You might be interested in

Mining

TEN-BAGGER: John Forwood thinks we are entering an 'almost everything rally'

Mining

Explorers Podcast: Alvo Minerals teams up with Ore Investments to dine down on Palma in Brazil

Mining

Mining

Coal miners continue to run as ratings agencies lift their forecasts, with one saying the ban of Russian coal in Europe could put a rocket under the previously unloved commodity.

Shares in Whitehaven Coal (ASX:WHC) hit a five-year high this morning, gaining for the third straight day as Russia’s coal ban came into force overnight.

Others were in the green as well in the wake of the ructions, with thermal coal prices currently trading out of Newcastle for an eye-watering price of over US$380/t.

According to Bloomberg, Fitch Ratings has lifted its 2022 average coal price forecast to US$320/t, saying prices could remain high for years as customers avert more expensive gas supplies amid supply disruptions caused by Russia’s war in Ukraine and subsequent sanctions.

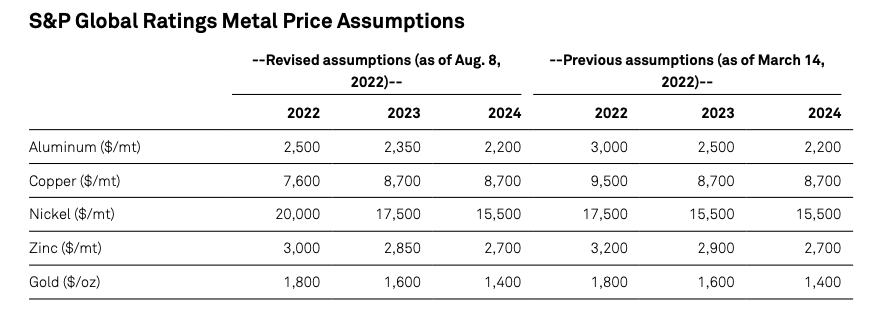

It is not the only forecaster upping its estimates. S&P Global, which at the same time slashed 2022 price expectations for copper, aluminium, met coal, zinc and iron ore, has lifted its thermal coal prediction from US$180/t to US$250/t.

Its met coal price assumption has been revised down from US$350 to US$230/t alongside weakness in global steel markets and a massive increase in domestic production in China.

But thermal coal is the commodity defying the downdrift.

“We raised our price assumption for the remainder of 2022 by more than 40%, owing to strong demand as a substitute to high-cost and constrained natural gas supplies,” S&P said.

“Our modestly higher thermal coal prices in 2023 and 2024 reflect our expectation that the global transition away from coal-fired power generation is delayed with the current energy crunch.”

Despite a global policy swing towards green energy and carbon emissions targets, S&P says Euro economies are relaxing coal fired energy limits to deal with the energy shortage and potential gas supply constraints out of Russia.

The main threat to Australian coal prices, S&P says, would be if other countries discounted their coal to undercut the Aussie market.

“Heatwaves across several regions, including Europe, the Mediterranean, China, and India, will keep electricity consumption high, while Europe’s ban on Russian coal, to take place from August 2022 onward, could boost global imports of non-Russian coal,” they said.

“Nevertheless, even with a higher near-term price, we believe that prices could ease from their current peak as discounts offered for other origin coals continue to lure price-sensitive Asian buyers away from Australian coal.”

It’s not only Russia that could hamper seaborne coal supply, with reports emerging in recent days that Indonesian lawmakers could pursue restrictions on exports out of Kalimantan, mirroring fears earlier this year that Indonesian sellers are withholding product from their domestic market due to price caps.

S&P thinks iron ore prices will be 20% lower than previously guided, with China’s steel mills unlikely to be able to support high raw material prices as they were when iron ore hit record highs in 2021.

Similar concerns about economic growth elsewhere have prompted downgrades in copper and aluminium forecasts from US$9500/t and US$3000/t to US$7600/t and US$2500/t respectively, with 2023 and 2024 forecasts unchanged for copper at US$8700/t.

S&P’s zinc price prediction for 2022 is down US$200/t to US$3000/t.

Nickel forecasts on the other hand have lifted from US$17,500/t to US$20,000/t for 2022, though these were withheld after the epic short squeeze that sent prices to US$100,000/t which shut the LME nickel market in March.

S&P thinks nickel prices will revert to US$17,500/t and US$15,500/t in 2023 and 2024 on rising nickel pig iron supply out of Indonesia, though most producers will remain profitable at those levels, which remain more than double the cyclical lows of early 2016.

Materials stocks lifted 1.44% as base metals rose overnight, with copper breaching US$8000/t for the first time in its month-long rally from the 20-month low hit in mid-July.

Zinc and nickel prices also gained, the latter impacted by capacity shutdowns due to high power prices.

Leading the way in the large cap space was Pilbara Minerals (ASX:PLS), now trading at $3.10 a share and extending its month-long gains to 36% as the battery metals sector experiences a renaissance three months on from the bearish Goldman Sachs report that sent investors running for the hills.