Ground Breakers: Northern Star to break ground on $1.5 billion Super Pit plant expansion to create global top 5 gold mine

Mining

Mining

Northern Star Resources (ASX:NST) has laid out a $1.5 billion plan to turn the Super Pit back into one of if not Australia’s largest producing gold mine.

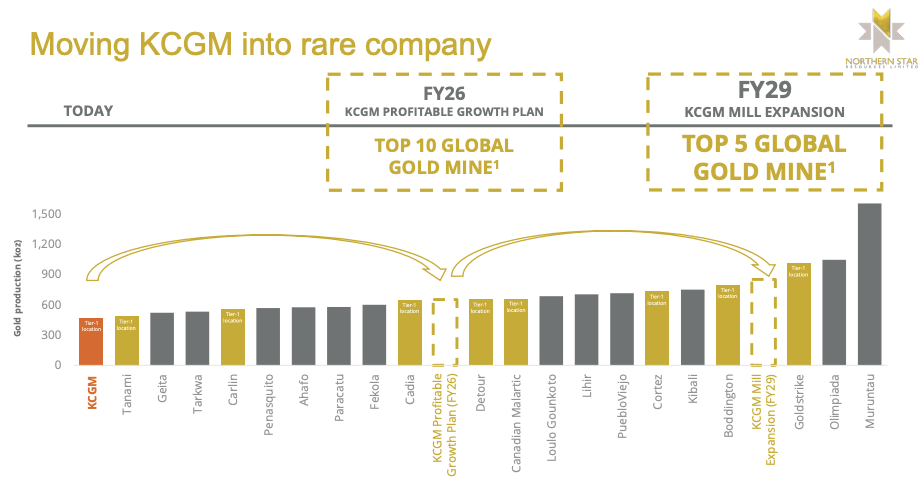

KCGM — comprising the iconic 3.5km long Super Pit and 60-year-old Mt Charlotte underground mine — could double its production rate to 900,000ozpa from 2029, returning to its halcyon days.

Northern Star, which will be Australia’s biggest listed gold miner should Newmont complete its acquisition of ASX 20 listed Newcrest (ASX:NCM) and end its Aussie listing, will fork out the cash to almost completely rebuild its Fimiston processing plant, taking its capacity up from 13Mtpa to 27Mtpa.

The option chosen in the FID today came ahead of one that would have seen the three-decade-old Fimiston Mill sent to the scrapheap and replaced by a 24Mtpa model that would have cost around $1b.

Instead NST will keep around 20% of the old components but close the historic Gidji processing plant 15km north of Kalgoorlie, where KCGM previously operated one of only two roasters in WA.

The ultra fine grinding mill which replaced the sulphur polluting roaster in 2015 will be closed, with a new one installed at the Fimiston plant itself.

The project at a $2600/oz gold price, a few hundred bucks below current spot prices, will carry a 19% IRR and 4.6 year payback period with targeted all in sustaining costs of $1425/oz.

Northern Star is planning to hit a production rate at KCGM of 650,000ozpa by FY26, when the build is complete, with ramp to take place over the next two years and steady state to be hit in FY29.

Located near the site of Paddy Hannan, Dan Shea and Tom Flanagan’s famous Kalgoorlie gold discovery in 1893 and incorporating all of the Golden Mile, it has at its disposal one of the largest resource and reserve bases in the nation, including 28.3Moz at 1.6g/t in resource and 12.2Moz at 1.3g/t in reserve.

At 900,000ozpa, that supports a mine life in excess of 20 years.

“Today is an exciting day for Northern Star and a historic new chapter for this world-class asset,” NST MD Stuart Tonkin said.

“The Board’s decision to approve the KCGM mill expansion and optimisation represents the next stage to revitalise our largest asset as well as the surrounding district for decades to come.

“This Project is financially compelling, and a significant enabling step towards delivering our strategy to generate superior returns for our shareholders.

“Our confidence in the economics of KCGM to remain a long-life, low-cost gold mine has been further reinforced through the feasibility study phase.

“Expanding the processing capacity of KCGM will strengthen Northern Star’s portfolio, materially increase our free cash flow generation and progress our long-term strategy to be within the 2nd quartile of the global cost curve.

“Further, the Project is important in our sustainability journey and will also sustain hundreds of local jobs, economic and social investment, and local procurement opportunities in the Goldfields region.”

Northern Star shares slid around 2.5% as of 10.50am AEST, though that came amid broader weakness for gold miners as suggestions the US Fed would continue lifting interest rates saw gold slip marginally to US$1932/oz ($2843/oz).

RBC’s Alex Barkley said the mill expansion would bolster confidence in the gold major despite choosing a higher cost option.

“The large capacity expansion is underpinned by the sizeable existing Resource (28Moz), large existing stockpiles (2.7Moz), strong pit and underground extension potential, plus the option to consolidate regional gold through inorganic growth,” he said.

