GTI rolls out the rigs in bid to strike nuclear paydirt in Wyoming

Mining

Mining

GTI Energy has rolled out the drill rigs at its closely watched Great Divide Basin ISR uranium project in Wyoming, where a maiden program in March confirmed a promising discovery of the nuclear feedstock.

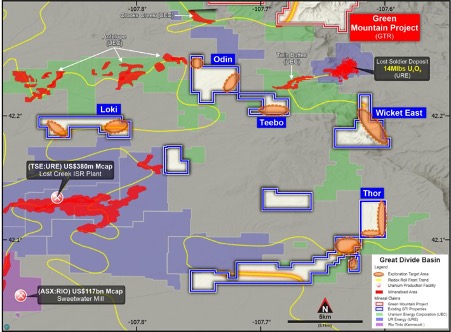

Two drill rigs have arrived to kick off more than 30,000m of drilling. The program starts with 12,000m of drilling in 70 new holes at the priority Thor prospect, where GTI (ASX:GTR) will target ~3.5km of mineralised roll front identified in drilling earlier this year.

Drilling will begin later this week.

The discovery at Thor was particularly exciting given its proximity to Ur-Energy’s 18Mlb Lost Creek uranium deposit and its operating ISR processing plant.

New drilling at Thor will focus on the northeast of the project, including two Wyoming state leases situated northeast of the claim blocks previously explored by GTI.

Another 20 holes for 6100m will be drilled at the Wicket East target area, exploring a projected mineralised trend extending from the southern boundary of Ur-Energy’s Lost Soldier property for around 5km.

It has been interpreted from similar historic drilling information to that used to plan the successful maiden drilling campaign at Thor.

Meanwhile, GTI will also sink 40 holes for 12,000m at the Odin, Teebo and Loki targets, located south of Uranium Energy Corp’s Antelope project and north of US$380m capped Ur’s Lost Creek plant, testing mineralised trends over a combined length of over 8km.

“We’re delighted to confirm that the drill rigs have been mobilised to site and we look set to start drilling at Thor later this week,” GTI executive director Bruce Lane said.

“The drilling is sequenced, across the five project areas to deliver the full ~30,000m program prior to Christmas.

“It is exciting to be back drilling again and we look forward to providing further updates in due course”.

Spot uranium is currently trading for around US$52/lb, three times levels seen in the downturn, as shortages of the energy source in the West and the improved long-term outlook for nuclear energy stir interest in the commodity.

This article was developed in collaboration with GTI Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.