Great Southern reaping the rewards of an aggressive exploration strategy at Duketon gold project

Mining

Mining

Great Southern Mining has just released it September quarterly and it appears the company’s aggressive exploration program is paying off.

During the quarter maiden drilling was completed at the Southern Star gold deposit and identified gold in soil anomalies at the Amy Clarke prospect – both within the Duketon gold project in WA.

The company also progressed with geological mapping and geochemical programs at the Edinburgh Park project in North Queensland and completed a $2.5 million placement to fund its ongoing aggressive exploration programs.

Great Southern Mining (ASX:GSN) completed a total of 4,656m of RC drilling at Southern Star, which extended the mineralisation in all directions, with best results including:

The company also discovered high-grade gold 200m to the south of the previously known extent of mineralisation with 17m at 7 g/t from 111m including 2m at 56.7 g/t including 1m at 109 g/t encountered in hole 21SSRC0039.

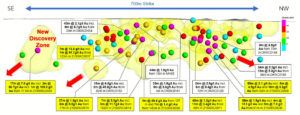

The high-grade extension intercept is positioned on a look-alike magnetic high feature also found at Southern Star with total strike length of more than 700m.

Based on the results, the company is now planning high priority diamond drilling to improve the geological understanding of the deposit as well as RC drilling to test the discovery zone, strike extensions and depth potential at Southern Star.

During the quarter the company also completed a 4,754m RC program at four regional targets in the Duketon Belt, intersecting gold in each of them.

Standout intersections at each target include:

GSN plans to input all the recent RC drill results and evaluate all four regional targets in light of the new data, with re-ranking underway to determine the appropriate follow-up exploration program for each target.

At the Amy Clarke prospect, large, kilometre-scale, gold in soil anomalies were identified sitting 3km south along the same mineralised trend as the 300,000-ounce Erlistoun gold deposit owned by Regis Resources (ASX:RRL).

An AC program is planned over the area for Q4 CY2021.

At the Edinburgh Park project in Queensland, geological mapping and geochemical programs continued during the quarter with the identification, validation, and current evaluation of three hydrothermal systems.

In July the company announced an updated mineral resource at the Mon Ami project of 1.41 Mt at 1.16 g/t gold for 52,500 ounces.

All technical and environmental studies have been completed and ancillary tenure granted.

And once a milling agreement becomes available at one of several nearby mills, mining approvals will be a simple six-week process under the Mining Act 1978.

During the quarter the company entered negotiations with the vendor of the Project regarding the potential return of the Cox’s Find tenements.

A Deed of Cancellation and Return was entered in August 2021 to relieve GSN of its obligation to pay the deferred payment of $800,000.

Consistent with sensible capital allocation for exploration programs, the board considered the divestment of the Cox’s Find Project as the preferred option given the project did not warrant immediate allocation of exploration capital following the acquisition of the highly prospective Southern Star and Duketon Belt tenure.

The company paid the Vendor $100,000 in cash to complete the transaction.

GSN also disposed of the non-core Mt Weld tenements and sold the mining information to a 3rd party for $50,000 in cash.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.