Great Southern aced it in 2019

Mining

Special Report: There is no shortage of potential company making projects in Great Southern Mining’s portfolio, but picking up a past-producing mine and attracting an $8 billion market cap gold miner as a partner have been the highlights of the junior explorer’s 2019.

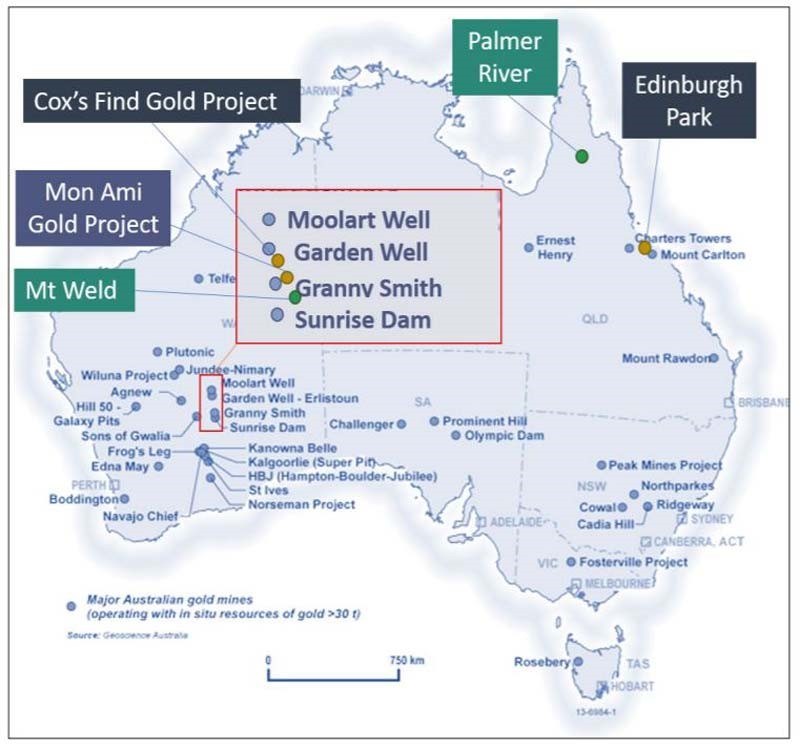

In late August, Great Southern (ASX:GSN) made the very smart move to acquire the Cox’s Find project, about 70km from the gold mining hub of Laverton in WA.

This project-buy represented low-risk exploration, early cash flow and genuine company-making upside.

And since announcing the acquisition, Great Southern’s share price has more than doubled.

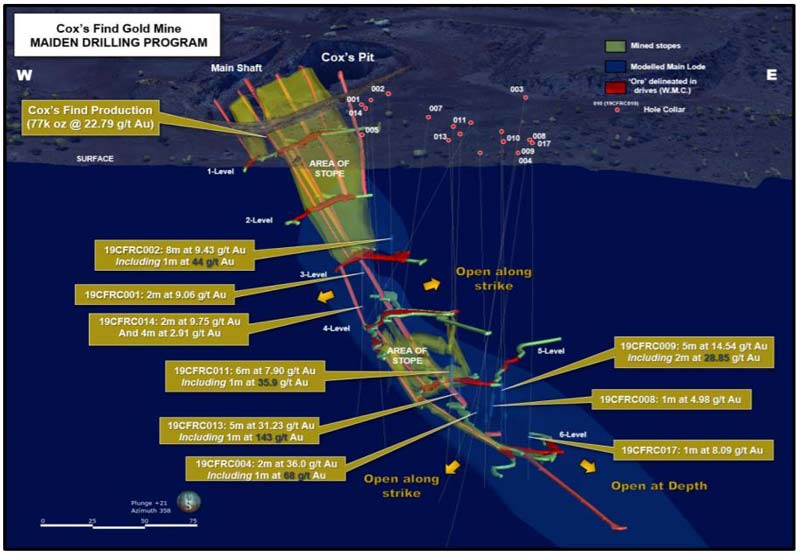

Cox’s Find, which produced 77,000 ounces at more than 21 grams per tonne (g/t) between 1935 and 1942, was Western Mining Corporation’s (WMC) first foray into Australian gold production.

