Gold: This ~30g/t, +300,000oz Tasmanian project hasn’t been touched since 1932

Mining

Mining

Revitalising historic gold mines has been the story of 2019 as prices surge to record highs.

But some of these old mining camps are literal treasure troves, begging the question — why hasn’t anyone picked up these projects before?

Just take Stavely Minerals’ (ASX:SVY) newly granted exploration licence (EL) at the Mathinna project in Tasmania which has been left, essentially untouched, since 1932.

At that time, the gold price was between $US17/oz ($25/oz) and $US20/oz (not adjusted for inflation).

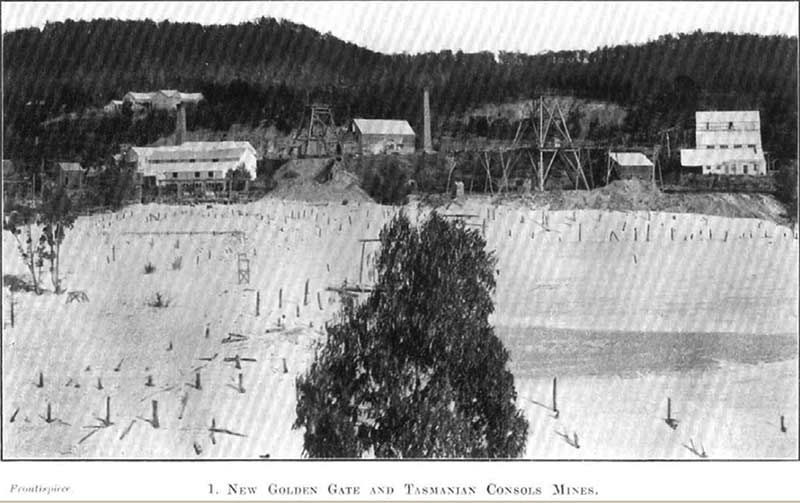

The Stavely EL covers the (old) New Golden Gate and Tasmanian Consols gold mines.

According to official records, the district produced 289,000oz of gold grading close to 30 grams per tonne (g/t) up to 1932.

But Stavely reckons that number is a lot higher, even though — post 1932 — there has been very little modern mining or exploration.

The crazy thing is that, since then, limited exploration has identified a number of shallow, high-grade mineralised trends.

The number of high-grade incepts, including 4m at 15.4g/t gold, 51m from surface, are numerous:

Most of the gold mineralised quartz-veins are between 1m and 10m wide, and 30m to 300m long. The maximum known vertical strike extent for a single vein is 336m at the New Golden Gate mine.

“The historical production of 254,000 ounces of gold from the New Golden Gate mine was primarily sourced from four main high-grade ore shoots of around 50,000 ounces each with a vertical extent of between 150m and 300m,” Stavely Minerals chairman Chris Cairns says.

“The potential to extend the known mineralisation along strike and at depth is considered excellent and, as at least two of the productive reefs had no surface expression, the potential to discover additional reefs is also considered very high.

“We are very excited to be planning our first drill campaign and hope to be drilling next month.”

Stavely has now moved on from reviewing dusty piles of data to ground-based exploration, with drilling on the project due to kick off next month. Stay tuned.

NOW READ: The mining town at the centre of Australia’s most famous rescue operation could have a new life

Black Cat (ASX:BC8) keeps uncovering more gold at the Bulong project in WA. A newly discovered lode now means that that the Trump Corridor extends over 1100m. Highlights included 4m at 13.46g/t gold, 50m from surface.

“It is exciting to find new lodes close to our potential mining operations,” managing director Gareth Solly says. “Results at Trump North show that the western most of the three mineralised corridors continues to the north with excellent potential to add to future resources. “We expect the results of an additional 3.5kms of SAM surveys along these corridors to also highlight additional targets.”

READ: As gold punches through $2K/oz, Black Cat’s Bulong grows and Nova drills its huge Alaskan project