Gold just logged its biggest gain since Brexit

Mining

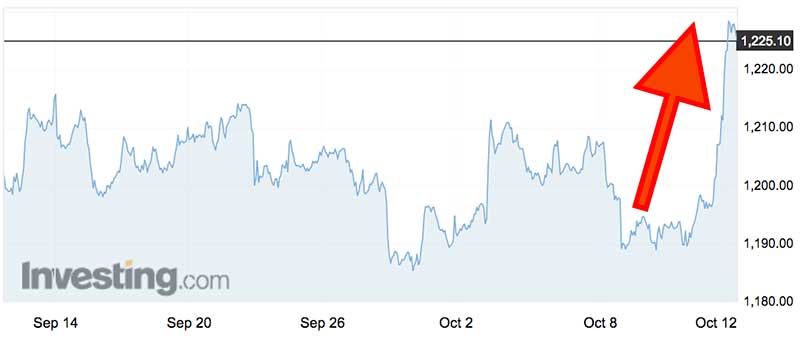

The spot gold price surged higher overnight after trading in a narrow trading range for the best part of two months, breaking the downtrend its been stuck in since mid-August this year.

Thursday’s 2.5 per cent gain was the largest in percentage terms since June 24, 2016 — the day after the UK Brexit vote.

The sudden and substantial buying burst was due to a combination of continued steep declines in US and European stocks as well as renewed weakness in the US dollar, said Comm Bank mining analyst Vivek Dhar.

“Gold prices rose by the most since June 2016 as falling equity markets spurred safe haven demand,” he said.

“Prices also gained as the US dollar weakened after US inflation grew at a slower than expected pace in September.

The outlook for the gold price will likely be determined by movements in the US dollar, rather than changes in real US bond yields that have been influential in the past, Mr Dhar says.

“We continue to tie our gold price expectations to US dollar movements,” he says.

“A stronger US dollar will weigh on gold prices and vice versa.”

With plenty of macro risks still to come in the month ahead, including the US mid-term elections, the prospects for gold are seemingly looking a lot brighter, especially given it’s now broken out of its downtrend.

The spot gold price currently trades at $US1224 an ounce.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.