX) Mt Forrest Project; Legacy Iron Ore (ASX:LCY) and Hawthorn Resources’ (ASX:HAW) Mt Bevan Project JV — which is no surprise given the amount of time iron ore has spent above US$200/tonne.

Magnetite Mines Ltd’s (ASX:MGT) development of “the high-return, long-life development of the large-scale resource at Razorback, using a staged approach to produce an attractive, high-grade concentrate” looks very promising on paper.

While the company claims to be a low capital intensity project, which may be true, US$429-506 million is still a reasonable amount of coin to find for what I can see as a modest return (IRR 27% based on a 62% Fines price of US$150/tonne), relatively high-risk (compared to DSO hematite) operation, so I’m not getting too excited. Following the huge cost blowouts at Fortescue Metals (ASX:FMG), I’m not sure if the market has the stomach for another magnetite development.

Mind you I have been wrong before (but not with respect to a magnetite play).

Fenix Resources’(ASX:FEX) June Quarterly Report is due out today, so I am expecting a strong result from five months of operating at Iron Ridge in the Weld Range.

This could be an understatement, particularly when FEX appears (by my numbers) to be making an operating margin in excess of $200/tonne of iron ore which would equate to operating cash flow of over $200 million per annum based on a 1.25 million tonne per annum operation.

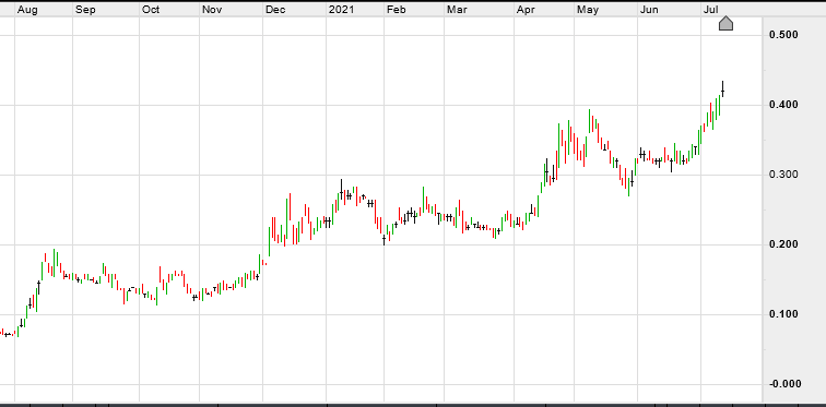

Another stock we mentioned a few months ago around 16 cents is Rumble Resources (ASX:RTR) that closed up 13% on Friday at 57c on heavy volume. Appears drilling has extended mineralisation at the Earaheedy Project (WA) to 3km x 1.8km and remains open in all directions. Additional RC and diamond rigs are due on site shortly which will no doubt pick up the pace of exploration in what has already been a cracking year for the company.

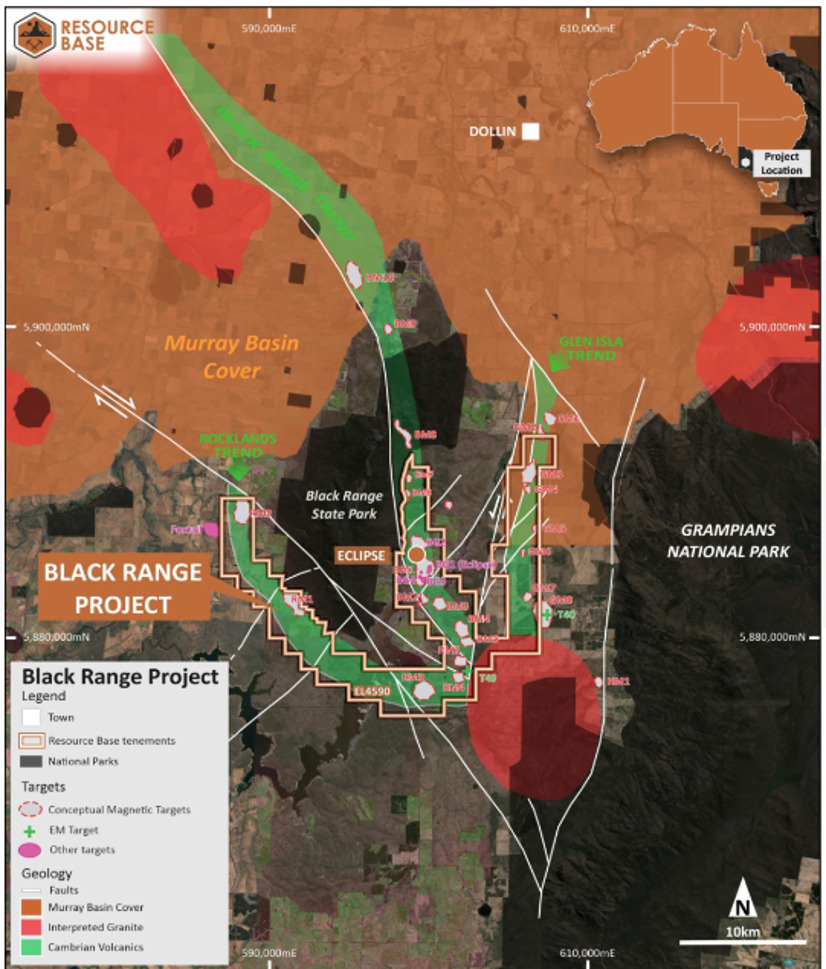

Resource Base Limited (ASX:RBX) had a rather disappointing start closing at 16 cents on its first day of ASX trading on turnover of 3.1 million shares after raising $5.5 million at 20 cents.

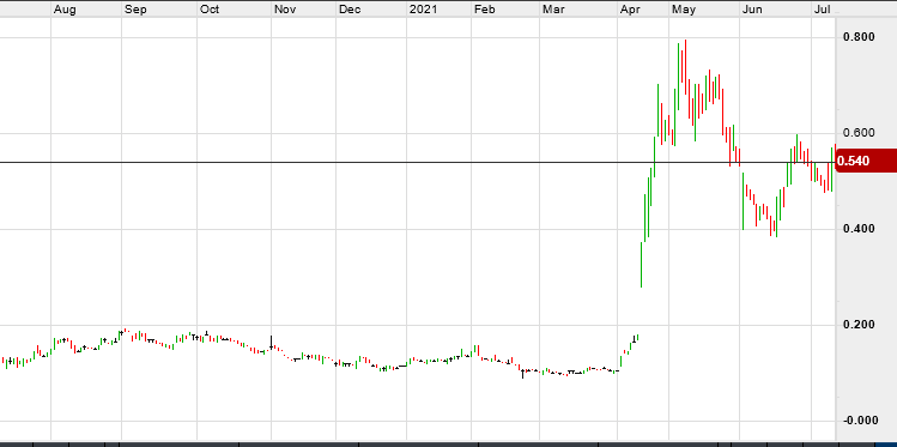

The company acquired 100% of the Black Range Project (figure 8 and 9) for paper from Navarre Minerals Limited (ASX:NML) with the tenements covering around 4km strike on a volcanic graben at the Eclipse Project. Previous surface sampling has returned grades of up to 3% copper and 2.95g/t gold from a supergene enriched zone with the tenements situated north of the recent Thursdays Gossan copper discovery by Staveley Minerals Limited (ASX: SVY).

The company’s July 2021 presentation lists “multiple, untested targets over approximately 100km of Stavely Arc volcanics”. All sounds very encouraging with exploration about to swing into gear.

Early days, but trading under the issue price of 20 cents may present an interesting opportunity.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.