“The upgrade would also help future proof the ageing facility. NST calculate an IRR of 19% (gold A$2600/oz) using a potentially conservative 1.3g/t mill feed input value, which only matches the current stockpile-heavy Reserve grade.”

Barkley said it would be value accretive despite appearing to hold a lower NPV than estimates from last year’s PFS.

“Using NST’s capex, Reserve life, gold price (A$2600/oz vs spot A$2860/oz), IRR and 7% real discount rate we calculate a rough NPV of A$1.15bn ($1.00/sh),” he said.

“This FS NPV would be a reduction on the A$1.4bn we calculated in the PFS, which was also at a lower gold price of A$2250/oz.

“The expansion would also have a portfolio cost benefit to NST as it should shift NST lower on the gold cost curve (FY23e AISC A$1731/oz).

“While overall value may be lower than suggested by the PFS, we do not explicitly value the expansion in our forecasts (A$4.00/sh, 44% of asset NAV).

“Approval today, albeit locking in higher costs, should help add confidence into market forecasts of this value accretive project.”

The approval comes amid massive cost pressures being felt in the mining industry in WA from inflation and labour shortages.

This will add another major project to further drain that talent pool, with NST aiming to construct a new camp in land-strapped Kalgoorlie to house workers on the project.

Labour shortages were this week blamed for delays and overruns at rare earths miner Lynas’ (ASX:LYC) $575 million cracking and leaching plant in the gold mining capital, which is due to start production in August.

Evolution Mining (ASX:EVN) is also moving forward with a major expansion of its 2.7Mtpa Mungari mill to 4.2Mtpa.

But Tonkin says NST will be able to staff the project, saying the 400-450 extra people required amounts to less than a tenth of its workforce. By virtue of its scale and proximity to the 30,000 person city of Kalgoorlie-Boulder, he says the project will be the most attractive on the market.

“I reckon this is the best project in the state, so I reckon we’ll get the people that are there to do it,” he said on an investor briefing today.

“We employ 6500 people across the business … it’s less than 10% of the overall business activity we’re currently already conducting so it’s not a crazy material change in what we do today and manage already.

“Do you pay more to get labour and secure it or do you take your time and not incur that cost? Because there’s often a trade off between cost and time that other companies are forced into because they’re single assets, single project, high risk on that regard on the execution phase.”

It comes amid a growing cloud over one of the other major Australian gold mines, the Cadia operation owned by Newcrest and the jewel in the crown in Newmont’s takeover of the Aussie gold major.

A literal dust cloud, actually.

The NSW EPA has issued a string of new conditions and STRONGLY WORDED NOTICE calling on Newcrest’s operating subsidiary to monitor and report monthly on dust discharge from one of its main vents, provide reports on lead dust fingerprinting research, impacts, health risk analysis and an update air quality impact assessment and take works to rectify dust generation underground and from tailings.

“We require the mine to take all necessary steps to ensure dust emissions are significantly reduced and this may include a reduction in production,” EPA CEO Tony Chappel said.

“If Newcrest cannot show its subsidiary is taking immediate action to comply, the EPA will take appropriate action which could include suspension of the licence, seeking court orders or, issuing further directions.

“We know this is strong action, but we will not shy away from doing what we must to prioritise human health and the environment.”

Tough talk there Tony.

Suspension of the licence would be a biggy in the context of the Newmont merger.

Cadia with its long life, massive copper output and sub-zero all in sustaining costs, is the big prize in Newmont’s takeover.

The US gold giant has already delayed spending on a sulphide expansion at the Yanacocha gold mine in Peru to smooth the integration of Newmont’s assets next year.

“We take our environmental obligations and the concerns raised by the EPA seriously and will take action to comply with the licence variation notice,” a Newcrest spokesperson told the Guardian.

“We are a longstanding member of the community and remain firmly committed to meeting all of our statutory obligations in a way that is aligned with our values.”

Blue cheese is a delicacy but mould on a Gruyere is not a tasty prospect.

And so the heavy rain that hit the northern Goldfields this quarter has done a number on the Australian gold mine of the same name.

That has mixed with poor reliability and utilisation of production drills at the operation — owned in a 50-50 JV between South African gold giant Gold Fields and ASX-listed Gold Road Resources (ASX:GOR) — to curb production through the June quarter.

“The situation has resulted in reduced availability of Run-of-Mine grade ore to the processing plant, with production being supplemented by the processing of low-grade ore stockpiles,” Gold Road reported in a statement to the ASX.

“A recovery plan is currently being developed with Gold Fields and the mining contractor, and will include the mobilisation of new drilling equipment, additional blasting resources and an additional mining fleet during the September quarter.

“The timing for the mobilisation and commissioning of these resources will impact total mining movement for the year.”

It means production for the June quarter will be just 72,000-76,000oz on a 100% basis contingent on the recovery from the rain.

Annual production will slip from 340,000-370,000oz to 320,000-350,000oz, something that will also see an unspecified lift in costs.

Peep the quarterly report next month to see the full damage.