In today’s terms — when +5g/t is generally considered high grade — that would make Cox’s Find one of the highest-grade gold mines in Australia.

Since adding this potentially lucrative project to its portfolio, Great Southern has wasted no time in finding out just what treasures Cox’s Find hosts.

It wasn’t long after the acquisition that leading institutional investors and high net worth individuals piled into Great Southern Mining in anticipation of just what might be to come.

This gave the company a further $1.485m to accelerate exploration of Cox’s Find.

In late October, Great Southern decided to more than double its initial planned drilling program to 5,000m.

“Cox’s Find presents an opportunity for the company to advance a historic high-grade project with exceptional exploration potential,” executive chairman John Terpu said.

“It was an easy decision to allocate additional funds to expand the drilling program.”

And Great Southern was on the money with that decision, with the company’s very first drill attack at Cox’s Find delivering initial high-grade shallow gold grading as high as 68g/t, from depths starting at just 74m.

In that same maiden drilling program, Great Southern followed that top result with an even better hit of 1m at 143g/t from within a broader 5m at 31.23g/t.

But that was just the tip of the iceberg — Terpu said the exceptional quality of the intersections in the first three drill holes provided confirmation that the mineralisation style and grade at Cox’s Find was consistent with what was previously mined there by WMC.

And he was confident Great Southern would “demonstrate that it’s open in every direction”.

Since those initial results in November, the high-grade gold hits have continued to roll in.

And just before Christmas, Great Southern revealed that its early drilling efforts had uncovered new high-grade zones.

Great Southern said this was “the first stage in unlocking the true potential of the Cox’s Find gold project and creating value for shareholders”.

READ: Great Southern unlocks true potential of Cox’s Find with early drilling success

Cox’s Find is a potential near-term development opportunity for Great Southern.

READ: Great Southern eyes early cashflow from stockpiled ore at high grade Cox’s Find

This is because of the potentially profitable abundant stockpiles, leach pads, and historic material on surface.

Great Southern previously undertook work towards delivering a JORC 2012 compliant resource on this easy-to process surface material and is examining monetisation options.

Using a third-party mill, those ore stockpiles represent significant near-term cash for Great Southern at today’s +$2,160/oz gold price.

But it’s not just the Cox’s Find project that has all eyes on Great Southern.

$8 billion gold miner Evolution Mining (ASX:EVN) sat up and took notice of the company’s North Queensland ground earlier this year.

READ: Great Southern’s North Queensland projects garners interest from neighbour Evolution

The North Queensland tenement package includes the Edinburgh Park project with a boundary that extends from 25km away to within just 5km from Evolution’s world class Mt Carlton gold-silver-copper project — which co-incidentally was discovered by Conquest Mining (now Evolution Mining) when Terpu was there as managing director.

Mt Carlton is one of the highest-grade open pit gold mines in the world, producing up to 105,000oz in FY19 at an all-in sustaining cost of between $670 and $720 per ounce.

Terpu is now hunting for his second company-making tier 1 deposit at Great Southern’s Edinburgh Park project.

In October, Evolution offered to pay half the cost (over $127,000) of flying a hyperspectral survey over the company’s North Queensland tenure.

Less than 15 per cent of the Edinburgh Park area of more than 1,000sqkm has been explored using modern techniques.

“We are looking for the next Mt Carlton in what is a highly prospective, well-endowed gold district,” Terpu said.

“We welcome the support of EVN to acquire the survey and from our reconnaissance exploration and drill programs to date, their interest gives us the confidence that the geology has all the right attributes to host the next tier 1 deposit.”

>> Gold stocks guide: Here’s everything you need to know

READ MORE:

Great Southern comes up trumps with its maiden drilling expedition at Cox’s Find – and it’s just the tip of the iceberg

Great Southern more than doubles gold drilling at Cox’s Find

Institutions, high net worths jump into Great Southern ahead of company making drill program